Question

Hello i need help answering this question, I have attached part one, which I have done and figured out. After looking at that please help

Hello i need help answering this question, I have attached part one, which I have done and figured out. After looking at that please help me answer part two with the break downs. Part two is the second photo and I feel like there's something I'm doing wrong for the month 2 and 3 budgets.

Part One:

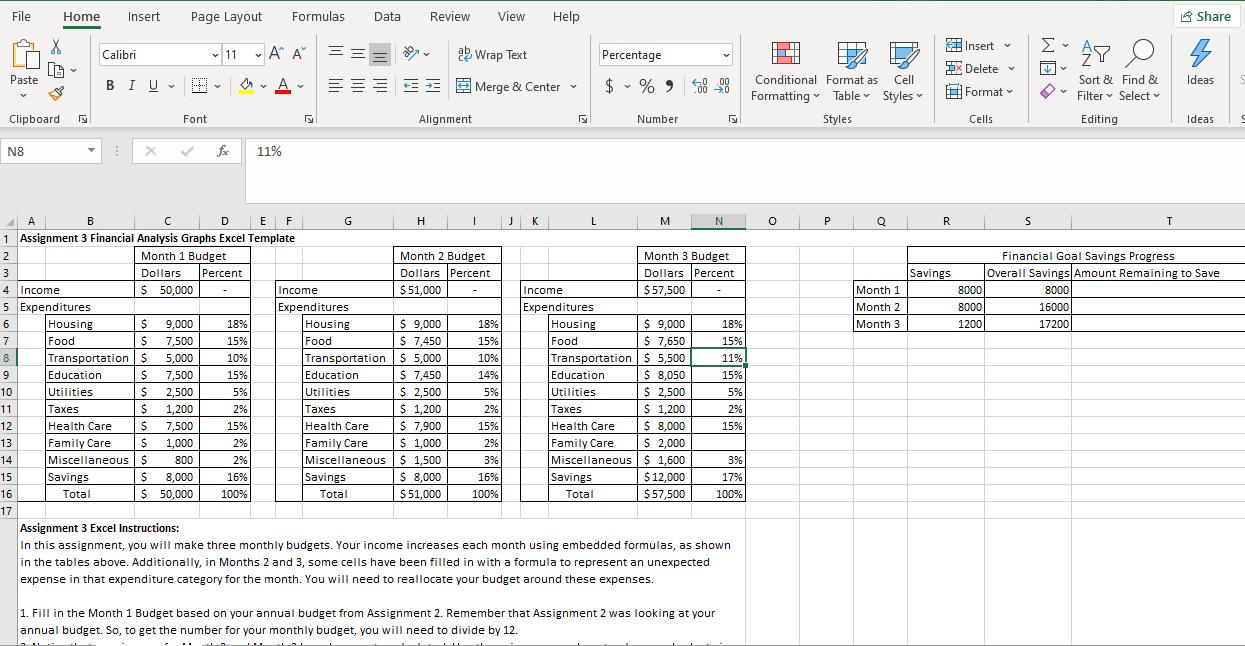

Assignment 2 Instructions for Excel Sheet:

1. Identify an annual income. This can be the $50,000 already in the "Income" cell, or you can use an income of your choice. If you use a different annual income, remember to change your income number.

2. Choose one of these five financial goals (remember to set a timeline for yourself that ranges from 1 year to 10 years). The number you put in the "Savings" cell of the budget table should be the cost of the goal you are saving for divided by the number of years you plan to be saving for it.

a. Create an emergency fund of $1,000.

b. Save for a vacation that will cost $2,000.

c. Save to buy a $15,000 vehicle.

d. Save for a down payment of $40,000 to buy a house.

e. Save $50,000 for education (personal, child, family, etc.).

3. Choose one of these three housing options. Put the dollar number in the budget table above for "Housing."

a. Rent a house. Cost is $15,000 per year.

b. Rent an apartment. Cost is $12,000 per year.

c. Rent a room only. Cost is $9,000 per year.

4. Fill in dollar values for the rest of your expenditures. This can be based on either a hypothetical ideal or what you might typically spend on these categories.

5. Use formulas to calculate the sum for your "Total" cell in the "Dollars" column and to fill in the "Percent" column.

6. Check to make sure your "Total" dollars is equal to the annual income you chose and that your "Total" percent is 100%.

The instructions for part two are below:

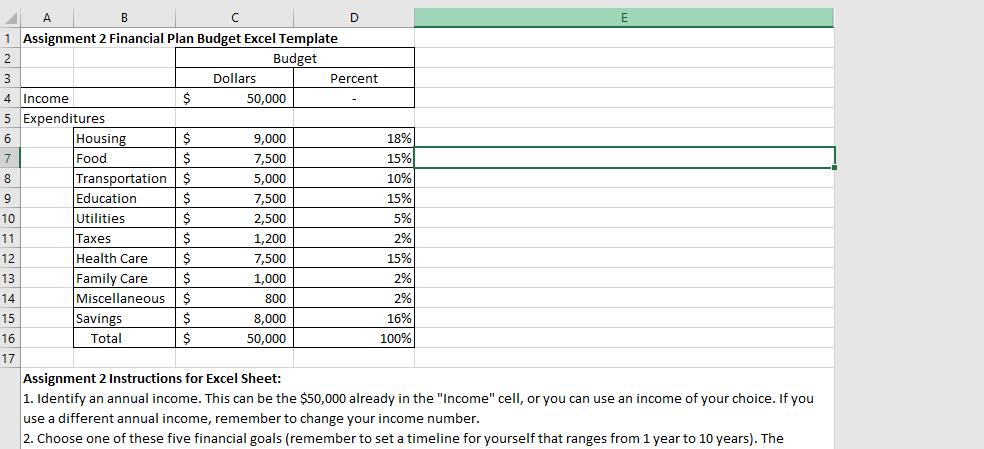

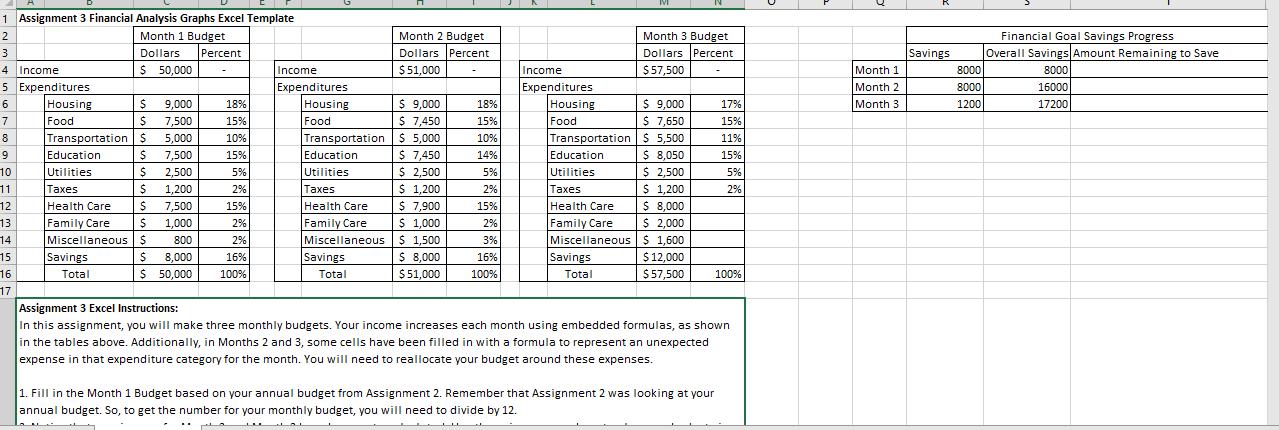

I've already fill Month 1 in along with parts 2 & 3. but I feel like parts 2 & 3 are wrong.The monthly incomes for part 2 &b 3 are already auto-calculated. Along with the “Health Care” costs for Month 2 and your “Miscellaneous” costs for Month 3.

Assignment 3 Excel Instructions:

In this assignment, you will make three monthly budgets. Your income increases each month using embedded formulas, as shown in the tables above. Additionally, in Months 2 and 3, some cells have been filled in with a formula to represent an unexpected expense in that expenditure category for the month. You will need to reallocate your budget around these expenses.

1. Fill in the Month 1 Budget based on your annual budget from Assignment 2. Remember that Assignment 2 was looking at your annual budget. So, to get the number for your monthly budget, you will need to divide by 12.

2. Notice that your income for Month 2 and Month 3 have been auto-calculated. Use these income numbers to plan your budgets in these months. Also, as noted in the instructions, notice that your “Health Care” costs for Month 2 and your “Miscellaneous” costs for Month 3 have auto-calculated. Do not change these numbers. You will need to plan around them.

3. For Month 2 and Month 3, fill in the cells for each category for how you are choosing to allocate your income in each of those months.

4. Use formulas to calculate the sum for your total in the “Dollars” columns, and fill in the “Percent” columns for each monthly budget.

5. Now produce a graphic for each of these three budgets to show the spending allocation. You could use a pie chart, bar chart, or other graphic from Excel. You will end up with three graphics, one for each month. Each graphic should show how you have allocated your income among the various categories.

6. Complete the Financial Goal Savings Progress table by entering in the “Savings” amount from each of your three monthly budgets. Use a formula to calculate how much you have left to save using the dollar amount of your chosen savings goal from Assignment 2.

7. Create a graphic that shows your progress toward your savings goal based on the information you input into the Financial Goal Savings Progress table. Select the type of graphic that you think would best illustrate your progress.

8. Put the graphics in the space below on this spreadsheet.

Part Two:

File Paste N8 Clipboard 5 7 8 9 10 4 Income 5 6 Home Insert X 11 12 13 14 15 16 17 Y Expenditures Housing Food Page Layout Calibri B IU ~ H A B DE E F 1 Assignment 3 Financial Analysis Graphs Excel Template 2 Month 1 Budget 3 Dollars Percent $ 50,000 Savings Total Font X Transportation $ $ 9,000 $ 7,500 5,000 7,500 Education Utilities Taxes $ 2,500 $ 1,200 Health Care $ 7,500 Family Care $ 1,000 Miscellaneous $ 800 $ 8,000 $50,000 11 A A == Y MA- E fxx 11% Formulas 18% 15% 10% 15% 5% 2% 15% 2% 2% 16% 100% Y F G Income Expenditures Housing Food Data Transportation Education Utilities Taxes Health Care Family Care Miscellaneous Savings Total Review View ab Wrap Text Alignment H $9,000 $ 7,450 $5,000 $ 7,450 $ 2,500 $ 1,200 $ 7,900 $ 1,000 $ 1,500 $ 8,000 $ 51,000 Merge & Center 1 Month 2 Budget Dollars Percent $51,000 - 18% 15% 10% 14% 5% 2% 15% 2% 3% 16% 100% Help J K Y 5 L Income Expenditures Housing Food Percentage $ % 900 000 Y Number M Month 3 Budget Dollars Percent $57,500 $ 9,000 $ 7,650 Transportation $ 5,500 Education Utilities Taxes Health Care $ 8,050 $ 2,500 $ 1,200 $ 8,000 Family Care Miscellaneous Savings Total N $ 2,000 $ 1,600 $ 12,000 $57,500 18% 15% 11% 15% 5% 2% 15% 3% 17% 100% Assignment 3 Excel Instructions: In this assignment, you will make three monthly budgets. Your income increases each month using embedded formulas, as shown in the tables above. Additionally, in Months 2 and 3, some cells have been filled in with a formula to represent an unexpected expense in that expenditure category for the month. You will need to reallocate your budget around these expenses. 1. Fill in the Month 1 Budget based on your annual budget from Assignment 2. Remember that Assignment 2 was looking at your annual budget. So, to get the number for your monthly budget, you will need to divide by 12. M Conditional Format as Cell Formatting Table Styles Styles 0 P Q Month 1 Month 2 Month 3 R Savings Insert x Delete Format Cells 8000 8000 1200 S SEM Share AY 04 Sort & Find & Filter Select Editing T Ideas Ideas Financial Goal Savings Progress Overall Savings Amount Remaining to Save 8000 16000 17200 S

Step by Step Solution

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 Annual income 50000 2 Chosen plan d Save for a downpayment of 40000 to buy a house Time period 5 years Therefore Savings 400005 8000 3 Chosen plan c ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started