ECON 206: Problem Set 8 1) The two questions in Tutorial Problems 7 looked at how changes in different macroeconomic variables affected the interest rate and and aggregate income. This week we'll extend the changes to how they affect the aggregate demand curve.

For b) - c) remember that this means that r does not affect C and I and so the IS curve exists but is not downward sloping. So now you need to know what this means for the slope of the AD curve. When r does affect C and I we get a downward sloping IS curve and a downward sloping AD curve. When r does not affect C and I we do not get a downward sloping IS curve. This means we also do not get a downward sloping AD curve. Once you have worked out what the AD curve looks like and why it looks like this, then you can answer b)-c).

a) Show on a diagram how the fiscal stimulus in Q1) of tutorial problems 7 affects the aggregate demand curve.

b) What would the aggregate demand curve look like when people and businesses are completely unresponsive to changes in the real interest rate over say 3-5 years? [Note: this is from Q2) of tutorial problems 7.]

c) What happens to the aggregate demand curve if the government spends more on goods and services when people and businesses are completely unresponsive to changes in the real interest rate over say 3-5 years? [Note: this is from Q2) of tutorial problems 7.]

d) What happens to the aggregate demand curve if the central bank increases the money supply when people and businesses are completely unresponsive to changes in the real interest rate over say 3-5 years? [Note: this is from Q2) of tutorial problems 7.]

tutorial problems 7 Q1 :

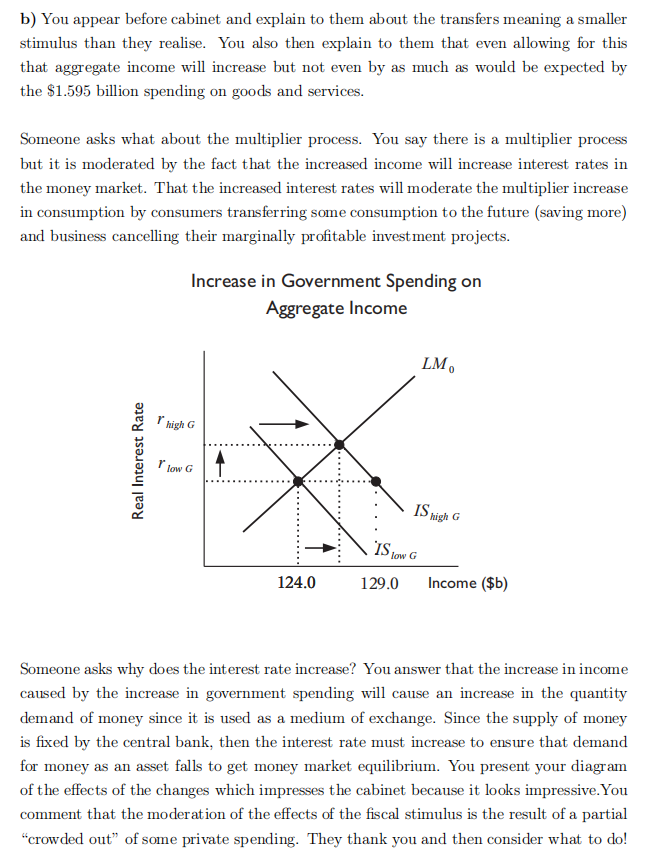

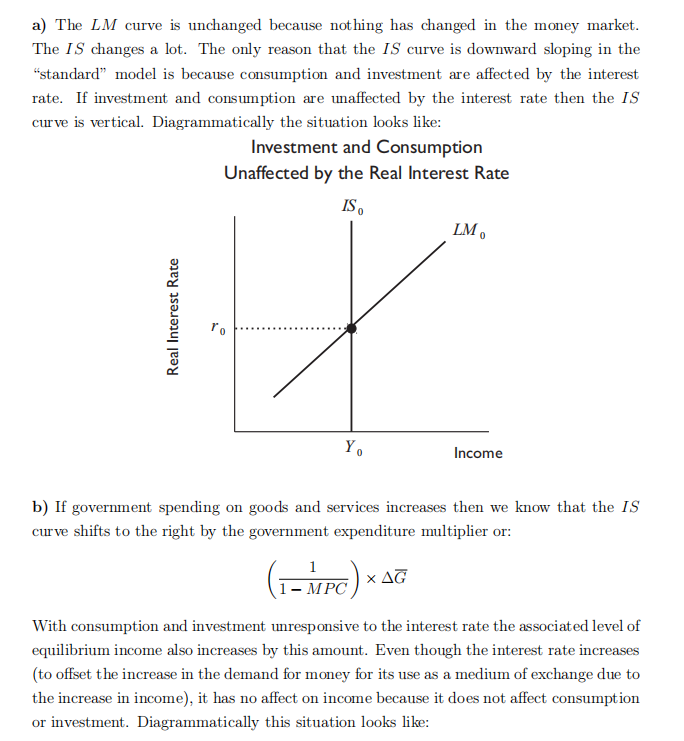

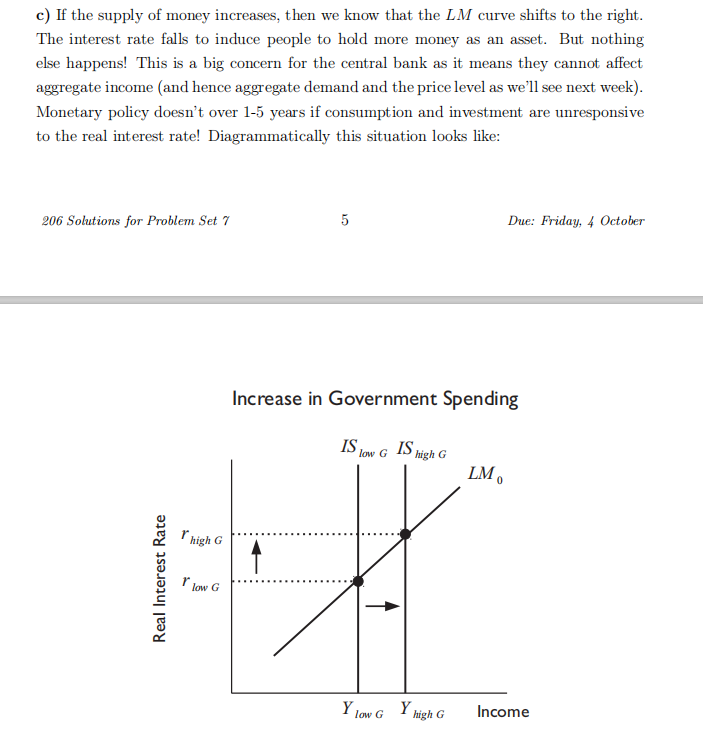

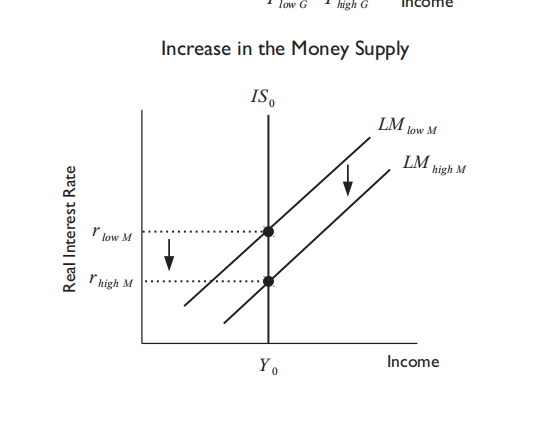

1) a} The rst thing you have to explain to the ruling party is that their scal stimulLs only increases plamied expenditures for goods by $1.595 billion. You explain to them that this is because fortyve percent of the proposed spending is on transfers which doesnlt increase planned expenditure in the goods market, just who does it. Of the spending only ftyve percent of the $2.9 billion, or $1.595 billion, is on purchasing goods and services. The other one quarters worth is just a redistribution of income from one group of people in the economy to another group of people in the economy. From your economics education you know that to work out the impact of govermnent expenditure on goods and services on income in the goods market that you need to know the marginal propensity to consume (MPG), since the govermuent expenditure multiplier is equal to 1 where the coefcient on the EEG term is the govermuent expenditure multiplier. Thankfully you have two values of aggregte consumption and income at different points in time so you can make a quick rough calculation of the MP0. Using the information on consumption and income you get, MPCZM 1310513255 _ 75,545 54,521 _ 123,255 22.572 = {1.531 Sllbstituting this into the formula for the government expenditure multiplier you work out that the increase in government spending leads to an increase of income of 1 1 = $5 billion b) You appear before cabinet and explain to them about the transfers meaning a smaller stimulus than they realise. You also then explain to them that even allowing or this that aggregte income will increase but not even by as much a would be expected by the $1.595 billion spending on goods and services. SOmeone asks what about the multiplier process. You say there is a multiplier procem but it is moderated by the fact that the increased income will increase interest rates in the money market. That the increased interest rates will moderate the multiplier increase in consumption by consumers transferring scme consumption to the future [saving more] and businem cancelling their marginally protable investment projects. Increase in Government Spending on Aggregate Income Real Interest Rate 124.0 129.0 Income {5 b} SOmeone asks why does the interest rate increase? You answer that the increase in income caused by the increase in government spending will cause an increase in the quantity demand of money since it is used as a medium of exchange. Since the supply of money is xed by the central bank, then the interest rate must increase to ensure that demand for money as an amet falls to get money market equilibrium. You present your diagram of the ei'liects of the changes which imprm the cabinet because it looks impreslve.You comment that the moderation of the effects of the scal stimulus is the result of a partial \"crowded out\" of scene private spending. They thank you and then consider what to do! a) The LM curve is unchanged because nothing has changed in the money market. The IS changes a lot. The only reason that the IS curve is downward sloping in the "standard" model is because consumption and investment are affected by the interest rate. If investment and consumption are unaffected by the interest rate then the IS curve is vertical. Diagrammatically the situation looks like: Investment and Consumption Unaffected by the Real Interest Rate IS o LM O Real Interest Rate ro Income b) If government spending on goods and services increases then we know that the IS curve shifts to the right by the government expenditure multiplier or: 1 - MPC x AG With consumption and investment unresponsive to the interest rate the associated level of equilibrium income also increases by this amount. Even though the interest rate increases (to offset the increase in the demand for money for its use as a medium of exchange due to the increase in income), it has no affect on income because it does not affect consumption or investment. Diagrammatically this situation looks like:c) If the supply of money increases, then we know that the LM curve shifts to the right. The interest rate falls to induce people to hold more money as an asset. But nothing else happens! This is a big concern for the central bank as it means they cannot affect aggregate income (and hence aggregate demand and the price level as we'll see next week). Monetary policy doesn't over 1-5 years if consumption and investment are unresponsive to the real interest rate! Diagrammatically this situation looks like: 206 Solutions for Problem Set 7 5 Due: Friday, 4 October Increase in Government Spending IS low G IS high G LM O Real Interest Rate I high G .. . . .. I' low G Y low G Yhigh G Incomelow G high G Income Increase in the Money Supply IS a LM low M LM high M Real Interest Rate I low M I high M Yo Income