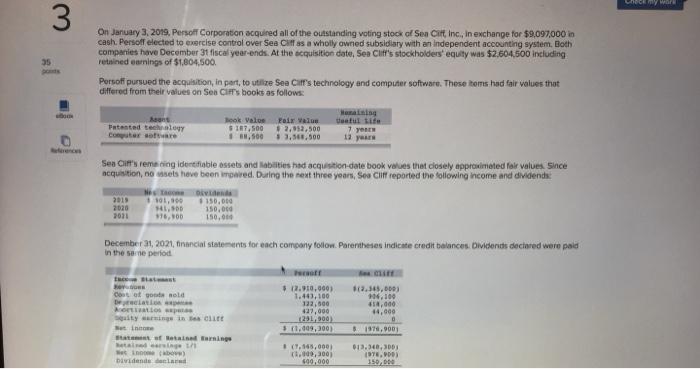

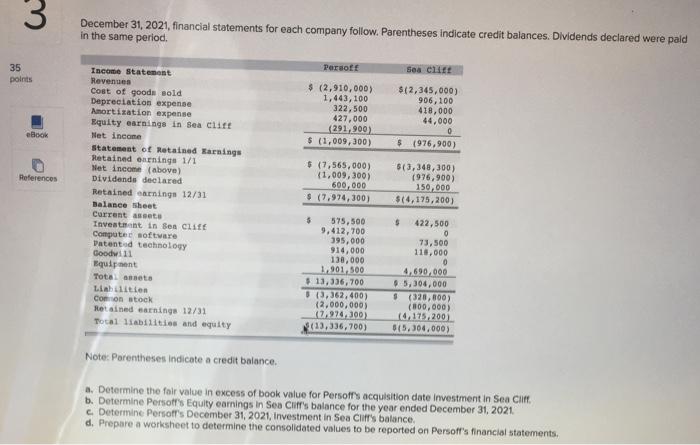

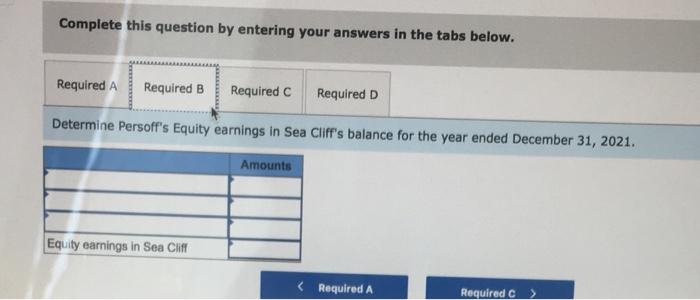

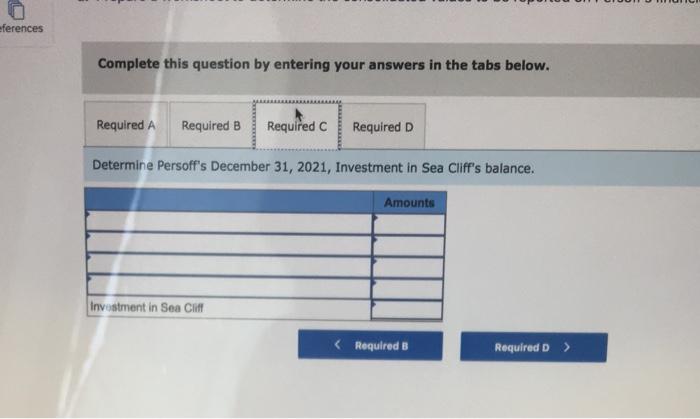

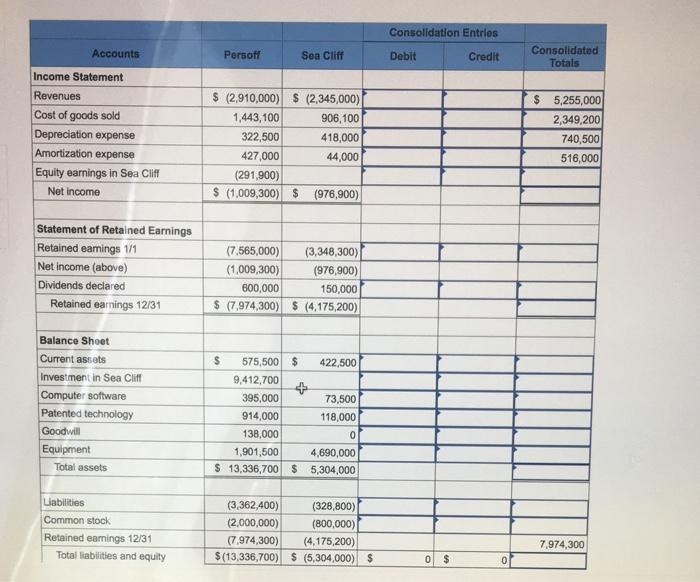

ECE wore 3 35 On January 3, 2019. Persoft Corporation acquired all of the outstanding voting stock of Sen Cift Inc., in exchange for $9,097.000 in cash. Persoff elected to exercise control over Sea Cliff as a wholly owned subsidiary with an independent accounting system. Both companies have December 31 fiscal year-ends. At the acquisition date, Sen Cuff's stockholders' equity was $2.604,500 including retained earnings of $1.804,500. Persoff pursued the acquisition, in part, to utilize Sea Cliff's technology and computer software. These toms had fair values that differed from their values on Sen CIFT's books as follows: emaining sont Valoe Foix Value teful tite Patented technolo 187,500 12,052,500 7 years conter of + 1,00 1,500.500 Book years Sea Cliff's remain identifiable assets and abilities had acquisition date book values that closely approximated fair values. Since acquisition, no sets have been word. During the next three years, Sea Cliff reported the following income and dividends: 2019 2010 100,00 1,500 176,00 150,000 150,00 150,000 2011 December 21, 2021, financial statements for each company follow. Parentheses Indicate credit balances Dividends declared were paid In the same period sos Otot good Deals Los ity inci e in of tasarning th etib Dividenden $ 12.900.000 1.443, 100 122.500 437,000 1231,900) 3 1.199,300) 12,345,000 14.100 18,00 44,000 1971,9001 (1.145,000 1.100,300 690,000 013.140,3003 INTE, 350,000 3 December 31, 2021, financial statements for each company follow. Parentheses indicate credit balances. Dividends declared were paid in the same period. Persoft 35 points Sea Clit $ (2,910,000) 1,443,100 322,500 427,000 (291,900) $ (1,009,300) $(2,345,000) 906, 100 418,000 44,000 0 $ (976,900) eBook References Income Statement Revenues Cost of goods sold Depreciation expense Amortization expense Equity earnings in Sea Clift Net income Statement of Retained Warnings Retained earnings 1/1 Net income (above) Dividends declared Retained earnings 12/31 Balance sheet Current asset Investment in Sen CHE Computer software Patented technology Goodwill Equipment Total susta Lialities Comon stock Retained earnings 12/31 Total liabilities and equity $ (7,565,000) (1,009,300) 600,000 $ (7,974,300) $(3,348,300) 1976,900) 150,000 $14,175, 200) 575,500 9.412,700 395,000 914,000 130,000 1.901,500 $ 13,336,700 (3,362,400) (2.000,000) (7,974.100) $(13,336,700) $ 422,500 O 73,500 118.000 0 4,690,000 $ 5,304,000 $ (320, 800) (800,000) 0.175,200) (5.304,000) Noter : Parentheses indicate a credit balance. a. Determine the fair value in excess of book value for Persoft's acquisition date investment in Sea Clift b. Determine Persots Equity earnings in Sea Cliff's balance for the year ended December 31, 2021 Determine Persoff's December 31, 2021, Investment in Sea Cliff's balance, d. Prepare a worksheet to determine the consolidated values to be reported on Persoff's financial statements, Complete this question by entering your answers in the tabs below. Required A Required B Required Required D Determine Persoff's Equity earnings in Sea Cliff's balance for the year ended December 31, 2021. Amounts Equity earnings in Sea Cliff eferences Complete this question by entering your answers in the tabs below. Required A Required B Required Required D Determine Persoff's December 31, 2021, Investment in Sea Cliff's balance. Amounts Investment in Sea C Consolidation Entries Accounts Persoff Sea Cliff Debit Credit Consolidated Totals Income Statement Revenues Cost of goods sold Depreciation expense Amortization expense Equity earnings in Sea Cliff Net income $ (2,910,000) $ (2,345,000) 1,443,100 906,100 322,500 418,000 427,000 44,000 (291,900) $ (1,009,300) $ (976,900) $ 5,255,000 2,349,200 740,500 516,000 Statement of Retained Earnings Retained earnings 1/1 Net income (above) Dividends declared Retained earnings 12/31 (7,565,000) (3,348,300) (1,009,300) (976,900) 600,000 150,000 $ (7.974,300) $ (4,175,200) Balance Sheet Current assets Investment in Sea Cliff Computer software Patented technology Goodwill Equipment Total assets $ 575,500 $ 422,500 9,412,700 + 395,000 73,500 914,000 118,000 138,000 0 1,901,500 4,690,000 $ 13,336,700 $5,304,000 Labilities Common stock Retained earnings 12/31 Total liabilities and equity (3,362,400) (328,800) (2,000,000) (800,000) (7,974,300) (4.175,200) $(13,336,700) $ (5,304,000) $ 7,974,300 0 $