Answered step by step

Verified Expert Solution

Question

1 Approved Answer

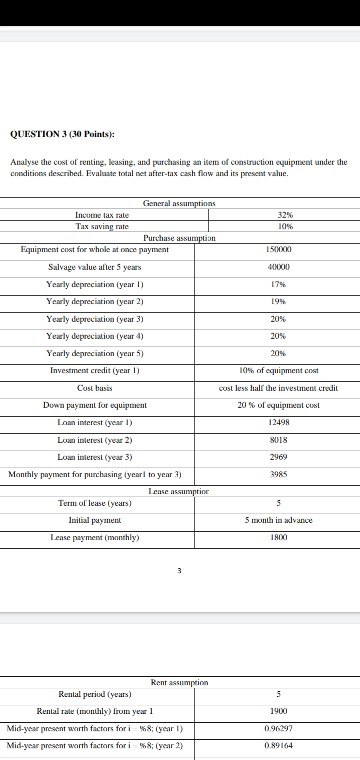

economy & construction QUESTION 3 (30 Points): Analyse the cost of renting, leasing, and purchasing an item of construction equipment under the conditions described. Evaluate

economy & construction

QUESTION 3 (30 Points): Analyse the cost of renting, leasing, and purchasing an item of construction equipment under the conditions described. Evaluate total net after-tax cash flow and its present value. 32% 10% 150000 40X200 General assumption Income tax rate Tax saving me Purchase assumption Equipment cost for whole at once payment Salvage value after 5 years Yearly depreciation year 1) Yearly depreciation year 2) Yearly depreciation (year 3) Yearly depreciation (year 4) Yearly depreciation (year 5) Investment credit (year 1) 17% 19% 20% 20% 20% Cost basis 10% of equipment cost cost less half the investment Credit 20% of equipment Col 12498 8018 2969 Down payment for equipment Loan interest (year 1) Luan interest(year 2) Loan interest (year 3) Monthly payment for purchasing (year to year :) Lense assumption Term of lease (years) Initial payment lease payment (monthly) 3985 S 5 month in advance 1800 S 1900 Rent assumption Rental period (years) Rental rale (minthly) from year 1 Mid-year present worth factors for i%8: (year 1) Mid-year present worth factors for i %8: (year 2) 0.96.297 0.89164 QUESTION 3 (30 Points): Analyse the cost of renting, leasing, and purchasing an item of construction equipment under the conditions described. Evaluate total net after-tax cash flow and its present value. 32% 10% 150000 40X200 General assumption Income tax rate Tax saving me Purchase assumption Equipment cost for whole at once payment Salvage value after 5 years Yearly depreciation year 1) Yearly depreciation year 2) Yearly depreciation (year 3) Yearly depreciation (year 4) Yearly depreciation (year 5) Investment credit (year 1) 17% 19% 20% 20% 20% Cost basis 10% of equipment cost cost less half the investment Credit 20% of equipment Col 12498 8018 2969 Down payment for equipment Loan interest (year 1) Luan interest(year 2) Loan interest (year 3) Monthly payment for purchasing (year to year :) Lense assumption Term of lease (years) Initial payment lease payment (monthly) 3985 S 5 month in advance 1800 S 1900 Rent assumption Rental period (years) Rental rale (minthly) from year 1 Mid-year present worth factors for i%8: (year 1) Mid-year present worth factors for i %8: (year 2) 0.96.297 0.89164Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started