Question

edit -looking for the solution to calculate number of days it takes Question - How long is it from when the company purchases raw materials

edit -looking for the solution to calculate number of days it takes

Question - How long is it from when the company purchases raw materials to when it disposed of the final product, either by selling it to satisfy a warranty or recall?

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

BALANCE SHEETS

At March 31, 2009

| 2009 | 2008 | |

| Non-current assets | ||

| Property, plant and equipment | 314 | 365 |

| Construction in progress | 47 | 51 |

| Intangible assets | 1853 | 1838 |

| Available-for-sale securities | 102 | 68 |

| Other | 205 | 172 |

| 2521 | 2494 | |

| Current Assets | ||

| Inventories | 450 | 472 |

| Trade receivables, net | 728 | 861 |

| Other | 746 | 1182 |

| Cash and cash equivalents | 1863 | 2191 |

| 3787 | 4706 | |

| Total Assets | 6308 | 7200 |

| Share capital | 1136 | 1180 |

| Reserves | 175 | 433 |

| Total equity | 1311 | 1613 |

| Non-current liabilities | 891 | 1098 |

| Current liabilities | ||

| Trade payables | 1991 | 2282 |

| Provisions and accruals | 1510 | 1945 |

| Income Tax payable | 89 | 87 |

| Bank loans | 20 | 61 |

| Current portion of long-term debt | 437 | 49 |

| Other | 59 | 65 |

| 4106 | 4489 | |

| Total Liabilities | 4997 | 5587 |

| Total liabilities and equity | 6308 | 7200 |

| INCOME STATEMENT | |

| For the year ended March 31, 2009 | |

| 2009 | |

| Sales | 14901 |

| Cost of sales | 13160 |

| Gross profit | 1741 |

| Selling, distribution and other expenses | -1103 |

| Administrative expenses | -628 |

| Research and development expense | -220 |

| Operating loss | -210 |

| Interest income | 62 |

| Interest expense | -40 |

| Loss before taxes | -188 |

| Taxation | -38 |

| Loss for year | -226 |

| CASH FLOW STATEMENT | |

| For the year ended March 31, 2009 | |

| 2009 | |

| Cash flows from operating activities | |

| Net income | -226 |

| Depreciation and amortization | 281 |

| Gain/loss on sale of equipment and other assets | -1 |

| Change in receivables | 616 |

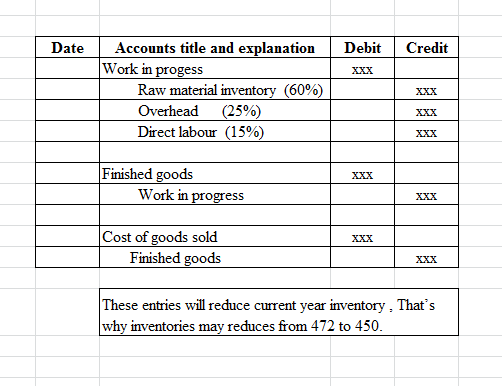

| Change in inventories | 26 |

| Change in payables | -692 |

| Other | -59 |

| Net cash generated from operating activities | -55 |

| Purchase of property, plant and equipment | -107 |

| Proceeds from sales of property, plant and equipment | 11 |

| Construction of property, plant and equipment in process | -64 |

| Purchases of intangible assets | -17 |

| Proceeds from sales of securities available for sale | 10 |

| Net cash used in investing activities | -173 |

| Exercise of share options | 10 |

| Repurchase of shares | -54 |

| Dividends paid | -178 |

| Increase in bank borrowings | 122 |

| Net cash used in financing activities | -100 |

| Change in Cash | -328 |

footnotes: 2009 2008

Raw Materials 72 210

Work-in-process 109 57

Finished goods 269 205

Total 450 472

construction in progress 2009

beg year 51

add paid in cash 64

transfers to property-plANT EQUIP -68

END OF YEAR 47

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started