Answered step by step

Verified Expert Solution

Question

1 Approved Answer

EBusinessCourse Return to course Course Content Chapter 7 I Exa 3 ( Chap 6 and 7 ) Exam 3 ( Chap 6 and 7 )

EBusinessCourse

Return to course

Course Content

Chapter

I Exa

Chap and

Exam Chap and

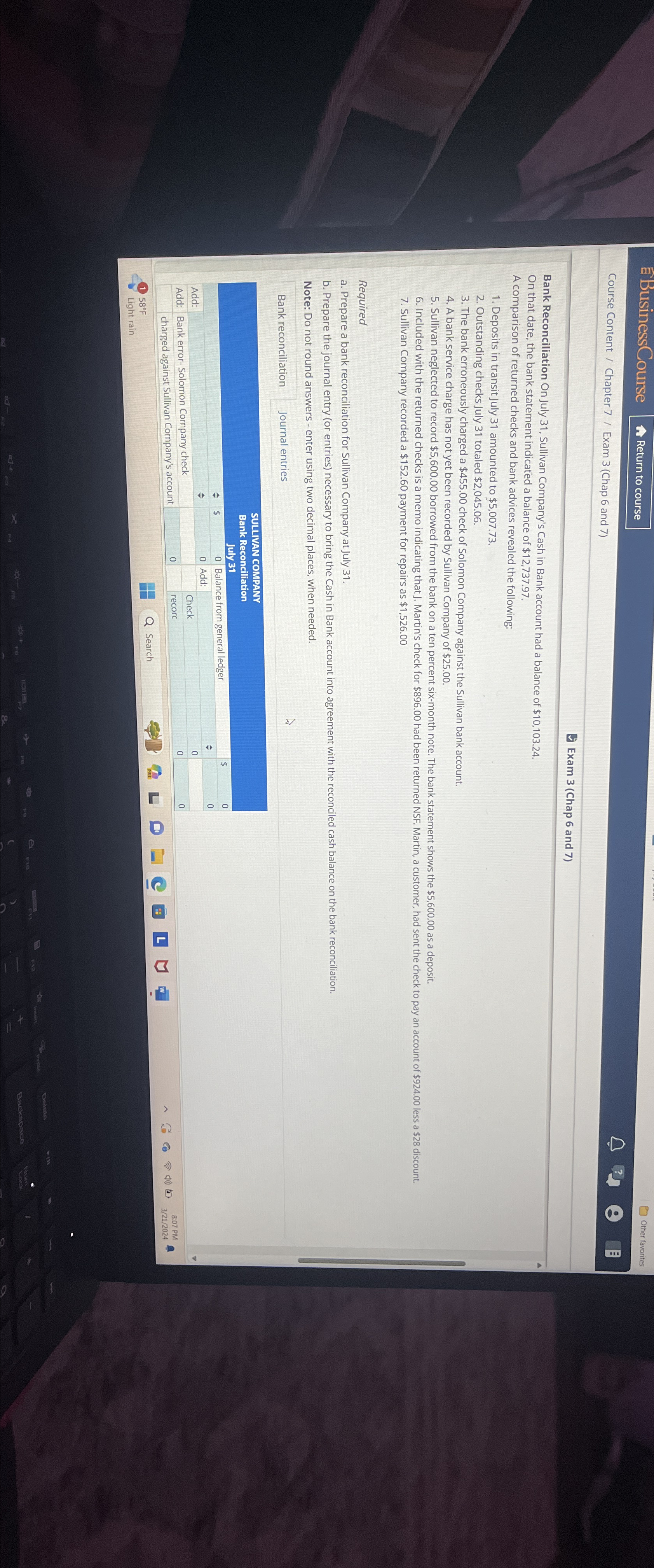

Bank Reconciliation On July Sullivan Company's Cash in Bank account had a balance of $

On that date, the bank statement indicated a balance of $

A comparison of returned checks and bank advices revealed the following:

Deposits in transit July amounted to $

Outstanding checks July totaled $

The bank erroneously charged a $ check of Solomon Company against the Sullivan bank account.

A bank service charge has not yet been recorded by Sullivan Company of $

Sullivan neglected to record $ borrowed from the bank on a ten percent sixmonth note. The bank statement shows the $ as a deposit.

Sullivan Company recorded a $ payment for repairs as $

Required

a Prepare a bank reconciliation for Sullivan Company at July

b Prepare the journal entry or entries necessary to bring the Cash in Bank account into agreement with the reconciled cash balance on the bank reconciliation.

Note: Do not round answers enter using two decimal places, when needed.

Bank reconciliation

Journal entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started