ec2 please respond to a b & c with explanation

I will upvote!

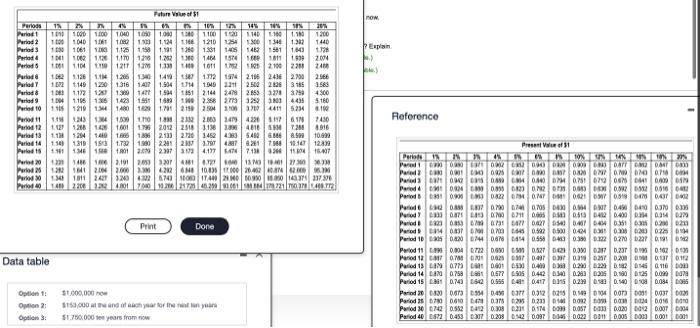

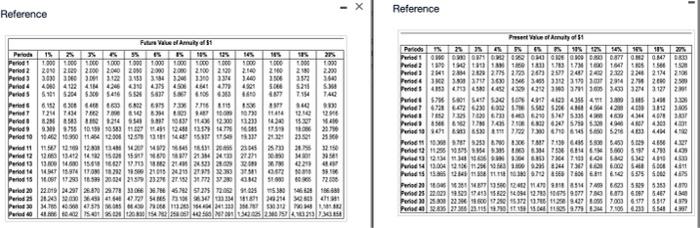

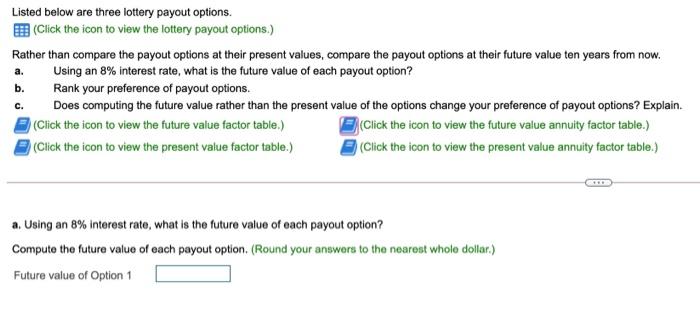

now Expan 2.1 Future of $1 Periods IN 145 1 203 Period T01000100 1040 100 1.000 0110016 1140 110110 1200 Period 2 1100101010 10.11.14 1210 15 1300346 1.312 1440 Periods 100 1061 1000 1.125 11581.1938 1301 145 1483 561 1643 1728 Period 1141 1002 1120 117012122130 1414 1514 1938 2004 Period 1104 11 121T17 1130 1611 1 105 2100 2200 2400 Pro 1.126 11 126 10 1497 1,712 1914 2.15 2.436 2.790 Purled 16221401200 13161411 1.9944 1540131 25 20263185 3565 Period 121122120 12301471 59451 2.1442492865 17 375 4300 P9 1.195125 14231 18 12:58 23 123 124435 Period 10 195 1210/134 1400 11215350430170 4411 5234 610 Pro11 12491139 1182522000 2494220 7430 Pred2 149 1801 1 20122.183.138134816128 8916 Period 3 11M 284 1480 1666 10 200 272 14522363 5.428.90 100 Pario 14 151319 150 1.732 1980 2281 282794897 421 79110 12.4 Parets 1 102 2107 31 4177 64 713011 U 15.497 Par 201402101200481. 13.09.2013 Pod 90216412022126N 10.098002040202 Pried 01511311242112040027017400 210.000 23.30 Prod 1402201304017003200452901001221 mm 13 st Reference Print Done Presse ! terbo TON 14 pand! WOON ATTOO Pad COMMON 0 0 0 Paris 0.807500 OM D.ON Period 0:00 N2009.12.2010 Period 00 00226 N 0021001 Dr Paroda 0.89 0740.705 DOM DMT DA0370 Period 0.750.00 D 053 D4 0.400.4 0.24 022 Period 1 0.85 0.7347256DT 035 0.2000 Period STD 0200 0.52 053 04 030320 02 Period 10 02200140878 844 0.55 04 03 02 0270 022 01992 Period 110.04 0722 0.00 0.527 Des 0.3 0.3 0.22 0.20 Period 1 CMT 0.70DN 0028 DOT 03 0.200 0.00 0.00 0.112 Puriod 1 077 0.00 0.00 0.22 0.22 0.22 01450 16 con Period 14 LIM 0.758 L 0.577 0462 0.30 0.20 03 0,980 0125 Don DN Period 15 L 0.740 152 0.55 0417 0.2 0.2 0.40 0.034 1.05 Period 20 0.20 0.57 0.54 0.49 Dan 0312 02 049 DOT DOM Parod 25 78 0.60 0.375 0.20 0.223 DONDOO 000 Period 30 01 0.552 042 0.30 0.20 0.114 Don DOST DON 0020 12 D.OOT 04 Parlod 40 72 0.453 0.209.420.097 0.55 0.022 0.00093 0.001 000 Data table Option Option 21 Option 1.000.000 158,000 year for the years 51.700.000 years from -X Reference Reference - . HD 220 Dum DEO DO CD CH TE UT PKS 2 091 LA MPC WORSE ORTHODES DONES BESONDE OVE Futura 11 Periode 15 2 95 1 185 10 15 Pred 1990000 1000 100 100 1000 1000 100 9000 100 Period 201 2020 2000 2000 2000 2000 2000 2000 290 2140 210 Pored 303030 312 313 3120 1300 14 100 312 340 Puro 4004122 4424 50 14 4991 s.be 5211 PS 59615304 IS 587 714 TAO Pied 61 1962 28 115 15 31 7434 EVO 10730 Pune 151312145SX 1200 13233 Pored 201755 10.15 10.5 12.0 131 16.15 1159 2006 2010 Perted to 10:30 1124 12:00 NETS 21 Pert 1150 12.00 134 14.2345 P2 12613412142152160822232211 13.00 15.09.2020 Pri 15.9 1700 1821250 2101 222 223 22331 0672 101 3 Periods 0 1280 1859 20.93021592328812722001 S60 223 Period 2 22.09 242 2870 277007625125 12.09.25 5380 16491883 Period 2007 SS1801 2021431 Prie 2000 3003530302 2009 Present of Amety of Period 21 45 905 12 40 105 Pet SRO Pied 39 118 117 1167 304 19 Pid21284 2820 275 2726 257 248 249 22222 2174 2100 Pi0373630154 345 3312 3172927 202 Poid 415 5 3942122016 300 120 1127 Punt 3. Pria 62304200 400013 Poids 50.000 4361 Poniec 10 580 1380 Ch 015 526 403 AM ce Per 100 25.6.215.00.444 P1121 1.63.631479 LOS Paul S.NO 100 LOGO 419 Pied 4 12.00 926073.500 11.11 P200301 1916.5329335 P220223 9377769975457 IN Pe 23.00 22 15372 29.07.037.00 6.57 5374 P2 1311 20001541 SE OK 31 SF 1005 SS149209219 STRESS OOR a. Listed below are three lottery payout options. (Click the icon to view the lottery payout options.) Rather than compare the payout options at their present values, compare the payout options at their future value ten years from now. Using an 8% interest rate, what is the future value of each payout option? b. Rank your preference of payout options. Does computing the future value rather than the present value of the options change your preference of payout options? Explain. (Click the icon to view the future value factor table.) (Click the icon to view the future value annuity factor table.) (Click the icon to view the present value factor table.) (Click the icon to view the present value annuity factor table.) c. a. Using an 8% interest rate, what is the future value of each payout option? Compute the future value of each payout option. (Round your answers to the nearest whole dollar) Future value of Option 1