Suppose the Russian government recognizes that its reliance on oil exports makes it vulnerable to the Dutch Disease. On the one hand, if oil

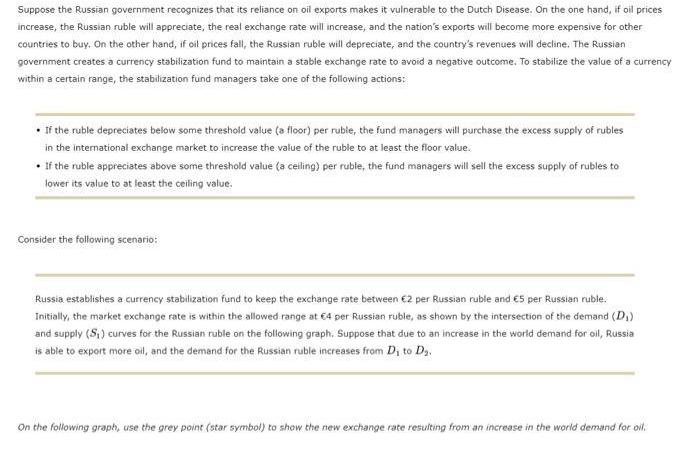

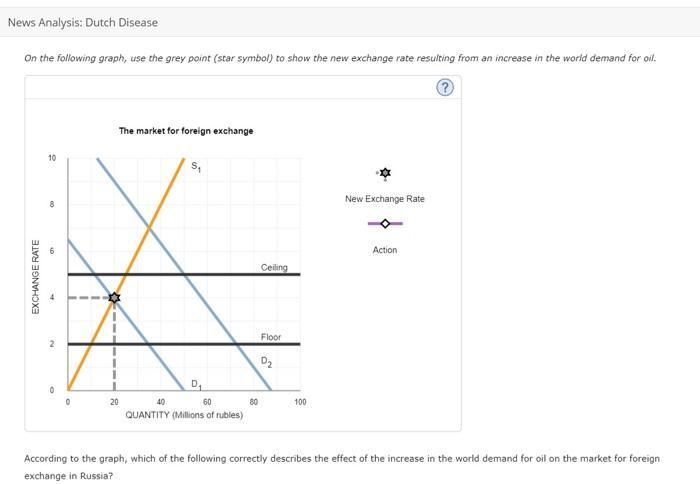

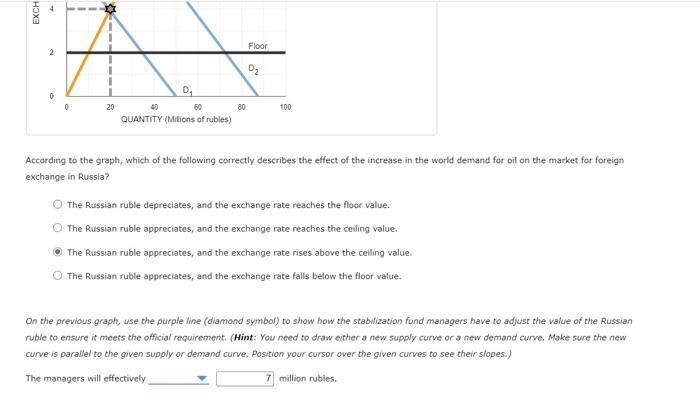

Suppose the Russian government recognizes that its reliance on oil exports makes it vulnerable to the Dutch Disease. On the one hand, if oil prices increase, the Russian ruble will appreciate, the real exchange rate will increase, and the nation's exports will become more expensive for other countries to buy. On the other hand, if oil prices fall, the Russian ruble will depreciate, and the country's revenues will decline. The Russian government creates a currency stabilization fund to maintain a stable exchange rate to avoid a negative outcome. To stabilize the value of a currency within a certain range, the stabilization fund managers take one of the following actions: f the ruble depreciates below some threshold value (a floor) per ruble, the fund managers will purchase the excess supply of rubles in the international exchange market to increase the value of the ruble to at least the floor value. if the ruble appreciates above some threshold value (a celing) per ruble, the fund managers will sell the excess supply of rubles to lower its value to at least the ceiling value. Consider the following scenario: Russia establishes a currency stabilization fund to keep the exchange rate between 2 per Russian ruble and 5 per Russian ruble. Initially, the market exchange rate is within the allowed range at 4 per Russian ruble, as shown by the intersection of the demand (D,) and supply (S) curves for the Russian ruble on the following graph. Suppose that due to an increase in the world demand for oil, Russia is able to export more oil, and the demand for the Russian ruble increases from D, to Dy. On the following graph, use the grey point (star symbol) to show the new exchange rate resulting from an increase in the world demand for oil. News Analysis: Dutch Disease On the following graph, use the grey point (star symbol) to show the new exchange rate resulting from an increase in the world demand for oil. The market for foreign exchange 10 New Exchange Rate Action Ceiling Floor D2 D, 20 40 60 80 100 QUANTITY (Millions of rubles) According to the graph, which of the following correctly describes the effect of the increase in the world demand for oil on the market for foreign exchange in Russia? EXCHANGE RATE Floor D2 20 40 60 80 100 QUANTITY (Milions of rubles) According to the graph, which of the following correctly describes the effect of the increase in the world demand for oil on the market for foreign exchange in Russia? The Russian ruble depreciates, and the exchange rate reaches the floor value. The Russian ruble appreciates, and the exchange rate reaches the ceiling value. The Russian ruble appreciates, and the exchange rate rises above the celling value. The Russian ruble appreciates, and the exchange rate falls below the floor value. On the previous graph, use the purple line (diamond symbol) to show how the stabilization fund managers have to adjust the value of the Russian ruble to ensure it meets the official requirement. (Hint: You need to draw either a new supply curve or a new demand curve. Make sure the new curve is parallel to the given supply or demand curve. Position your cursor over the given curves to see their slopes.) The managers will effectively 7 million rubles. EXCH Suppose the Russian government recognizes that its reliance on oil exports makes it vulnerable to the Dutch Disease. On the one hand, if oil prices increase, the Russian ruble will appreciate, the real exchange rate will increase, and the nation's exports will become more expensive for other countries to buy. On the other hand, if oil prices fall, the Russian ruble will depreciate, and the country's revenues will decline. The Russian government creates a currency stabilization fund to maintain a stable exchange rate to avoid a negative outcome. To stabilize the value of a currency within a certain range, the stabilization fund managers take one of the following actions: f the ruble depreciates below some threshold value (a floor) per ruble, the fund managers will purchase the excess supply of rubles in the international exchange market to increase the value of the ruble to at least the floor value. if the ruble appreciates above some threshold value (a celing) per ruble, the fund managers will sell the excess supply of rubles to lower its value to at least the ceiling value. Consider the following scenario: Russia establishes a currency stabilization fund to keep the exchange rate between 2 per Russian ruble and 5 per Russian ruble. Initially, the market exchange rate is within the allowed range at 4 per Russian ruble, as shown by the intersection of the demand (D,) and supply (S) curves for the Russian ruble on the following graph. Suppose that due to an increase in the world demand for oil, Russia is able to export more oil, and the demand for the Russian ruble increases from D, to Dy. On the following graph, use the grey point (star symbol) to show the new exchange rate resulting from an increase in the world demand for oil. News Analysis: Dutch Disease On the following graph, use the grey point (star symbol) to show the new exchange rate resulting from an increase in the world demand for oil. The market for foreign exchange 10 New Exchange Rate Action Ceiling Floor D2 D, 20 40 60 80 100 QUANTITY (Millions of rubles) According to the graph, which of the following correctly describes the effect of the increase in the world demand for oil on the market for foreign exchange in Russia? EXCHANGE RATE Floor D2 20 40 60 80 100 QUANTITY (Milions of rubles) According to the graph, which of the following correctly describes the effect of the increase in the world demand for oil on the market for foreign exchange in Russia? The Russian ruble depreciates, and the exchange rate reaches the floor value. The Russian ruble appreciates, and the exchange rate reaches the ceiling value. The Russian ruble appreciates, and the exchange rate rises above the celling value. The Russian ruble appreciates, and the exchange rate falls below the floor value. On the previous graph, use the purple line (diamond symbol) to show how the stabilization fund managers have to adjust the value of the Russian ruble to ensure it meets the official requirement. (Hint: You need to draw either a new supply curve or a new demand curve. Make sure the new curve is parallel to the given supply or demand curve. Position your cursor over the given curves to see their slopes.) The managers will effectively 7 million rubles. EXCH

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The manket for Jorign exchenge Jeega excheege 10 7 New Exchanye ate 4 Flooe ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started