Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The monthly income from a piece of commercial property is $1,400 (paid as a lump sum at the end of the year). Annual expenses

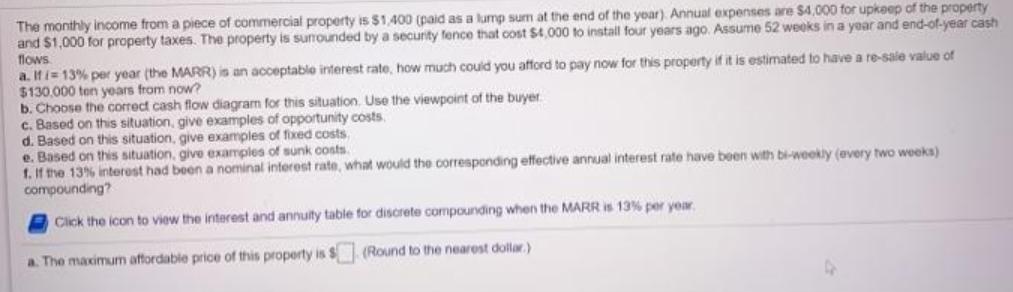

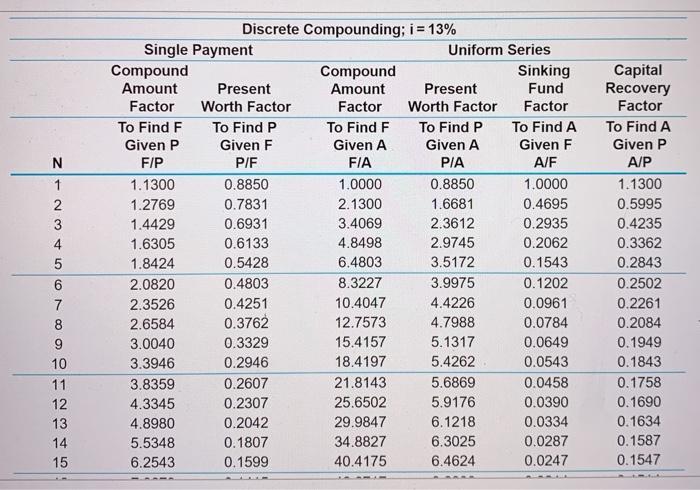

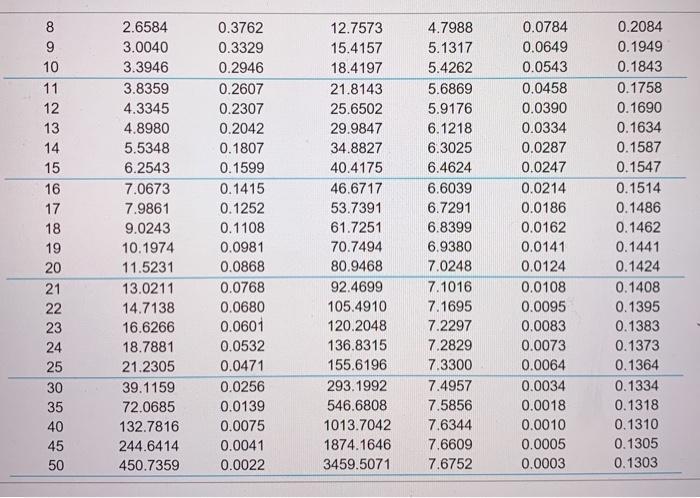

The monthly income from a piece of commercial property is $1,400 (paid as a lump sum at the end of the year). Annual expenses are $4,000 for upkeep of the property and $1,000 for property taxes. The property is surrounded by a security fence that cost $4,000 to install four years ago. Assume 52 weoks in a year and end-of-year cash flows a. If i= 13% per year (the MARR) is an acceptable interest rate, how much couid you afford to pay now for this property if it is estimated to have a re-sale value of $130,000 ten yeoars from now? b. Choose the correct cash flow diagram for this situation. Use the viewpoint of the buyer c. Based on this situation, give examples of opportunity costs. d. Based on this situation, give examples of fixed costs. e. Based on this situation, give examples of sunk costs. 1. If the 13% interest had been a nominal interest rate, what would the corresponding etfective annual interest rate have been with bi-weokly (every two weeks) compounding? Click the icon to view the interest and annulty table for discrete compounding when the MARR is 13% per year a. The maximum affordable price of this property is $ (Round to the nearest dollar.) Discrete Compounding; i= 13% Single Payment Uniform Series Compound Amount Capital Recovery Compound Sinking Fund Present Amount Present Factor Worth Factor Factor Worth Factor Factor Factor To Find P To Find F Given A To Find F To Find P To Find A To Find A Given P Given F Given A Given F Given P F/P P/F FIA PIA A/F A/P 1 1.1300 0.8850 1.0000 0.8850 1.0000 1.1300 1.2769 0.7831 2.1300 1.6681 0.4695 0.5995 3 1.4429 0.6931 3.4069 2.3612 0.2935 0.4235 4 1.6305 0.6133 4.8498 2.9745 0.2062 0.3362 1.8424 0.5428 6.4803 3.5172 0.1543 0.2843 6 2.0820 0.4803 8.3227 3.9975 0.1202 0.2502 7. 2.3526 0.4251 10.4047 4.4226 0.0961 0.2261 8 2.6584 0.3762 12.7573 4.7988 0.0784 0.2084 9. 3.0040 0.3329 15.4157 5.1317 0.0649 0.1949 10 3.3946 0.2946 18.4197 5.4262 0.0543 0.1843 11 3.8359 0.2607 21.8143 5.6869 0.0458 0.1758 12 4.3345 0.2307 25.6502 5.9176 0.0390 0.1690 13 4.8980 0.2042 29.9847 6.1218 0.0334 0.1634 14 5.5348 0.1807 34.8827 6.3025 0.0287 0.1587 15 6.2543 0.1599 40.4175 6.4624 0.0247 0.1547 8 2.6584 0.3762 12.7573 4.7988 0.0784 0.2084 9 3.0040 0.3329 15.4157 5.1317 0.0649 0.1949 10 3.3946 0.2946 18.4197 5.4262 0.0543 0.1843 11 3.8359 0.2607 21.8143 5.6869 0.0458 0.1758 12 4.3345 0.2307 25.6502 5.9176 0.0390 0.1690 13 4.8980 0.2042 29.9847 6.1218 0.0334 0.1634 14 5.5348 0.1807 34.8827 6.3025 0.0287 0.1587 15 6.2543 0.1599 40.4175 6.4624 0.0247 0.1547 16 7.0673 0.1415 46.6717 6.6039 0.0214 0.1514 17 7.9861 0.1252 53.7391 6.7291 0.0186 0.1486 18 9.0243 0.1108 61.7251 6.8399 0.0162 0.1462 19 10.1974 0.0981 70.7494 6.9380 0.0141 0.1441 20 11.5231 0.0868 80.9468 7.0248 0.0124 0.1424 21 13.0211 0.0768 92.4699 7.1016 0.0108 0.1408 0.0680 105.4910 7.1695 0.0095 0.0083 22 14.7138 0.1395 23 16.6266 0.0601 120.2048 7.2297 0.1383 24 18.7881 0.0532 136.8315 7.2829 0.0073 0.1373 25 21.2305 0.0471 155.6196 7.3300 0.0064 0.1364 30 39.1159 0.0256 293.1992 7.4957 0.0034 0.1334 35 72.0685 0.0139 546.6808 7.5856 0.0018 0.1318 40 132.7816 0.0075 1013.7042 7.6344 0.0010 0.1310 45 244.6414 0.0041 1874.1646 7.6609 0.0005 0.1305 50 450.7359 0.0022 3459.5071 7.6752 0.0003 0.1303

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Security fence cost would have been 40001114 if done today Annual savings1400 Annual Expenses4000900...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started