Answered step by step

Verified Expert Solution

Question

1 Approved Answer

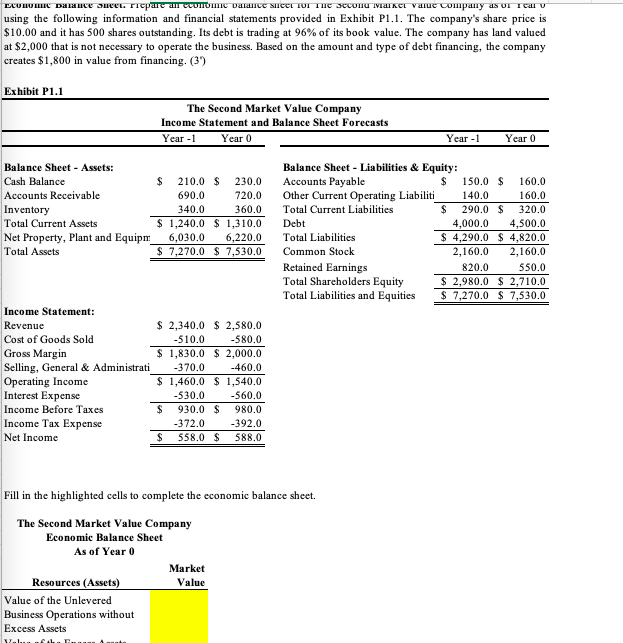

Economic Balance Sheet. Prepare an economic balance sheet for The Second Market Value Company as of Year 0 using the following information and financial statements

Economic Balance Sheet. Prepare an economic balance sheet for The Second Market Value Company as of Year using the following information and financial statements provided in Exhibit P The company's share price is $ and it has shares outstanding. Its debt is trading at of its book value. The company has land valued at $ that is not necessary to operate the business. Based on the amount and type of debt financing, the company creates $ in value from financing. Fill in the highlighted cells to complete the economic balance she

The Second Market Value Company

Economic Balance Sheet

As of Year using the following information and financial statements provided in Exhibit P The company's share price is

$ and it has shares outstanding. Its debt is trading at of its book value. The company has land valued

at $ that is not necessary to operate the business. Based on the amount and type of debt financing, the company

creates $ in value from financing.

Exhibit P

Revenue

Cost of Goods Sold

Gross Margin

$$

Operating Income

Interest Expense

Income Before Taxes

Income Tax Expense

Net Income

Fill in the highlighted cells to complete the economic balance sheet.

The Second Market Value Company

Economic Balance Sheet

As of Year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started