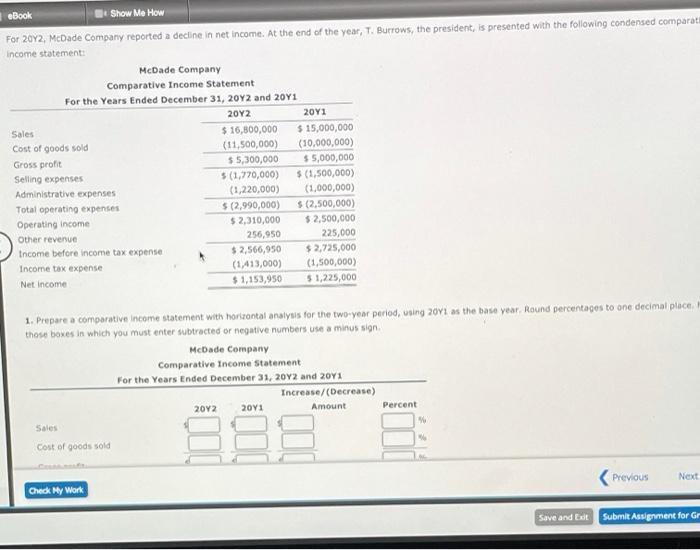

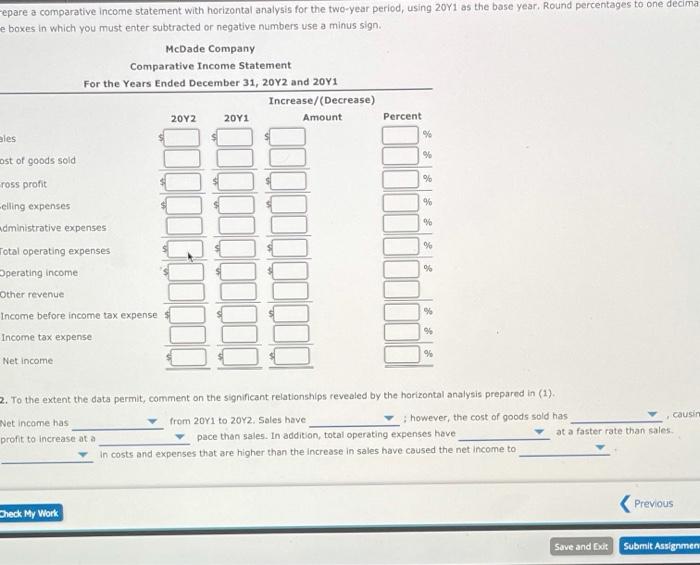

eBook Show Me How For 2072. McDade Company reported a decline in net income. At the end of the year, T. Burrows, the president, is presented with the following condensed comparati income statement: McDade Company Comparative Income Statement For the Years Ended December 31, 2012 and 2041 2012 2011 Sales $ 16,800,000 $ 15,000,000 Cost of goods sold (11,500,000) (10,000,000) Gross profit $5,300,000 $5,000,000 Selling expenses 5 (1,770,000) $ (1,500,000) Administrative expenses (1,220,000) (1,000,000) Total operating expenses $(2,990,000) $(2,500,000) Operating income $ 2,310,000 $2,500,000 Other revenue 256,950 225,000 Income before income tax expense $ 2,566,950 $ 2,725,000 Income tax expense (1,413,000) (1,500,000) Net Income $ 1,153,950 $1,225,000 1. Prepare a comparative Income statement with horizontal analysis for the two-year period, using 2072 as the base Year Round percentages to one decimal place those boxes in which you must enter subtracted or negative numbers use a minus sign McDade Company Comparative Income Statement For the Years Ended December 31, 2012 and 2041 Increase/(Decrease) 2012 2011 Amount Percent Sales Cost of goods sold 229 Previous Next Check My Work Save and Edt Submit Assignment for Gr Amount % % epare a comparative Income statement with horizontal analysis for the two-year period, using 2071 as the base year. Round percentages to one decima e boxes in which you must enter subtracted or negative numbers use a minus sign. McDade Company Comparative Income Statement For the Years Ended December 31, 20Y2 and 2011 Increase/(Decrease) 2012 2011 Percent bles ost of goods sold ross pront elling expenses administrative expenses Total operating expenses Operating income Other revenue Income before income tax expense Income tax expense % % % 96 %% Net income cousin 2. To the extent the data permit, comment on the significant relationships revealed by the horizontal analysis prepared in (1). Net Income has from 20Y1 to 2012. Sales have however, the cost of goods sold has profit to increase ata pace than sales. In addition, total operating expenses have at a faster rate than sales in costs and expenses that are higher than the increase in sales have caused the net income to