Question

EDGAR: Nike (ticker: NKE) Visit www.sec.gov/edgar and search for the Nike annual report (10-K) for the year ended May 31, 2019, using EDGAR (Electronic

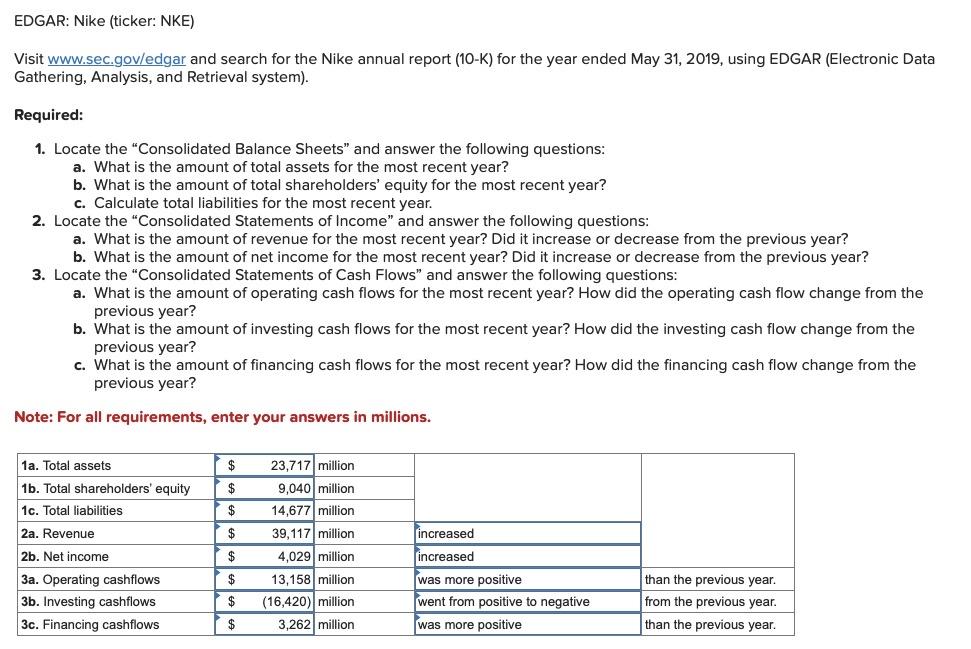

EDGAR: Nike (ticker: NKE)\ Visit \ www.sec.gov/edgar and search for the Nike annual report (10-K) for the year ended May 31, 2019, using EDGAR (Electronic Data Gathering, Analysis, and Retrieval system).\ Required:\ Locate the "Consolidated Balance Sheets" and answer the following questions:\ a. What is the amount of total assets for the most recent year?\ b. What is the amount of total shareholders' equity for the most recent year?\ c. Calculate total liabilities for the most recent year.\ Locate the "Consolidated Statements of Income" and answer the following questions:\ a. What is the amount of revenue for the most recent year? Did it increase or decrease from the previous year?\ b. What is the amount of net income for the most recent year? Did it increase or decrease from the previous year?\ Locate the "Consolidated Statements of Cash Flows" and answer the following questions:\ a. What is the amount of operating cash flows for the most recent year? How did the operating cash flow change from the previous year?\ b. What is the amount of investing cash flows for the most recent year? How did the investing cash flow change from the previous year?\ c. What is the amount of financing cash flows for the most recent year? How did the financing cash flow change from the previous year?\ Note: For all requirements, enter your answers in millions.\ \\\\table[[1a. Total assets,

$,23,717,million,,],[1b. Total shareholders' equity,

$,9,040,million,,],[1c. Total liabilities,

$,14,677,million,,],[2a. Revenue,

$,39,117,million,increased,],[2b. Net income,

$,4,029,million,increased,],[3a. Operating cashflows,

$,13,158,million,was more positive,than the previous year.],[3b. Investing cashflows,

$,

(16,420),million,went from positive to negative,from the previous year.],[3c. Financing cashflows,

$,3,262,million,was more positive,than the previous year.]]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started