Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ecnomics Q1. Answer the following questions: (a) If your credit card has an interest rate of 2.1% per month compounded monthly, what is its nominal

ecnomics

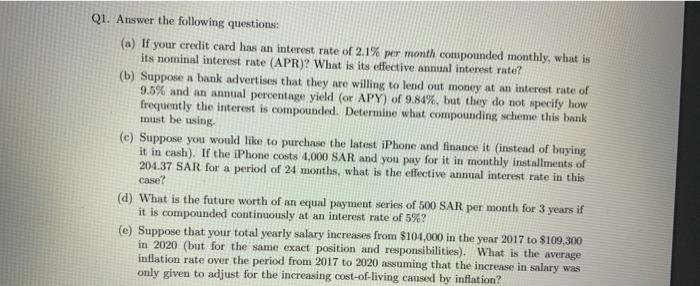

Q1. Answer the following questions: (a) If your credit card has an interest rate of 2.1% per month compounded monthly, what is its nominal interest rate (APR)? What is its effective annual interest rate? (b) Suppose a bank advertises that they are willing to lend out money at an interest rate of 9.5% and an annual percentage yield (or APY) of 9.84%, but they do not specify how frequently the interest is compounded. Determine what compounding scheme this bank must be using (e) Suppose you would like to purchase the latest iPhone and finance it (instead of buying it in cash). If the iPhone costs 1,000 SAR and you pay for it in monthly installments of 204.37 SAR for a period of 24 months, what is the effective annual interest rate in this case? (d) What is the future worth of an equal payment series of 600 SAR per month for 3 years if it is compounded continuously at an interest rate of 5%? (e) Suppose that your total yearly salary increases from $104,000 in the year 2017 to $109,300 in 2020 (but for the same exact position and responsibilities). What is the average inflation rate over the period from 2017 to 2020 assuming that the increase in salary was only given to adjust for the increasing cost-of-living caused by inflation? Q1. Answer the following questions: (a) If your credit card has an interest rate of 2.1% per month compounded monthly, what is its nominal interest rate (APR)? What is its effective annual interest rate? (b) Suppose a bank advertises that they are willing to lend out money at an interest rate of 9.5% and an annual percentage yield (or APY) of 9.84%, but they do not specify how frequently the interest is compounded. Determine what compounding scheme this bank must be using (c) Suppose you would like to purchase the latest iPhone and finance it instead of buying it in cash). If the iPhone costs 4,000 SAR and you pay for it in monthly installments of 204.37 SAR for a period of 24 months, what is the effective annual interest rate in this case? (d) What is the future worth of an equal payment series of 500 SAR per month for 3 years if it is compounded continuously at an interest rate of 5%? (e) Suppose that your total yearly salary increases from $104,000 in the year 2017 to $109,300 in 2020 (but for the same exact position and responsibilities). What is the average inflation rate over the period from 2017 to 2020 assuming that the increase in salary was only given to adjust for the increasing cost-of-living caused by inflation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started