Question: eBook Problem Walk - Through n investor has two bonds in his portfolio that have a face value of $ 1 , 0 0 0

eBook

Problem WalkThrough

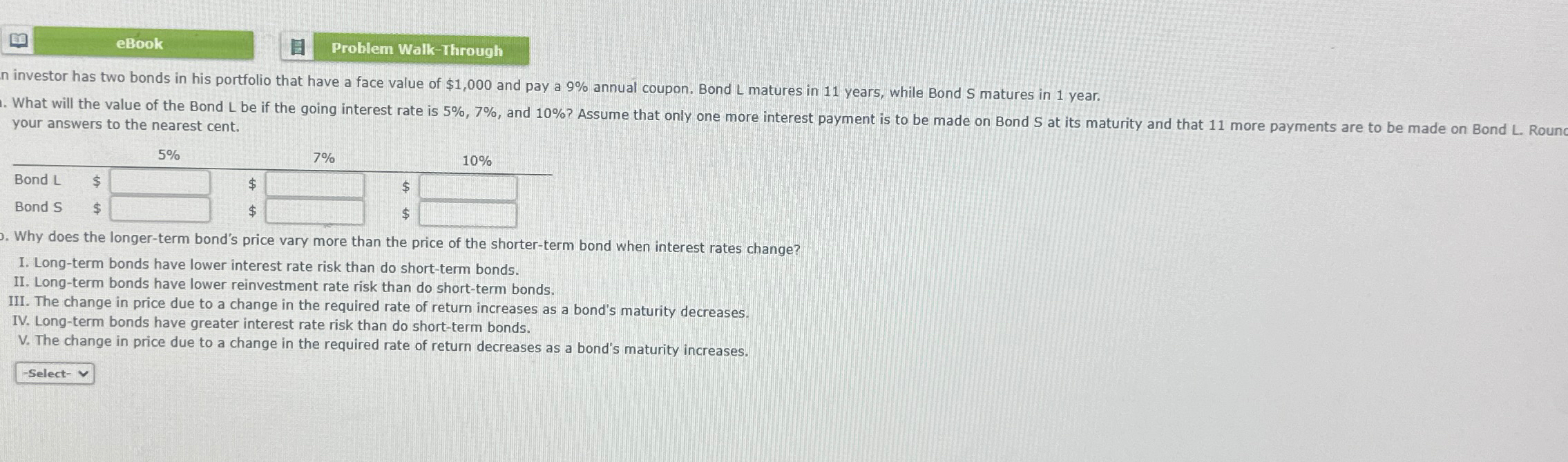

n investor has two bonds in his portfolio that have a face value of $ and pay a annual coupon. Bond matures in years, while Bond matures in year. your answers to the nearest cent.

Why does the longerterm bond's price vary more than the price of the shorterterm bond when interest rates change?

I. Longterm bonds have lower interest rate risk than do shortterm bonds.

II Longterm bonds have lower reinvestment rate risk than do shortterm bonds.

III. The change in price due to a change in the required rate of return increases as a bond's maturity decreases.

IV Longterm bonds have greater interest rate risk than do shortterm bonds.

V The change in price due to a change in the required rate of return decreases as a bond's maturity increases.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock