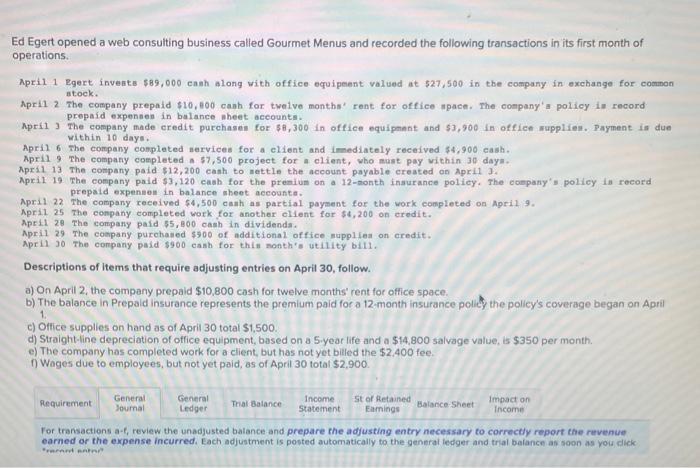

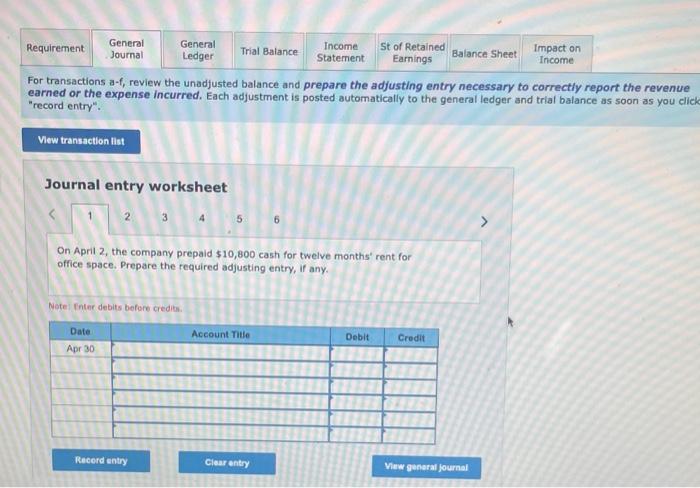

Ed Egert opened a web consulting business called Gourmet Menus and recorded the following transactions in its first month of operations. Apri1 1 Egert investe $89,000 canh along with office equipent valued at 527,500 in tbe company in exchange for cominon atock. Aprit 2 The company prepaid $10,$00 canh for twelve months' rent for office npace. The company'a policy-in record propaid expensen in balance wheet accounts. Apri1 3 The company made eredit purchasen for 56,300 in office equipmnnt and 53,900 in office wupplifel. Payment is due within 10 days. April 6 The company conpleted aervices for a elient and innediately received $4,900 cash. April 9 The company completed a 57,500 project for a client, who must pay within 30 daym. Apri1 13 The company paid $12,200 cash to nettle the account payable created on April 3. April 19. The company paid $3,120 cash for the preniun on a 12-nonth inaurance policy. The eompany's policy ia record prepaid expenaen in balance mheet accounta. April 22. The company received 54,500 caah as partial payment for the work completed on April 9. Aprit 25 The eonpany completed wark for another elient for $4,200 on eredit. April 28 The eompany paid 55,300 cash in dividenda. April 29 The coapany purchased $500 of additional office muppliea on credit. April 30 The company paid $900 eanh for thin nonth's utility bill. Descriptions of items that require adjusting entries on April 30 , follow. a) On April 2, the company prepaid $10,800 cash for twelve months' rent for office space. b) The balance in Prepaid insurance represents the premium paid for a 12 -month insurance policy the policy's coverage began on April 1. c) Office supplies on hand as of April 30 total $1,500. d) Straight-line depreciation of office equipment, based on a 5 year life and a $14,800 salvage value, is $350 per month. e) The company has completed work for a client, but has not yet billed the $2,400 fee. f) Wages due to employees, but not yet paid, as of April 30 total $2,900. For transactions a-f, review the unadjusted balance and prepare the adfusting entry necessary to correcty report the ruvenue earned or the expense incurred, Each adjustment is posted automatically to the general ledger and trial bolance as soon as you dick "rament entrop" For transactions a-f, review the unadjusted balance and prepare the adjusting entry necessary to correctly report the revenue earned or the expense incurred. Each adjustment is posted automatically to the general ledger and trial balance as soon as you clic "record entry". Journal entry worksheet 6 On April 2, the company prepaid $10,800 cash for twelve months' rent for office space. Prepare the required adjusting entry, if any. Note Thter debits before credits