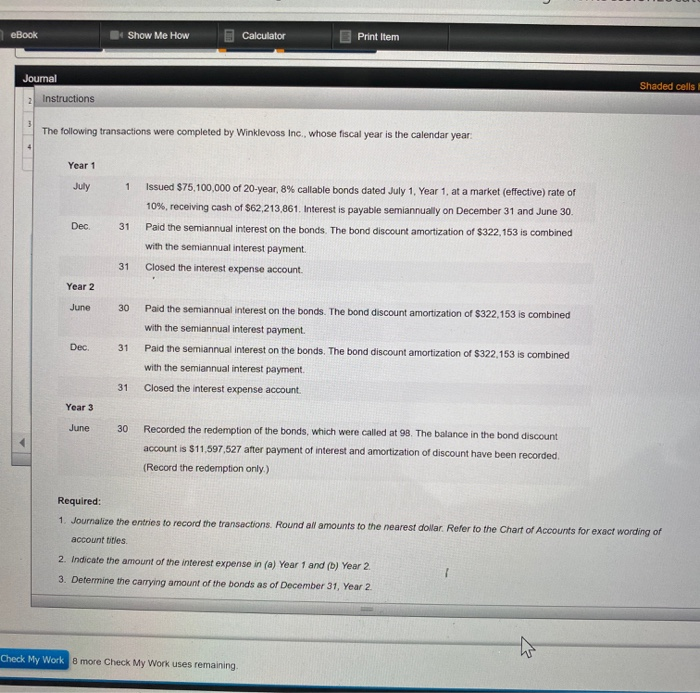

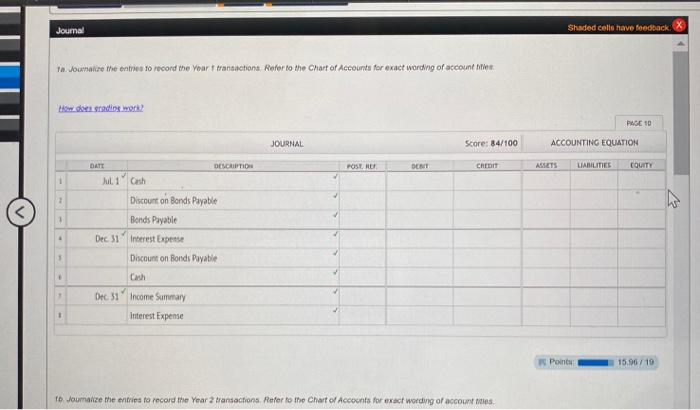

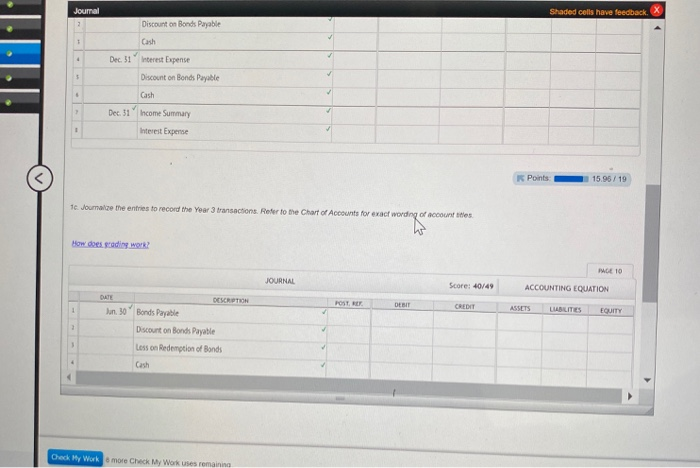

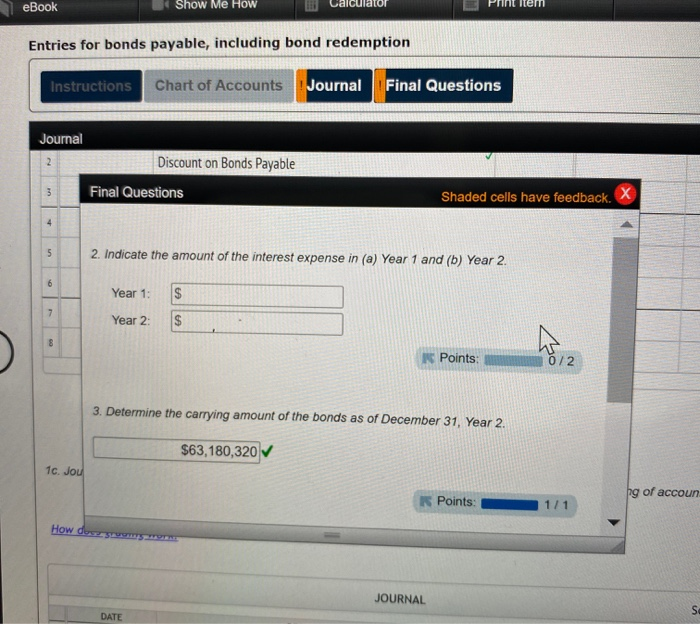

eBook Show Me How Calculator Print Item Journal Shaded cells Instructions The following transactions were completed by Winklevoss Inc., whose fiscal year is the calendar year Year 1 July 1 Dec 31 Issued $75,100,000 of 20-year, 8% callable bonds dated July 1, Year 1, at a market (effective) rate of 10%, receiving cash of $62,213,861. Interest is payable semiannually on December 31 and June 30. Paid the semiannual interest on the bonds. The bond discount amortization of $322,153 is combined with the semiannual interest payment. Closed the interest expense account. 31 Year 2 June 30 Dec 31 Paid the semiannual interest on the bonds. The bond discount amortization of $322,153 is combined with the semiannual interest payment. Pald the semiannual interest on the bonds. The bond discount amortization of $322,153 is combined with the semiannual interest payment. Closed the interest expense account. 31 Year 3 June 30 Recorded the redemption of the bonds, which were called at 98. The balance in the bond discount account is $11,597,527 after payment of interest and amortization of discount have been recorded (Record the redemption only) Required: 1. Journalize the entries to record the transactions. Round all amounts to the nearest dollar. Refer to the Chart of Accounts for exact wording of account titles 2. Indicate the amount of the interest expense in (a) Year 1 and (b) Year 2 3. Determine the carrying amount of the bonds as of December 31, Year 2 Check My Work 8 more Check My Work uses remaining. Journal Shaded cells have feedback. X 1a Journalize the entries to record the Year 1 transactions. Refer to the Chart of Accounts for exact wording of accounties How does sreding work? PAGE 10 JOURNAL Score: 84/100 ACCOUNTING EQUATION DATE DESCRIPTION POST. REF DET CREDIT LIABILITIES EQUITY 1 2 1 Jul 1 Cash Discount on Bonds Payable Bonds Payable Dec 31" Interest Expense Discount on Bonds Payable Cash 4 5 7 Dec 31 Income Summary 1 Interest Expense Points 15.96/10 Ib Journalize the entries to record the Year 2 transactions. Refer to the Chart of Accounts for exact wording of accounts Journal Shaded cells have feedback. Discount on Bonds Payable Cash 1 Dec 31" Interest Expense Discount on Bonds Payable 3 Cash Dec. 31Income Summary Interest Expense Points 15 95 / 19 1e. Journalize the entries to record the Year 3 transactions. Refer to the Chart of Accounts for exact wording of accounties How does grading WOR? PAGE 10 JOURNAL Score: 40/49 ACCOUNTING EQUATION POSTRE DEBIT CREDIT ASSETS LIABILITIES EQUITY DATE OSCROWN Jun 30 Bonds Payable Discount on Bonds Payable Lesson Redemption of Bands Cash Check My Workmore Check My Work uses remaining eBook Show Me How ulator nnt item Entries for bonds payable, including bond redemption Instructions Chart of Accounts Journal Final Questions Journal 2 Discount on Bonds Payable 3 Final Questions Shaded cells have feedback. X 5 2. Indicate the amount of the interest expense in (a) Year 1 and (b) Year 2 6 Year 1: A 7 Year 2: $ 8 Points 0/2 3. Determine the carrying amount of the bonds as of December 31, Year 2. $63,180,320 1c. Jou hg of accoun Points: 1/1 How dusz JOURNAL SO DATE