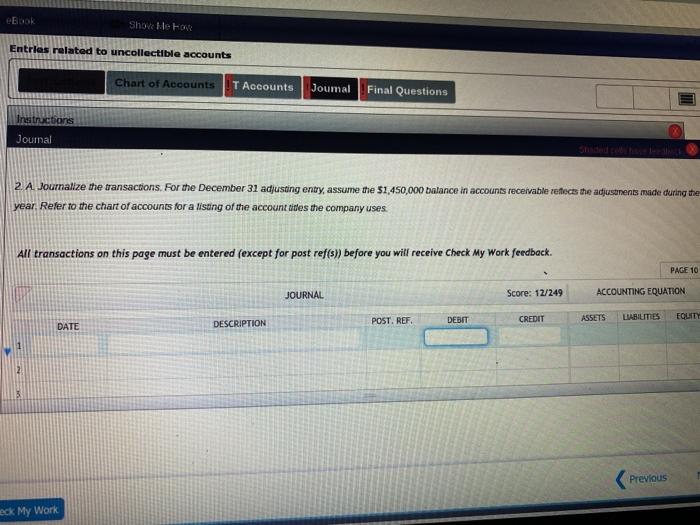

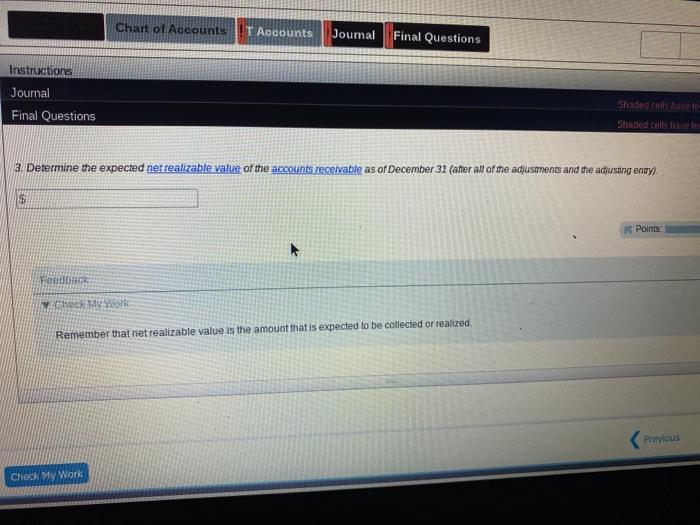

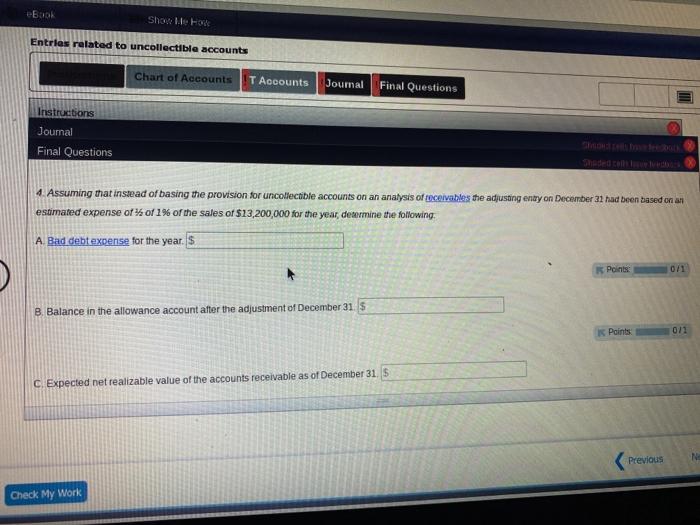

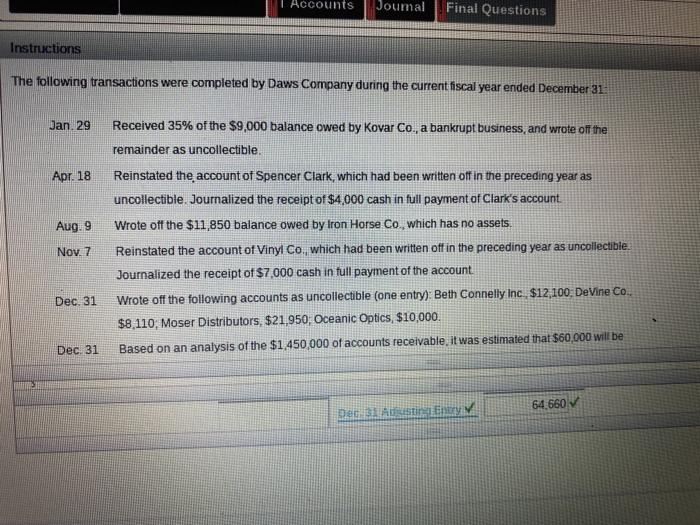

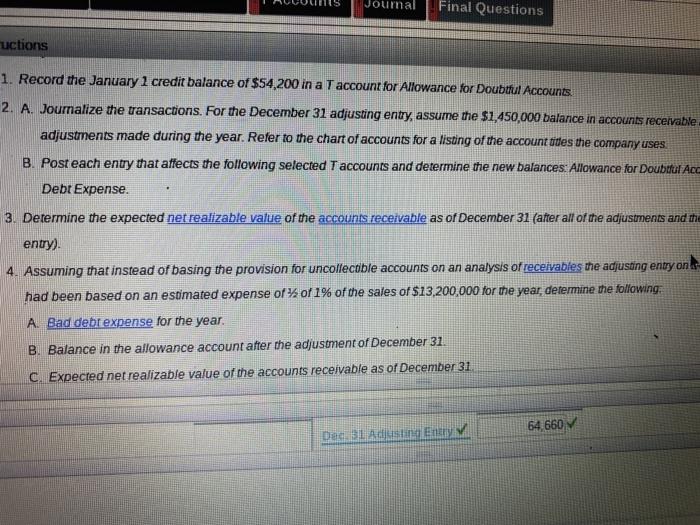

eBook Shoe Ho Entries related to uncollectible accounts Chart of Accounts TAccounts Joumal Final Questions Instructions Journal 2 A Journalize the transactions. For the December 31 adjusting enty, assume the $1,450,000 balance in accounts receivable retects the adjustments made during the year. Refer to the chart of accounts for a sing of the accountides the company uses All transactions on this page must be entered (except for post ref(s) before you will receive Check My Work feedback. PAGE 10 JOURNAL Score: 12/249 ACCOUNTING EQUATION DEBIT CREDIT POST. REF. LIABILITIES ASSETS DATE DESCRIPTION EQUITY Previous eck My Work Chart of Accounts T Accounts Joumal Final Questions Instructions Journal Final Questions Shaded cells Shaded cells the 3. Determine the expected net realizable value of the accounts receivable as of December 31 (after all of the adjustments and the adjusting entry) S 5 Points Feedback Chuck My Work Remember that net realizable value is the amount that is expected to be collected or realized Previous Check My Work eBook Shoelle For Entries related to uncollectible accounts Chart of Accounts T Accounts Joumal Final Questions Instructions Journal Final Questions 4. Assuming that instead of basing the provision for uncollectible accounts on an analysis of receivables the adjusting enay on December 31 had been based on an estimated expense of of % of the sales of $13,200,000 for the year, dermine the following A Bad debtexpense for the year. $ Point 0/1 B. Balance in the allowance account after the adjustment of December 31 S Points 011 C. Expected net realizable value of the accounts receivable as of December 31 $ Previous N Check My Work Accounts Joumal Final Questions Instructions The following transactions were completed by Daws Company during the current fiscal year ended December 31- Jan. 29 Received 35% of the $9,000 balance owed by Kovar Co., a bankrupt business, and wrote off the remainder as uncollectible. Apr. 18 Aug. 9 Nov. 7 Reinstated the account of Spencer Clark, which had been written off in the preceding year as uncollectible. Journalized the receipt of $4,000 cash in full payment of Clark's account. Wrote off the $11,850 balance owed by Iron Horse Co., which has no assets. Reinstated the account of Vinyl Co. which had been written off in the preceding year as uncollectible. Journalized the receipt of $7,000 cash in full payment of the account Wrote off the following accounts as uncollectible (one entry): Beth Connelly Inc. $12,100, DeVine Co., $8,110, Moser Distributors, $21,950, Oceanic Optics, $10,000. Based on an analysis of the $1,450,000 of accounts receivable, it was estimated that $60,000 will be Dec. 31 Dec. 31 64 660 Decs Aursti Enery Journal Final Questions ructions 1. Record the January 1 credit balance of $54,200 in a Taccount for Allowance for Doubtful Accounts. 2. A. Journalize the transactions. For the December 31 adjusting entry, assume the $1,450,000 balance in accounts receivable adjustments made during the year. Refer to the chart of accounts for a listing of the account tites the company uses B. Post each entry that affects the following selected Taccounts and determine the new balances: Allowance for Doubtful Acc Debt Expense. 3. Determine the expected net realizable value of the accounts receivable as of December 31 (after all of the adjustments and the entry) 4. Assuming that instead of basing the provision for uncollectible accounts on an analysis of receivables the adjusting entry on had been based on an estimated expense of % of 1% of the sales of $13,200,000 for the year, determine the following A. Bad debrexpense for the year. B. Balance in the allowance account after the adjustment of December 31. C Expected net realizable value of the accounts receivable as of December 31 64 660 Dec 31 Adjusting Entry