Answered step by step

Verified Expert Solution

Question

1 Approved Answer

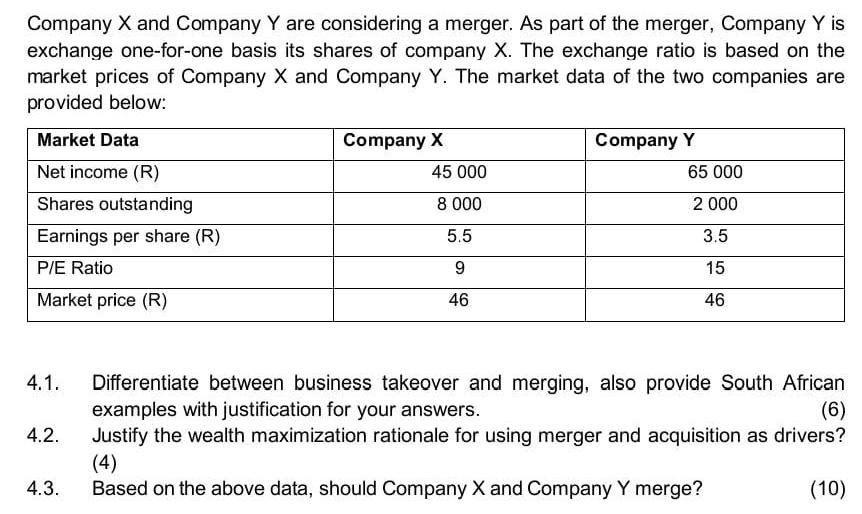

Company X and Company Y are considering a merger. As part of the merger, Company Y is exchange one-for-one basis its shares of company

Company X and Company Y are considering a merger. As part of the merger, Company Y is exchange one-for-one basis its shares of company X. The exchange ratio is based on the market prices of Company X and Company Y. The market data of the two companies are provided below: Market Data Net income (R) Shares outstanding Earnings per share (R) P/E Ratio Market price (R) 4.1. 4.2. 4.3. Company X 45 000 8 000 5.5 9 46 Company Y 65 000 2 000 3.5 15 46 Differentiate between business takeover and merging, also provide South African examples with justification for your answers. (6) Justify the wealth maximization rationale for using merger and acquisition as drivers? (4) Based on the above data, should Company X and Company Y merge? (10)

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

41 A takeover happens when one corporation acquires another Friendly and hostile takeo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started