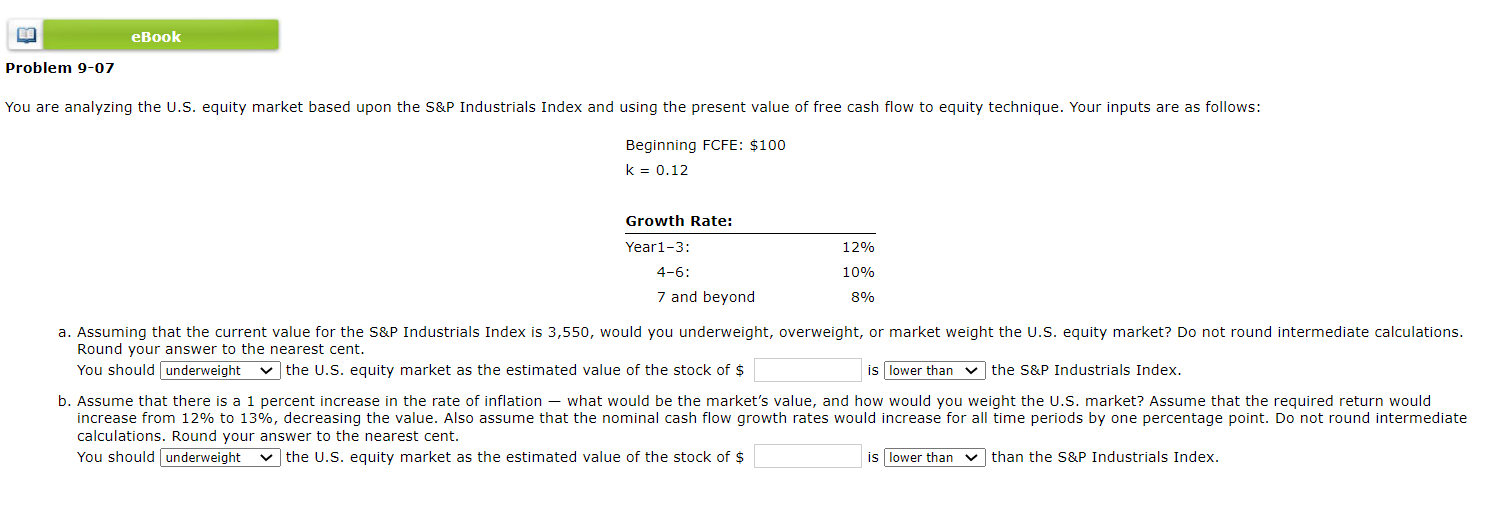

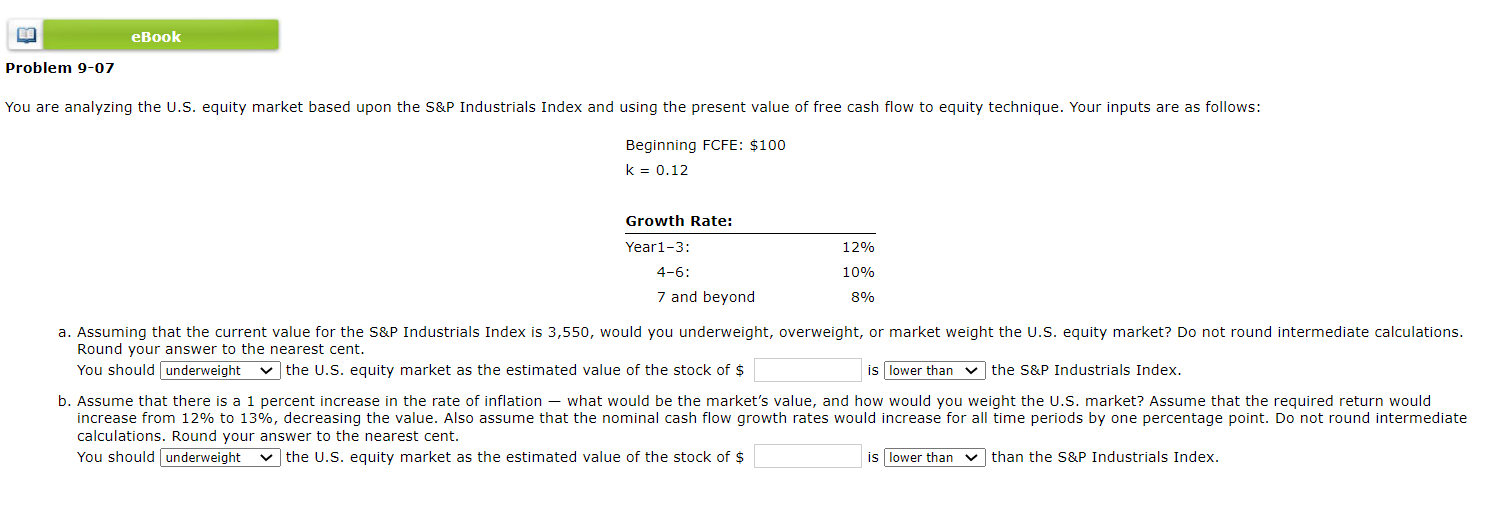

eBook Problem 9-07 You are analyzing the U.S. equity market based upon the S&P Industrials Index and using the present value of free cash flow to equity technique. Your inputs are as follows: Beginning FCFE: $100 k = 0.12 12% Growth Rate: Year1-3: 4-6: 7 and beyond 10% 8% a. Assuming that the current value for the S&P Industrials Index is 3,550, would you underweight, overweight, or market weight the U.S. equity market? Do not round intermediate calculations. Round your answer to the nearest cent. You should underweight the U.S. equity market as the estimated value of the stock of $ is lower than the S&P Industrials Index. b. Assume that there is a 1 percent increase in the rate of inflation what would be the market's value, and how would you weight the U.S. market? Assume that the required return would increase from 12% to 13%, decreasing the value. Also assume that the nominal cash flow growth rates would increase for all time periods by one percentage point. Do not round intermediate calculations. Round your answer to the nearest cent. You should underweight the U.S. equity market as the estimated value of the stock of $ is lower than than the S&P Industrials Index. eBook Problem 9-07 You are analyzing the U.S. equity market based upon the S&P Industrials Index and using the present value of free cash flow to equity technique. Your inputs are as follows: Beginning FCFE: $100 k = 0.12 12% Growth Rate: Year1-3: 4-6: 7 and beyond 10% 8% a. Assuming that the current value for the S&P Industrials Index is 3,550, would you underweight, overweight, or market weight the U.S. equity market? Do not round intermediate calculations. Round your answer to the nearest cent. You should underweight the U.S. equity market as the estimated value of the stock of $ is lower than the S&P Industrials Index. b. Assume that there is a 1 percent increase in the rate of inflation what would be the market's value, and how would you weight the U.S. market? Assume that the required return would increase from 12% to 13%, decreasing the value. Also assume that the nominal cash flow growth rates would increase for all time periods by one percentage point. Do not round intermediate calculations. Round your answer to the nearest cent. You should underweight the U.S. equity market as the estimated value of the stock of $ is lower than than the S&P Industrials Index