Answered step by step

Verified Expert Solution

Question

1 Approved Answer

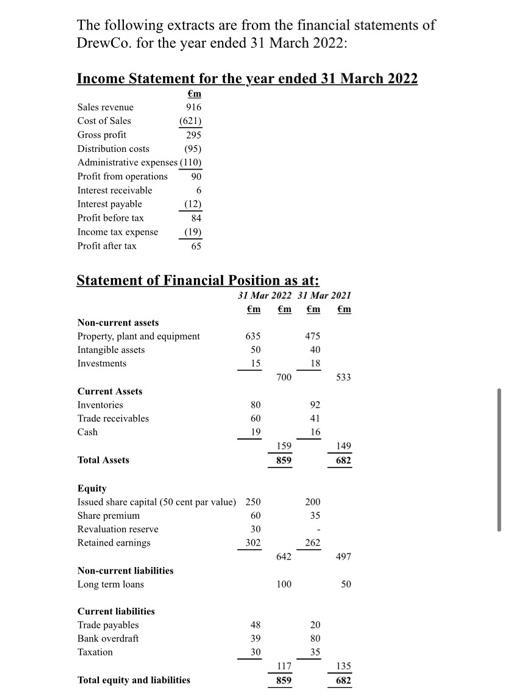

The following extracts are from the financial statements of DrewCo. for the year ended 31 March 2022: Income Statement for the year ended 31

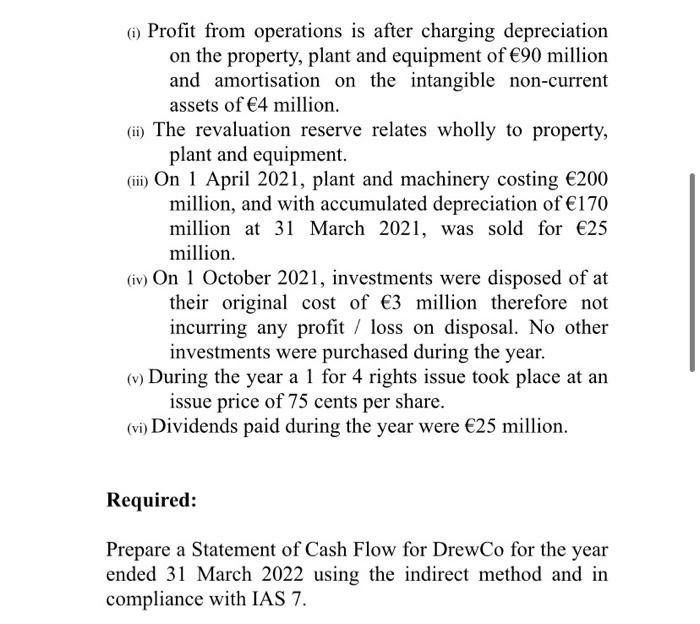

The following extracts are from the financial statements of DrewCo. for the year ended 31 March 2022: Income Statement for the year ended 31 March 2022 Sales revenue Cost of Sales Gross profit Interest payable Profit before tax Income tax expense Profit after tax Distribution costs (95) Administrative expenses (110) Profit from operations Interest receivable Current Assets Inventories Trade receivables Cash Total Assets ******** Statement of Financial Position as at: 916 Non-current assets Property, plant and equipment Intangible assets Investments Revaluation reserve Retained earnings (621) Non-current liabilities. Long term loans Current liabilities Trade payables Bank overdraft Taxation (12) 84 (19) 65 Equity Issued share capital (50 cent par value) 250 Share premium 60 30 302 31 Mar 2022 31 Mar 2021 Em Em Em Em Total equity and liabilities 635 50 15. 80 60 19 *88| 700 159 859 642 100 117 859 475 40 18 92 41 16 200 35 262 20 80 35 533 149 682 497 50 135 682 (i) Profit from operations is after charging depreciation on the property, plant and equipment of 90 million and amortisation on the intangible non-current assets of 4 million. (ii) The revaluation reserve relates wholly to property, plant and equipment. (iii) On 1 April 2021, plant and machinery costing 200 million, and with accumulated depreciation of 170 million at 31 March 2021, was sold for 25 million. (iv) On 1 October 2021, investments were disposed of at their original cost of 3 million therefore not incurring any profit / loss on disposal. No other investments were purchased during the year. (v) During the year a 1 for 4 rights issue took place at an issue price of 75 cents per share. (vi) Dividends paid during the year were 25 million. Required: Prepare a Statement of Cash Flow for DrewCo for the year ended 31 March 2022 using the indirect method and in compliance with IAS 7.

Step by Step Solution

★★★★★

3.48 Rating (181 Votes )

There are 3 Steps involved in it

Step: 1

Statement of Cash Flows for the year ended 31 March 2022 Cash flows from operating activities Profit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started