ec4 please respond to 1 2 & 3 with explanation

I will upvote!

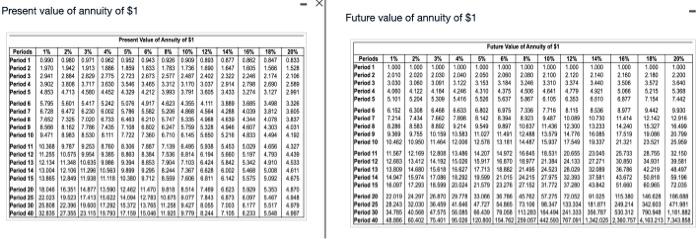

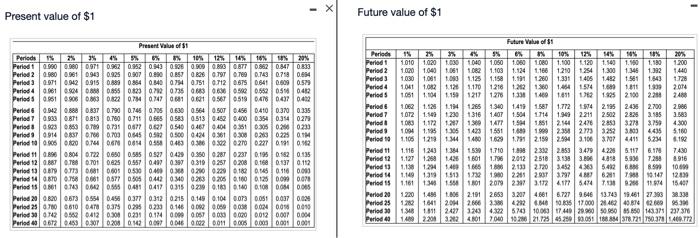

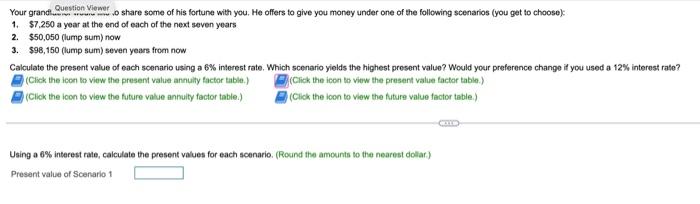

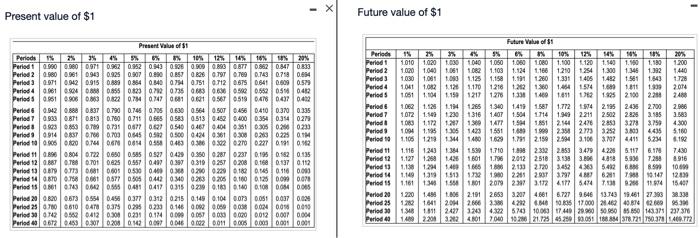

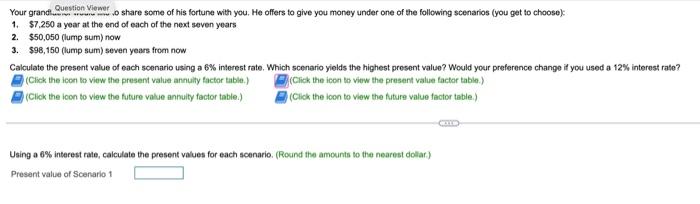

1 Present value of annuity of $1 Future value of annuity of $1 Present of Periode 16 2 3 0% i TON 124 10 185 21 Period 1 020 01 02 03200480328 09 0.18 0.827 182 87 0233 Period 1920 1912 1913 188 1888 1158 1180 1:50 1631 Period 284 2884 22.7152723 2678 2577 248 249 222 223 2.174 215 Period 392 102 1035 145 102 10 2017 2027 2120 Pened 25 4850414043294212330 2.79 3.60534333ZN 1127 Period 5.79558015417525.019 4917 464396411131996 3.49 2324 Pred 1.7289472 4730 S7582200 40454442804030 38122406 73052646210 N.344033 On 33 Period.0074351.99 N.MP3 444 44001 Period 10 ses 2.722 70 6.70 6.14665052104 4.60 418 Period 119.76 926.7.877.39 86651091094527 Period 12 11.25 10.875 0.554 386.00 1.384 7.395 46.1959 4.790 4480 Period 13 21411.80.9.29448537.900 7.703642458425.3249104533 Period 19.00 12.5 11.22092999206 207387 6621 5460 5.0084611 Period 1 1812901939111810380171215064811610 SSS 9.024875 00016339012101514 TAR451 Pod 2200 1020012000 BOTY.HOP 4141 02100 22.10.2012 15:32 1.250 1.0 TSI 41 2016 on 1244 Alom 41 Pature Viluty of 1 Periods 15 3% 5% EX 101 124 16 SI 20% Period 90 1.000 1.000 1000 1999 1.000 100 1.000 5.000 1200 1000 1000 1000 Period 2 2010 2.000 22040 2050 2030 2000 2100 2130 2140 2160 210 2300 Periods 303030603001112231534 3310 3334 3.140 3506 351 3500 Period 40004122 41M4208375 500 4 1 5000 520 5. Periods 610152045303416 8.5M 5.631 SP 610019 STO 49 11 7412 Perlot 11243 846 46 26.97 7.30 71168.11 1.56 2009 0.42 330 PT 72947434 708143 2 ART 10 5031 11414 11 12016 Period 20*5012049540 0.837 1031113.300 13233 14.20 150 400 Periods 2.755 105110711411124 13:17 16 1759 100 10 Period 10 10 10.50 116412001251448715031754810337 21.125 23.500 Period 11 11.5 12.109 12.800 12.4 14.20 4.99265478.571 20.055245 26.733 Port2 123 12412 14925911 9977212112212721 21.796 12.150 3090 14001 Period 1311.809 14.880 15.95.427 17.713 214 24.529 28.029 12.000 36.784 42-219 48400 Period 14415.974 1703012100 21015 215 21:27527 43,672 SMO 180 Periods NC17200.000 21.69 2270 271 27200 NG 510 2008 Pero 2010 2007 2008 113 AM Periods 2020 22.000 460 47.710001140214 Period 0.7 40.5 USM M430 NO 1112001.04.2013.821.312.12 Period 120.14 4020 MT 902.0127 - - Present value of $1 Future value of $1 Present of 11 Periode 2% 35 4% 9% 8% 10% 12% 14% 16% 20% Period 0.560 0.5800911 0.952 0.952 0.943 0.9250.500 0.8930.BTT 0.862 0.847 0.833 Period 20.980 0961 0.9430.9.25 0.907 0.90 0.8570.28 0.797.789 0.743 0.7490.654 Period 30.971 0942 0915 0.8890354084007540J51 0.12 0.875 0.541 0.6090.529 Period 40.961.040.8 0.8550823 072 0735680.600.500.552 059 0412 Periods 0.9610906 0.8 0.22 0.7 0.747061 0.0156 05190478 0.437 0.422 Periods 0.9420888 0.837 0.790 0.745 0.70 0.630 0.5645070.456 0.40 0.370 0.335 Period 0.933 BT+0.813 0.750 0.71 0.665 0.583 0.513 0.452 0.400 0.3540354 0.279 Periods 0.03 0860 0.7 0.73 0.677 007 0540 046704040.51 0.30 0.250 0.230 Periods 0.9148ST0.7680.709 0.545 0.520.5000424 0.36 0.00 0.2 0.22 0.1 Period to 0.50 0.10 0.14 0.61 08140.350.400.40.32 020 0221 0.991 0.42 Period 1 089 08040.722 0.650 0.595 0.52704390350287 023T0.195 0.582 0.135 Period 120.887798 0.701 0.625 0.557 0.40 0.39 0.31025702080.160.137 0.112 Period 1.89 0.008 0.50 0.500 0.400 0.3600200022001600.16 0.116 0.000 Period 1406700.750.500.577 0.504 0400 340020002050.160 0.125 0.09 0.078 Period 1 0.861 0.7490.0120.5660.411 0417 0.31502090.160.100.1080010.085 Period 20 820 0.673 0.554 0.45 0.377 0.3120.15 0.14 0.14 0.07 0.05 0.007 0.02 Periods 0.78 0.610 0.4 0.375 0295 023301460090 0.00 0.00 0.00 0.00 0.0 Period 3007420520412 0.30 0.21 0.1740.00 0.067 0.00 0.0200012 0.00 0.004 Period 49 06720453 0.20 0.200 00 00 00 00 00 0.00 0.00 0.00 0.001 Period Period Period 2 Period Period Periods Period Period 7 Period Periods Period 10 Period Period 12 Period 13 Period 14 Period 15 Period 20 Period 25 Period 30 Period Future Value of 15 29% 3% 99 es 105 124 90 20% 1.010 1.020 1.0301040 1.050 1.050 1.080 1.100 120 1.540 1.90 1.10 1.200 1.0201040 1.0611082 1.100 1.1241.166 1.2102541.300 1.346 1.382 1440 1.030.081 1.090 1.125 1.1581.191 1260 1331 1405 1.482 1.581 1.543 1.728 1041 1082126 1.170121612021360 1.454 15741.600 1811 1990 2014 1051 1.5041150 121712761330 1489 1611 121825 2190 2.251 24 1.052 1.528 1.194 12651340 141 1.587 1.772 1974 2195 2435 2700 2.586 1072 1.541 1 230 1316 1.407 1.504 1714 1.949 2211 2.902 2826 3.595 3.580 ORO 1.112 1202 13001477 15 1851 2.54 2476 2850 3.27 3.750 4.300 1094 1.185 1305 1423 1551 1699 1999 2354277332523.8034435 5.100 1.105 129 1944 1480 1629 12.159 2.53.100 3.707 4411 5234 190 1.116 1243 13841599 1.7601.199233228533.479 4.225.176.119 7430 1.1271.260 1.4251601 1.196 2012 25183.139 3.3664848 5931 7.290 8916 1.131.2941481666 1862.13 2.720 3.452436 5412 6.888.59 10.00 1.149 139 151317321980220293737974876.2017 19.147 12030 1.161 1340 150110120792307 3.17241776.4747.530.20 11.415.407 1220 1.490 1.800 2.191 2653 3.207 4.6616721 9 5481374319.451 27.383 38.338 12010412026662.3842126.000 17.000 21.46249.814268953 13481011242732404222 570 10.00 17.440 29.95090950 5.50 14.378 237376 14022013212401 2000 192021.725525000 1888 378 720 090.3205460.72 Your grand.Question Viewer o share some of his fortune with you. He offers to give you money under one of the following scenarios (you get to choose) 1. $7.250 a year at the end of each of the next seven years 2. $50,050 (lump sum) now 3. $98,150 (lump sum) seven years from now Calculate the present value of each scenario using a 6% interest rate. Which scenario yields the highest prosent value? Would your preference change if you used a 12% interest rate? (Click the icon to view the present value annuity factor table.) (Click the icon to view the present value factor table) (Click the toon to view the future value annuity factor table.) (Click the icon to view the future value factor table) CALLE Using a 6% interest rato, calculate the present values for each scenario. (Round the amounts to the nearest dollar) Present value of Scenario 1