Econ/Finance multiple choice questions:

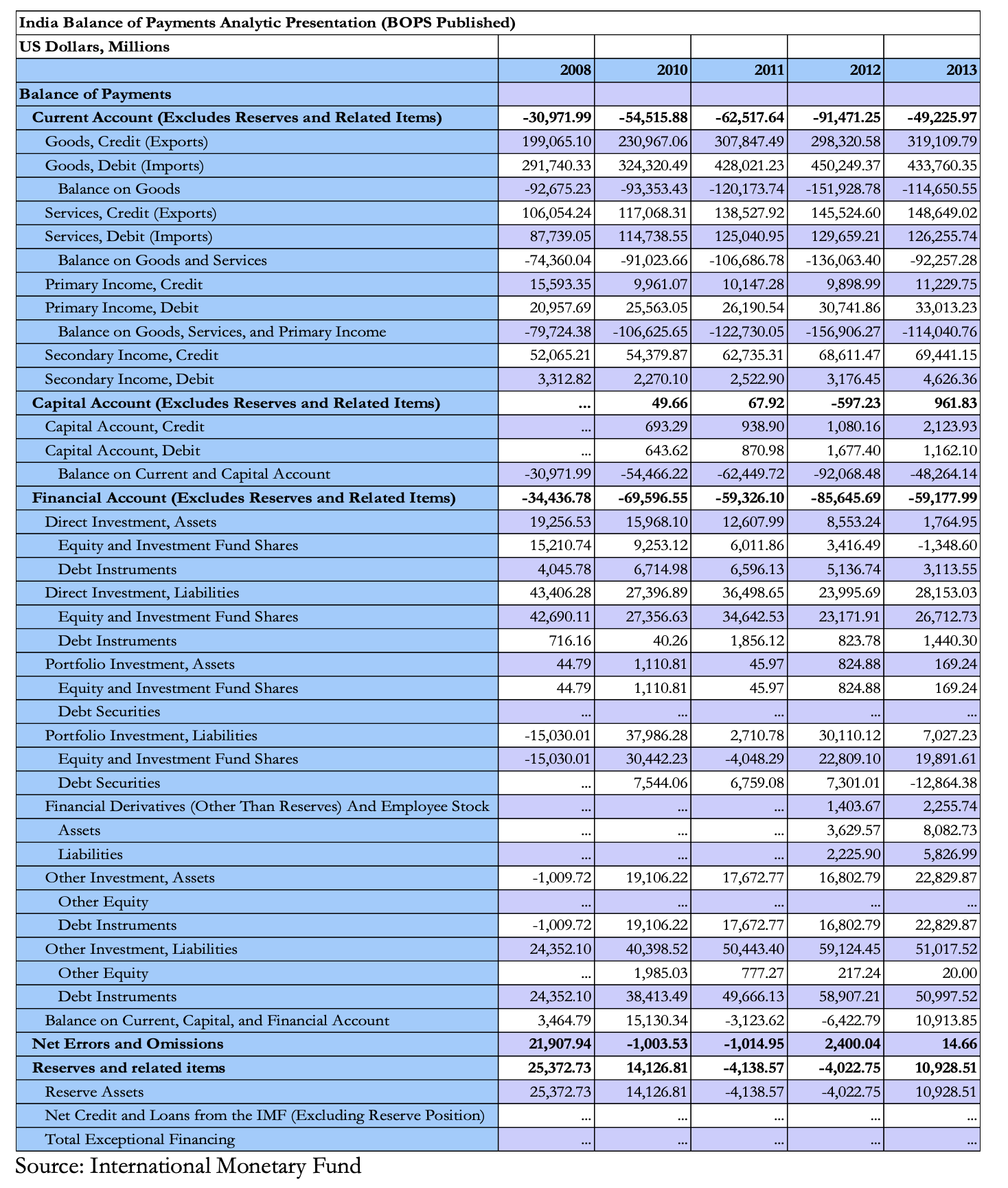

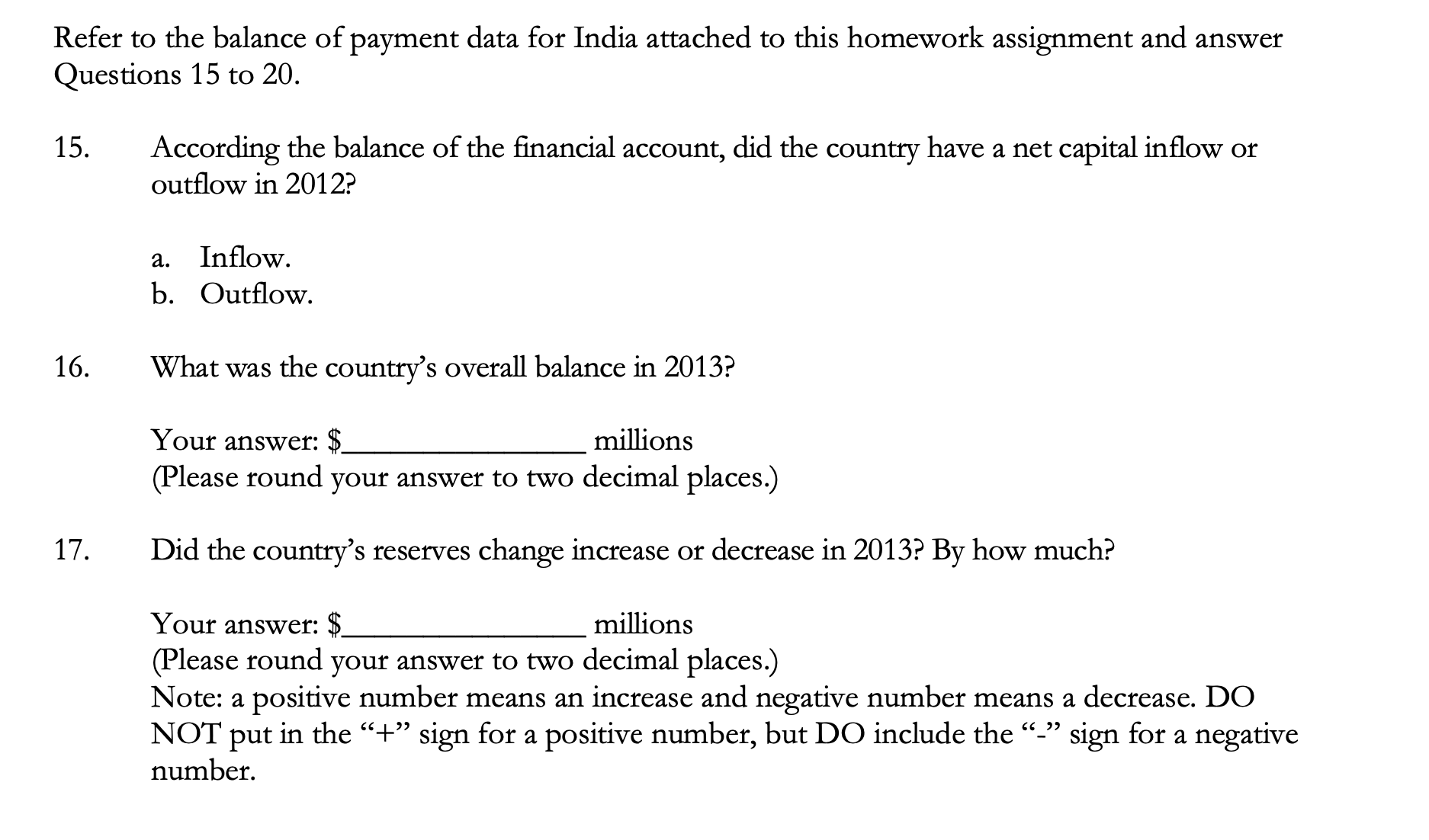

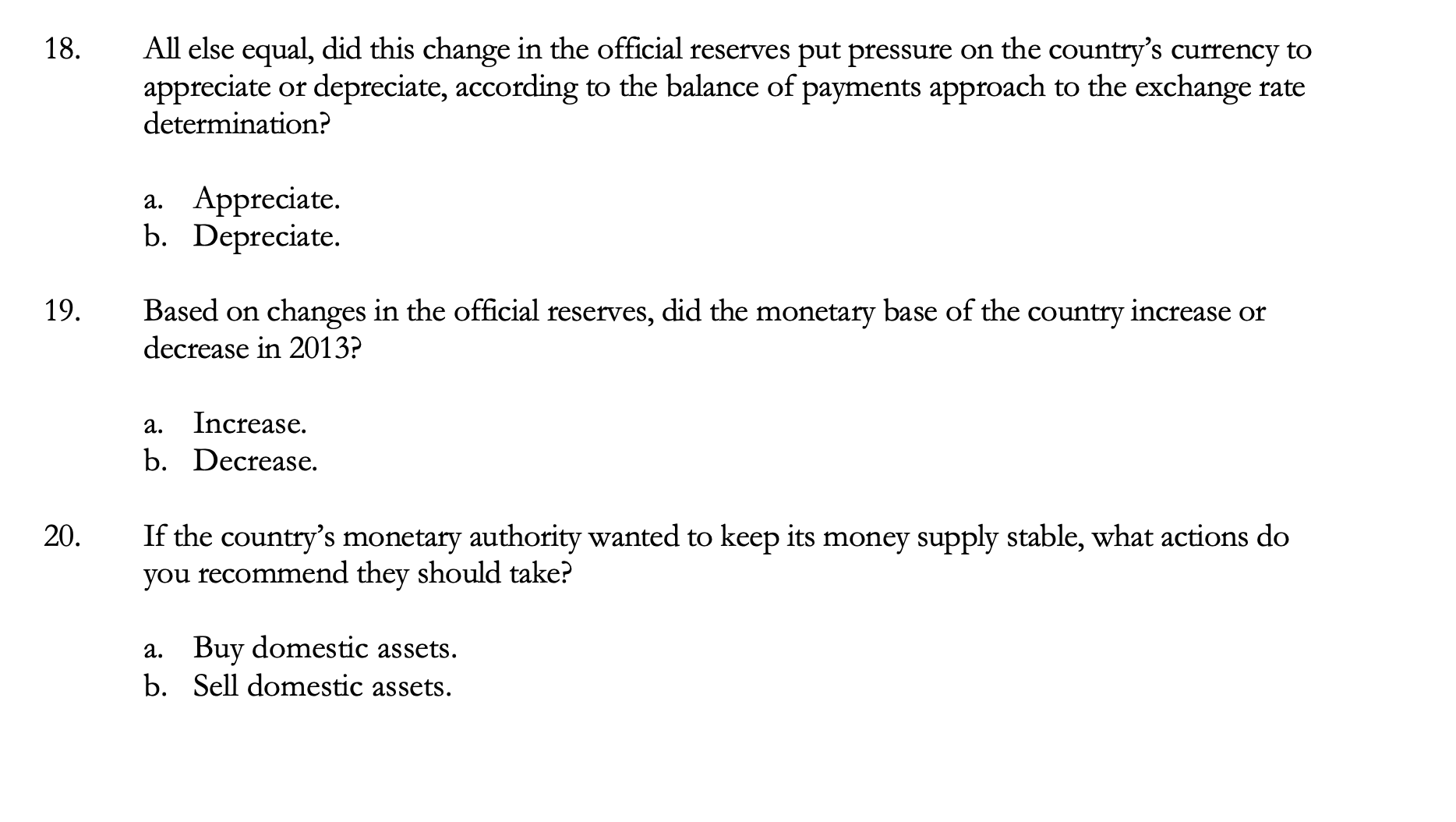

India Balance of Payments Analytic Presentation (BOPS Published) US Dollars, Million 2008 2010 2011 2012 2013 Balance of Payments Current Account (Excludes Reserves and Related Items) -30,971.99 -54,515.88 -62,517.64 -91,471.25 -49,225.97 Goods, Credit (Exports) 199,065.10 230,967.06 307,847.49 298,320.58 319,109.79 Goods, Debit (Imports) 291,740.33 324,320.49 428,021.23 450,249.37 433,760.35 Balance on Goods 92,675.23 93,353.43 -120,173.74 151,928.78 114,650.55 Services, Credit (Exports) 106,054.24 117,068.31 138,527.92 145,524.60 148,649.02 Services, Debit (Imports) 87,739.05 114,738.55 125,040.95 129,659.21 126,255.74 Balance on Goods and Services 74,360.04 91,023.66 -106,686.78 -136,063.40 -92,257.28 Primary Income, Credit 5,593.35 9,961.07 10,147.28 9,898.99 1,229.75 Primary Income, Debit 20,957.69 25,563.05 26,190.5 30,741.86 33,013.23 Balance on Goods, Services, and Primary Income 79,724.38 -106,625.65 -122,730.05 -156,906.27 -114,040.76 Secondary Income, Credit 52,065.21 54,379.87 62,735.31 58,611.47 69,441.15 Secondary Income, Debit 3,312.82 2,270.10 2,522.90 3,176.45 1,626.36 Capital Account (Excludes Reserves and Related Items) 49.6 67.92 -597.23 961.83 Capital Account, Credit 693.29 38.90 ,080.16 2,123.93 Capital Account, Debit 643.62 370.9 ,677.40 1,162.10 Balance on Current and Capital Account 30,971.99 -54,466.22 -62,449.72 92,068.48 48,264.14 Financial Account (Excludes Reserves and Related Items) -34,436.78 -69,596.55 -59,326.10 -85,645.69 -59,177.99 Direct Investment, Assets 19,256.5. 5,968.10 12,607.99 3,553.24 1,764.95 Equity and Investment Fund Shares 15,210.74 ,253.12 ,011.8 3,416.49 -1,348.60 Debt Instruments 4,045.78 6,714.98 6,596.13 5,136.74 3,113.55 Direct Investment, Liabilities 43,406.28 27,396.89 36,498.6. 23,995.69 28,153.03 Equity and Investment Fund Shares 42,690.11 27,356.63 34,642.53 23,171.91 26,712.73 Debt Instruments 716.16 40.26 1,856.12 $23.78 1,440.30 Portfolio Investment, Assets 14.79 1,110.81 45.97 324.88 69.24 Equity and Investment Fund Shares 44.79 1,110.81 45.97 824.8 169.24 Debt Securities Portfolio Investment, Liabilities -15,030.01 37,986.28 2,710.78 30,110.12 7,027.23 Equity and Investment Fund Shares 15,030.01 30,442.23 4,048.29 22,809.10 19,891.61 Debt Securities 7,544.06 6,759.08 7,301.01 12,864.38 Financial Derivatives (Other Than Reserves) And Employee Stock , 403.67 2,255.74 Asset 3,629.57 8,082.73 Liabilities 2,225.90 5,826.99 Other Investment, Assets 1,009.72 19,106.22 17,672.77 16,802.79 22,829.87 Other Equity Debt Instruments 1,009.72 19,106.22 17,672.77 16,802.79 22,829.87 Other Investment, Liabilities 24,352.10 40,398.52 50,443.40 59,124.45 51,017.52 Other Equity 1,985.03 777.27 217.24 20.00 Debt Instruments 24,352.10 38,413.49 49,666.13 58,907.21 50,997.52 Balance on Current, Capital, and Financial Account 3,464.79 15,130.34 3,123.62 6,422.79 0,913.85 Net Errors and Omissions 21,907.94 -1,003.53 1,014.95 2,400.04 14.66 Reserves and related items 25,372.73 14,126.81 4,138.57 4,022.75 10,928.51 Reserve Assets 25,372.73 14,126.81 4,138.57 4,022.75 10,928.51 Net Credit and Loans from the IMF (Excluding Reserve Position) Total Exceptional Financing .. Source: International Monetary FundRefer to the balance of payment data for India attached to this homework assignment and answer Questions 15 to 20. 15. According the balance of the nancial account, did the country have a net capital inow or outow in 2012? a. Inow. b. Outow. 16. What was the country's overall balance in 2013? Your answer: $ millions (Please round your answer to two decimal places.) 17. Did the country's reserves change increase or decrease in 2013? By how much? Your answer: $ millions (Please round your answer to two decimal places.) Note: a positive number means an increase and negative number means a decrease. DO 5' ,3 NOT put in the \"+\" sign for a positive number, but DO include the - sign for a negative number. 18. 19. 20. All else equal, did this change in the ofcial reserves put pressure on the country's currency to appreciate or depreciate, according to the balance of payments approach to the exchange rate determination? a. Appreciate. b. Depreciate. Based on changes in the ofcial reserves, did the monetary base of the country increase or decrease in 2013? a. Increase. b. Decrease. If the country's monetary authority wanted to keep its money supply stable, What actions do you recommend they should take? a. Buy domestic assets. b. Sell domestic assets