Answered step by step

Verified Expert Solution

Question

1 Approved Answer

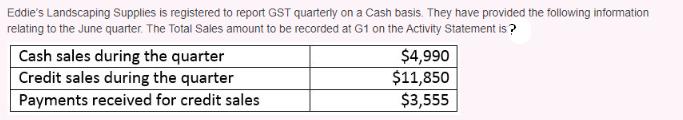

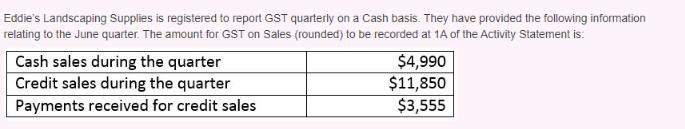

Eddie's Landscaping Supplies is registered to report GST quarterly on a Cash basis. They have provided the following information relating to the June quarter.

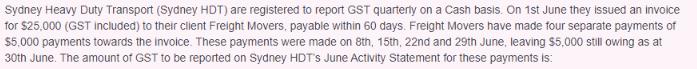

Eddie's Landscaping Supplies is registered to report GST quarterly on a Cash basis. They have provided the following information relating to the June quarter. The Total Sales amount to be recorded at G1 on the Activity Statement is? Cash sales during the quarter Credit sales during the quarter Payments received for credit sales $4,990 $11,850 $3,555 Eddie's Landscaping Supplies is registered to report GST quarterly on a Cash basis. They have provided the following information relating to the June quarter. The amount for GST on Sales (rounded) to be recorded at 1A of the Activity Statement is: Cash sales during the quarter Credit sales during the quarter Payments received for credit sales $4,990 $11,850 $3,555 Sydney Heavy Duty Transport (Sydney HDT) are registered to report GST quarterly on a Cash basis. On 1st June they issued an invoice for $25,000 (GST included) to their client Freight Movers, payable within 60 days. Freight Movers have made four separate payments of $5,000 payments towards the invoice. These payments were made on 8th, 15th, 22nd and 29th June, leaving $5,000 still owing as at 30th June. The amount of GST to be reported on Sydney HDT'S June Activity Statement for these payments is:

Step by Step Solution

★★★★★

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Eddies Landscaping supplies a Total Sales amount to be recorded at G1 on the Activity Statement Cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started