Econ homework.

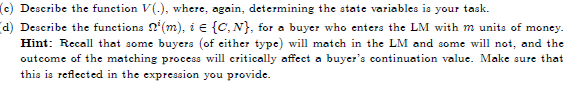

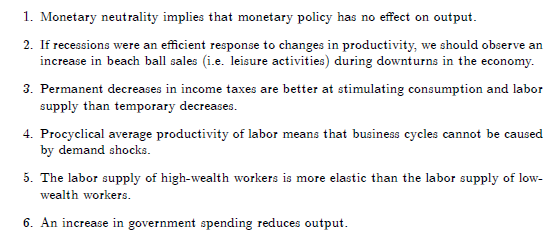

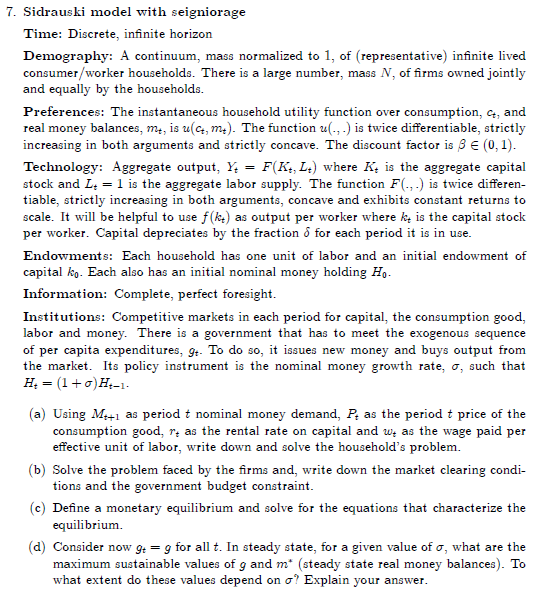

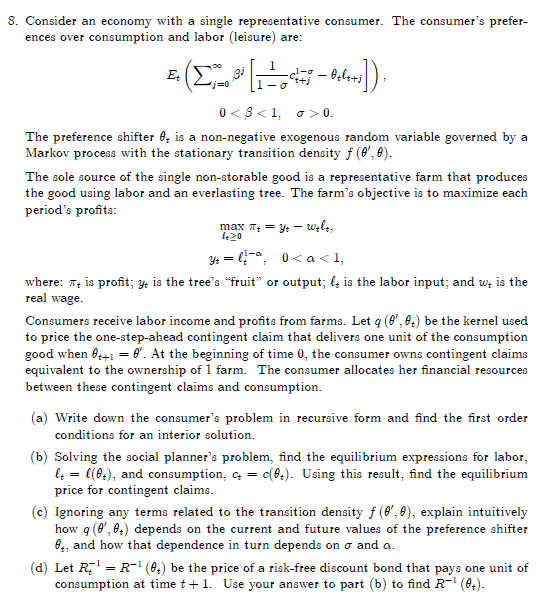

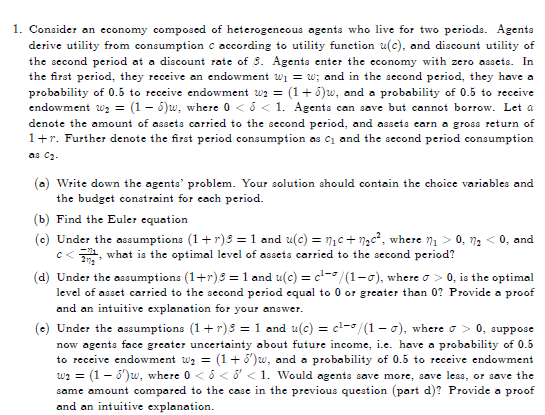

[ell Describe the function VI\1. Monetary neutrality.r implies that monetary policy.r has no effect on output. 2. If recessions were an eicient response to changes in productivity. we should observe an increase in beach ball sale: [i.e. leisure activities} during downturns in the economy. 3. Permanent decreases in income taxes are better at stimulating consumption and labor supply.r than temporary.r decreases. 4. Procyclical average productivity of labor means that business cycles cannot be caused by demand shocks. 5. The labor supply of highwealth workers is more elastic than the labor supply of low wealth workers. 6. An increase in government spending reduces output. 'i". Sidrauslci model with seig'nior'age Time: Discrete, innite horizon Demography: PL continuum, mass normalized to l, of {representative} innite lived consumerlg'worker households. There is a large number, mass N, of rms owned jointly and equally by the households. Preferences: The instantaneous household utility flmction over consumption, ch and real money balances, rm, is \"{5}, arm]. The function u{., .I is twice dierentiable, strictly increasing in both arguments and strictly concave. The discount factor is ,3 E [I], 1}. Technology: Aggregate output, Y1; = FfflthsII where K} is the aggregate capital stock and L; = 1 is the aggregate labor supply. The function F{., .II is twice dierecn tiable, strictly increasing in both arguments, concave and exhibits constant returns to scale. It will be helpful to use Hist} as output per worker where in, is the capital stock per worker. Capital depreciates by the fraction 5 for each period it is in use. Endowments: Each household has one unit of labor and an initial endowment of capital kn. Each also has an initial nominal money holding H\". Information: Complete, perfect foresight. Institutions: Competitive markets in each period for capital, the consumption good, labor and money. There is a government that has to meet the exogenous sequence of per capita expenditures, 3*. To do so, it issues new money and buys output om the market. Its policy instrument is the nominal money growth rate, or, such that H; = {1 + J}H_1. {a} Using Mien-1 as period t nominal money demand, P; as the period t price of the consumption good, r; as the rental rate on capital and w; as the wage paid per effective unit of labor, write down and solve the household's problem. {b} Solve the problem faced by the rms and, write down the market clearing condi tions and the government budget constraint. {c} Dene a monetary equilibrium and solve for the equations that characterize the equilibrium. [dII Consider now 91., = g for all t. In steady state, for a given value of a", what are the maximum sustainable values of g and m' [steady state real money balances}. To what extent do these values depend on no"? Explain your answer. \fl. lConsider an economy composed of heterogeneous agents who live for two periods. Agents derive utility from consumption :1: according to utility function EEG}, and discount utility of the second period at a discount rate of 3. .F'Lgents enter the economy with zero assets. In the rst period, they receive an endowment 101 = to; and in the second period.I they have a probability of ll.5 to receive endowment to: = [1+ lm. and a probability of {1.5 to receive endowment to; = {l :5}u.l._ where D {I .5 -'.T 1. agents can save but cannot borrow. Let n denote the amount ofassets carried to the second period1 and assets earn a gross return of 1+ 1". Further denote the first period consumption as {:1 and the second period consumption as 433. [all tVrite down the agents' problem. Your solution should contain the choice variables and the budget constraint for each period. b Find. the Euler e tion qua [cl Under the assumptions {1 + 1"]5 = l and EEC} = $116+ W361. where 7'31 I? l}. 11': -'.T I]. and I: 11' ll" what is the optimal level ofassets carried to the second period? {d} Under the assumptions [1 +T]I5 = l and ulc} = G1_\"_.-"[l I;T:|, where LT 12* I}. is the optimal level of asset carried to the second period equal to D or greater than I]? Provide a proof and an intuitive explanation for your answer. [ell Under the assumptions [1 + 1"}3 = l and My} 2 cl_al."{l LT], where IF 2" (I, suppose now agents face greater uncertainty.r about future income1 i.e. have a probability of [lull to receive endowment to; = [l + Ellis, and a probability of [1.5 to receive endowment to; : [l Jill's}, where {I -'.'. .5 of will s: 1. '53:?on agents save more. save less, or save the sarne amount cornpared to the ease in the previous question [part d}? Provide a proof and an intuitive explanation