Question

Given that it is equally likely that the stock will go up by 36.5% or go down by 5.5%. The current price is $30. The

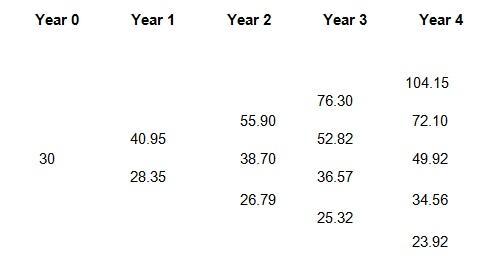

Given that it is equally likely that the stock will go up by 36.5% or go down by 5.5%. The current price is $30. The future prices for the next 4 years are:

What is the expected price of this stock in 4 years?

If we have a call option: we can buy 20,000 shares in 4 years. What is the expected value of the stock option?

If Mark buys 9125 shares of MHP using $27,375 of personal money and borrows the rest of the money at the risk-free rate of 5%. Then, he offers 10,500 stock options to us at his valued price (Assume this is a one-year option). What kind of an investment is this for Mark? What are the different payoffs for Mark and what is his risk in this investment?

The next hurdle we want to tackle is the extension of the ideas to account to multiple periods. What are the main challenges in this extension? Is there a reasonable way to extend the analysis to tackle the valuation of a multi-period option?

Year 0 30 Year 1 40.95 28.35 Year 2 55.90 38.70 26.79 Year 3 76.30 52.82 36.57 25.32 Year 4 104.15 72.10 49.92 34.56 23.92

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

What is the expected price of this stock in 4 years ANS WER The expected price of the stock in 4 years is 37 54 WORK ING We use the formula for expect...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started