Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Eddie Company has been in business for several years. During those years they reported steadily increasing profits. However, according to information obtained from a

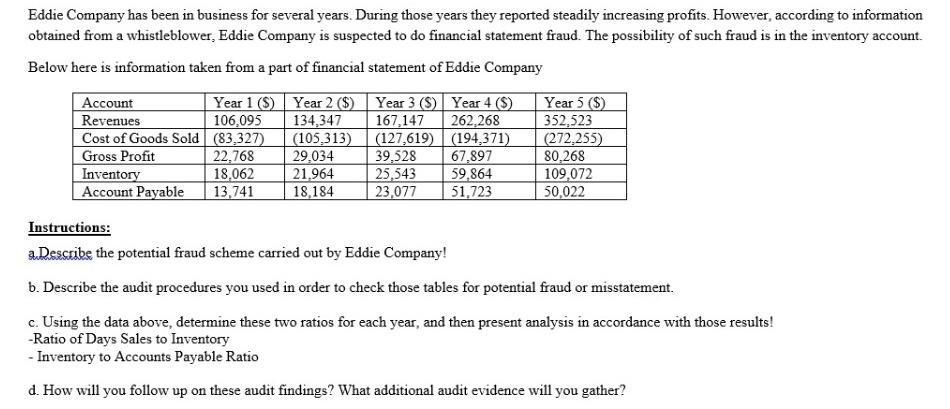

Eddie Company has been in business for several years. During those years they reported steadily increasing profits. However, according to information obtained from a whistleblower, Eddie Company is suspected to do financial statement fraud. The possibility of such fraud is in the inventory account. Below here is information taken from a part of financial statement of Eddie Company Account Revenues Year 1 (S) Year 2 ($) 106,095 Cost of Goods Sold (83,327) Gross Profit 22,768 18,062 13,741 Inventory Account Payable 134,347 (105,313) 29,034 21,964 18,184 Year 3 (S) 167,147 (127,619) Year 4 ($) 262,268 (194,371) 39,528 67,897 25,543 59,864 23,077 51,723 Year 5 (S) 352,523 (272,255) 80,268 109,072 50,022 Instructions: a.Describe the potential fraud scheme carried out by Eddie Company! b. Describe the audit procedures you used in order to check those tables for potential fraud or misstatement. c. Using the data above, determine these two ratios for each year, and then present analysis in accordance with those results! -Ratio of Days Sales to Inventory - Inventory to Accounts Payable Ratio d. How will you follow up on these audit findings? What additional audit evidence will you gather?

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Explain the possibilities of fraud scheme conducted by Eddie Company Answer Fraud is carried out by increasing the value of the inventory and record...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started