Answered step by step

Verified Expert Solution

Question

1 Approved Answer

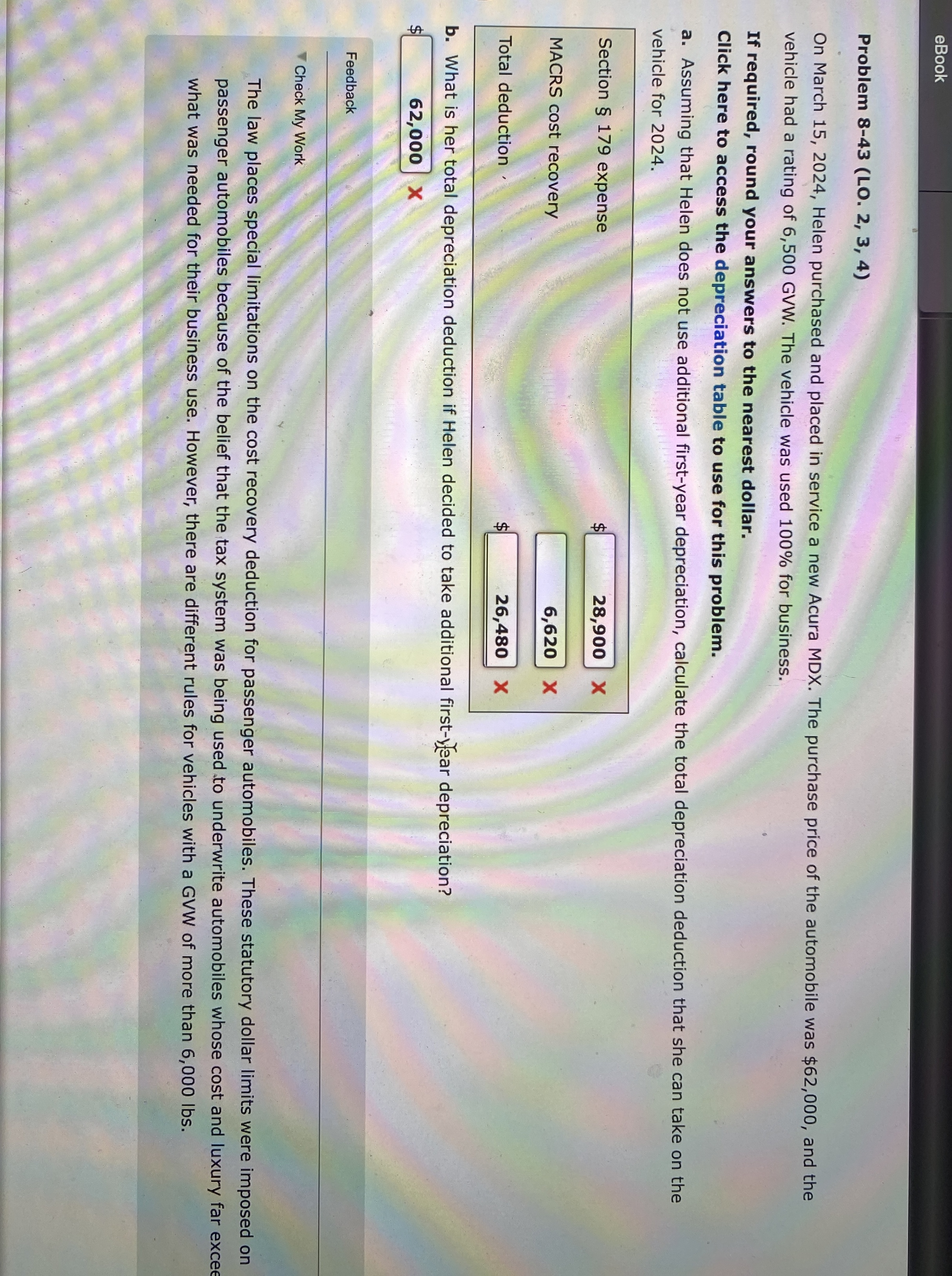

eBook Problem 8 - 4 3 ( LO . 2 , 3 , 4 ) On March 1 5 , 2 0 2 4 ,

eBook

Problem LO

On March Helen purchased and placed in service a new Acura MDX The purchase price of the automobile was $ and the vehicle had a rating of GVW The vehicle was used for business.

If required, round your answers to the nearest dollar.

Click here to access the depreciation table to use for this problem.

a Assuming that Helen does not use additional firstyear depreciation, calculate the total depreciation deduction that she can take on the vehicle for

Section expense

MACRS cost recovery

Total deduction

Feedback

Check My Work

The law places special limitations on the cost recovery deduction for passenger automobiles. These statutory dollar limits were imposed on passenger automobiles because of the belief that the tax system was being used to underwrite automobiles whose cost and luxury far excet what was needed for their business use. However, there are different rules for vehicles with a GVW of more than lbs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started