Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ecolnvest group of companies comprises of Ecolnvest Holding Bhd (Ecolnvest) and two wholly-owned subsidiaries, Dayalnvest Sdn Bhd (Dayalnvest) and Majulnvest Sdn Bhd (Majulnvest). Ecolnvest

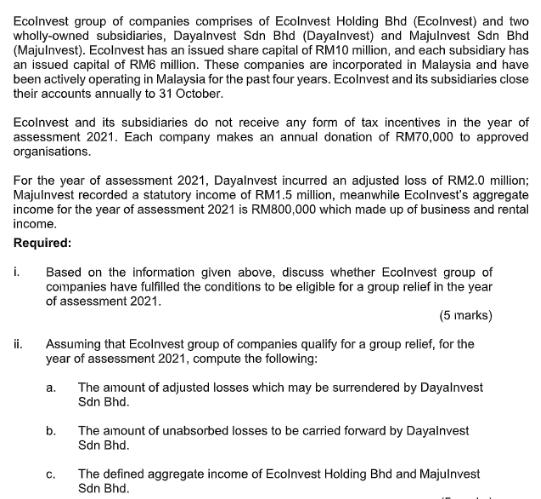

Ecolnvest group of companies comprises of Ecolnvest Holding Bhd (Ecolnvest) and two wholly-owned subsidiaries, Dayalnvest Sdn Bhd (Dayalnvest) and Majulnvest Sdn Bhd (Majulnvest). Ecolnvest has an issued share capital of RM10 million, and each subsidiary has an issued capital of RM6 million. These companies are incorporated in Malaysia and have been actively operating in Malaysia for the past four years. Ecolnvest and its subsidiaries close their accounts annually to 31 October. Ecolnvest and its subsidiaries do not receive any form of tax incentives in the year of assessment 2021. Each company makes an annual donation of RM70,000 to approved organisations. For the year of assessment 2021, Dayalnvest incurred an adjusted loss of RM2.0 million; Majulnvest recorded a statutory income of RM1.5 million, meanwhile Ecolnvest's aggregate income for the year of assessment 2021 is RM800,000 which made up of business and rental income. Required: i. ii. Based on the information given above, discuss whether Ecolnvest group of companies have fulfilled the conditions to be eligible for a group relief in the year of assessment 2021. (5 marks) Assuming that Ecolnvest group of companies qualify for a group relief, for the year of assessment 2021, compute the following: a. b. C. The amount of adjusted losses which may be surrendered by Dayalnvest Sdn Bhd. The amount of unabsorbed losses to be carried forward by Dayainvest Sdn Bhd. The defined aggregate income of Ecolnvest Holding Bhd and Majulnvest Sdn Bhd.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i Based on the information given above discuss whether E col n vest group of companies have fulfille...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started