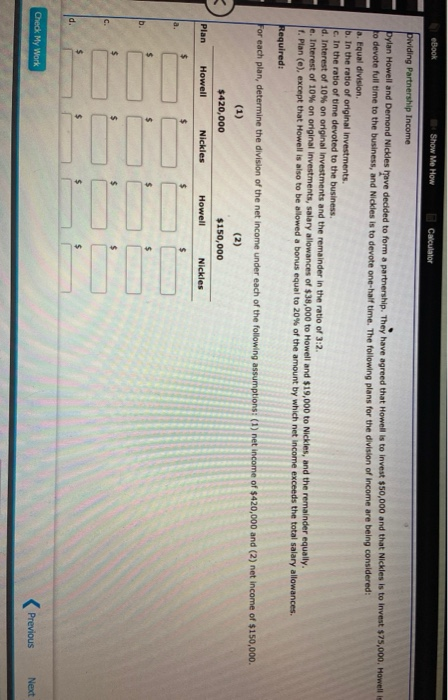

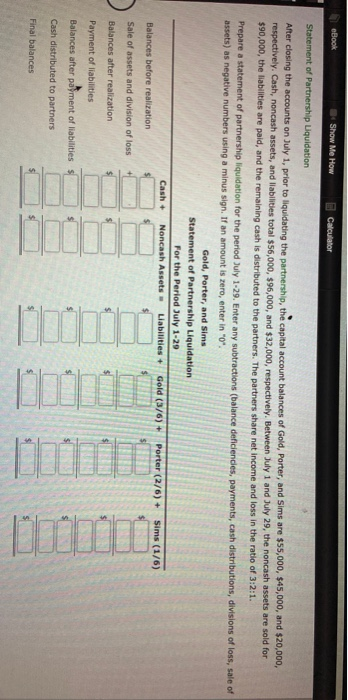

eBook Show Me How Calculator Dividing Partnership Income Dylan Howell and Demond Nickles ipave decided to form a partnership. They have agreed that Howell is to invest $50,000 and that Nickles is to invest $75,000. Howell to devote full time to the business, and Nickles is to devote one-half time. The following plans for the division of income are being considered: a. Equal division b. In the ratio of original Investments. c. In the ratio of time devoted to the business d. Interest of 10% on original Investments and the remainder in the ratio of 3:2. Interest of 10% on original investments, salary allowances of $38,000 to Howell and $19,000 to Nickles, and the remainder equally. 1. Plan (), except that Howell is also to be allowed a bonus equal to 20% of the amount by which net income exceeds the total salary allowances. Required: For each plan, determine the division of the net income under each of the following assumptions: (1) net income of $420,000 and (2) net income of $150,000. (1) (2) $420,000 $150,000 Plan Howell Nickles Nickles Howell $ $ $ $ $ $ $ $ b $ $ $ $ C $ d. Check My Work Previous Next eBook Show Me How Calculator Statement of Partnership Liquidation After closing the accounts on July 1, prior to liquidating the partnership, the capital account balances of Gold, Porter, and Sims are $55,000, $45,000, and $20,000, respectively. Cash, noncash assets, and liabilities total $56,000, $96,000, and $32,000, respectively. Between July 1 and July 29, the noncash assets are sold for $90,000, the liabilities are paid, and the remaining cash is distributed to the partners. The partners share net income and loss in the ratio of 3:2:1. Prepare a statement of partnership liquidation for the period July 1-29. Enter any subtractions (balance deficiencies, payments, cash distributions, divisions of loss, assets) as negative numbers using a minus sign. If an amount is zero, enter in "O". Gold, Porter, and Sims Statement of Partnership Liquidation For the Period July 1-29 Cash + Noncash Assets Liabilities Gold (3/6) + Porter (2/6) Sims (1/6) Balances before realization of Sale of assets and division of loss Balances after realization Payment of liabilities Balances after payment of liabilities Cash distributed to partners Final balances