Answered step by step

Verified Expert Solution

Question

1 Approved Answer

[Related to the Apply the Concept: Is the Burden of the Social Security Tax Really Shared Equally between Workers and Firms?] The city of

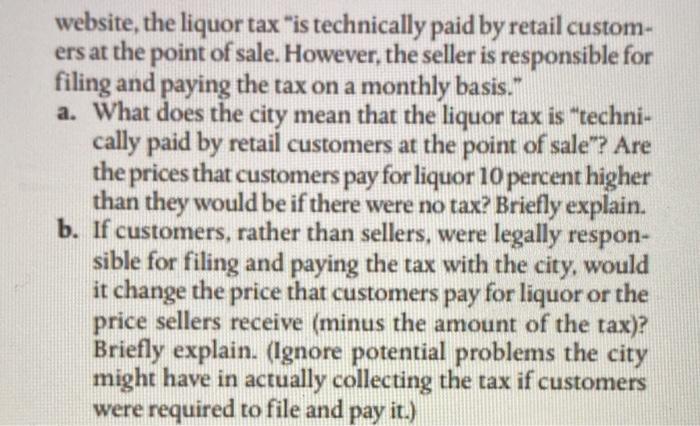

[Related to the Apply the Concept: "Is the Burden of the Social Security Tax Really Shared Equally between Workers and Firms?"] The city of Philadelphia imposes a 10 percent tax on sales of liquor in the city. According to the city's website, the liquor tax "is technically paid by retail custom- ers at the point of sale. However, the seller is responsible for filing and paying the tax on a monthly basis." a. What does the city mean that the liquor tax is "techni- cally paid by retail customers at the point of sale? Are the prices that customers pay for liquor 10 percent higher than they would be if there were no tax? Briefly explain. b. If customers, rather than sellers, were legally respon- sible for filing and paying the tax with the city, would it change the price that customers pay for liquor or the price sellers receive (minus the amount of the tax)? Briefly explain. (Ignore potential problems the city might have in actually collecting the tax if customers were required to file and pay it.)

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a Liquor tax is technically paid by retail customers at the point of sale means that most of the bur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started