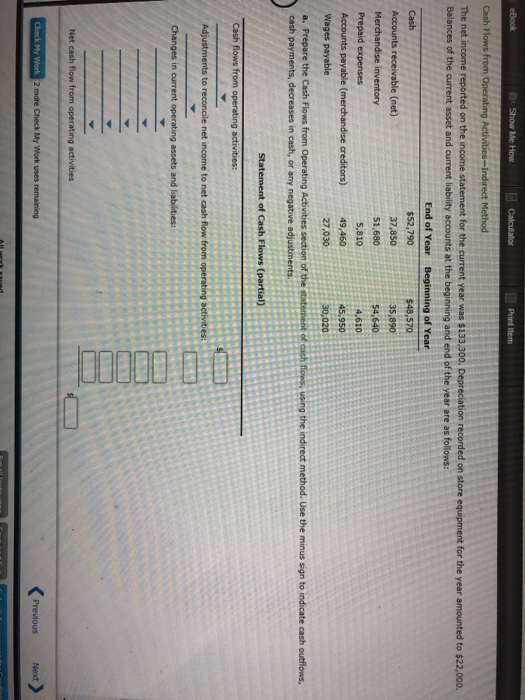

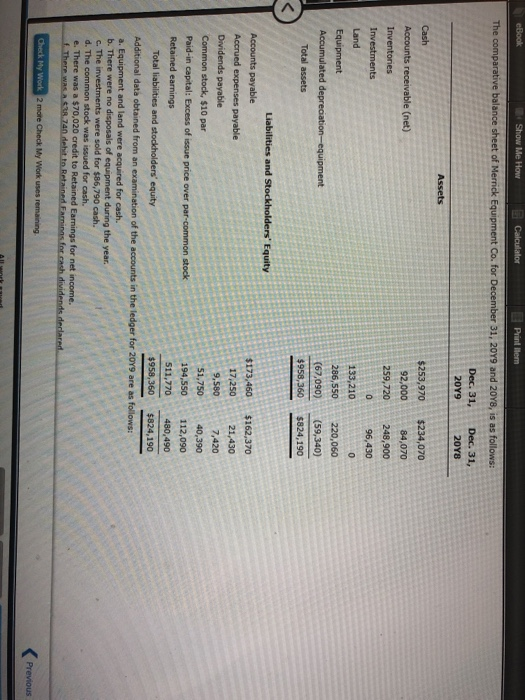

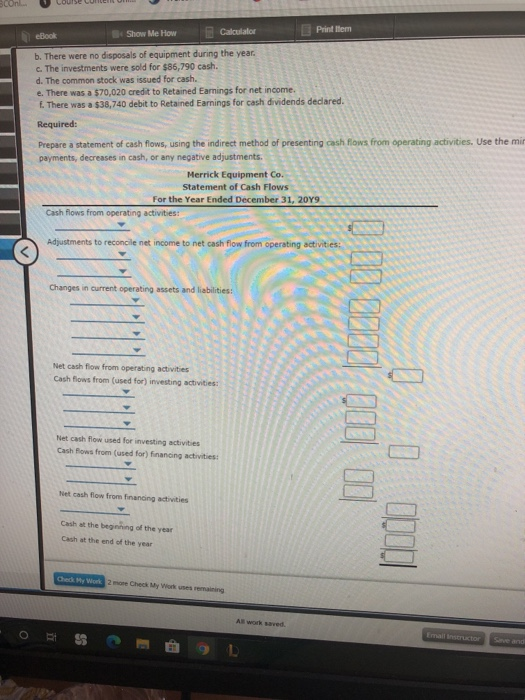

eBook Show Me How Calculator Printem Cash Flows from Operating Activities-Indirect Method . The net income reported on the income statement for the current year was $133,300. Depreciation recorded on store equipment for the year amounted to $22,000. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: End of Year Beginning of Year Cash $52,790 $48,570 Accounts receivable (net) 37,850 35,890 Merchandise inventory 51,680 54,640 Prepaid expenses 5,810 4,610 Accounts payable (merchandise creditors) 49,460 45,950 Wages payable 27,030 30,020 a. Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Statement of Cash Flows (partial) Cash flows from operating activities: Adjustments to reconcile net income to net cash flow from operating activities: Changes in current operating assets and liabilities: Net cash flow from operating activities o Check My Work 2 more Check My Work uses remaining Previous Next cBook Show Me How Calculator Print Item The comparative balance sheet of Merrick Equipment Co. for December 31, 2019 and 20Y8, is as follows: Dec. 31, 2019 Dec. 31, 2018 Assets Cash $253,970 92,000 259,720 0 133,210 286,550 (67,090) $234,070 84,070 248,900 96,430 Accounts receivable (net) Inventories Investments Land Equipment Accumulated depreciation-equipment Total assets 0 220,060 (59,340) $824,190 $958,360 Liabilities and Stockholders' Equity Accounts payable $173,460 $162,370 Accrued expenses payable 17,250 21,430 Dividends payable 9,560 7,420 Common stock, $10 par 51,750 40,390 Paid-in capital: Excess of issue price over par common stock 194,550 112,090 Retained earnings 511,770 480,490 Total liabilities and stockholders' equity $958,360 $824,190 Additional data obtained from an examination of the accounts in the ledger for 2049 are as follows: a. Equipment and land were acquired for cash. b. There were no disposals of equipment during the year. c. The investments were sold for $86,790 cash. d. The common stock was issued for cash. e. There was a $70,020 credit to Retained Earnings for net income. f. There was 38.740 dehit to Retained Farias for cash dividends declared Check My Work 2 more Check My Work uses remaining Previous 3cOnl Calculator Show Me How ebook Print item b. There were no disposals of equipment during the year c. The investments were sold for $86,790 cash. d. The common stock was issued for cash. e. There was a $70,020 credit to Retained Earnings for net income. . There was a $38,740 debit to Retained Earnings for cash dividends declared. Required: Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Use the mir payments, decreases in cash, or any negative adjustments. Merrick Equipment Co. Statement of Cash Flows For the Year Ended December 31, 2019 Cash flows from operating activities: Adjustments to reconcile net income to net cash flow from operating activities: Changes in current operating assets and liabilities: ( 11 1700 Q 20 Net cash flow from operating activities Cash flows from (used for) investing activities: Net cash flow used for investing activities Cash flows from (used for) financing activities: Net cash flow from financing activities Cash at the beginning of the year Cash at the end of the year Cred My Work 2 Check My Womang