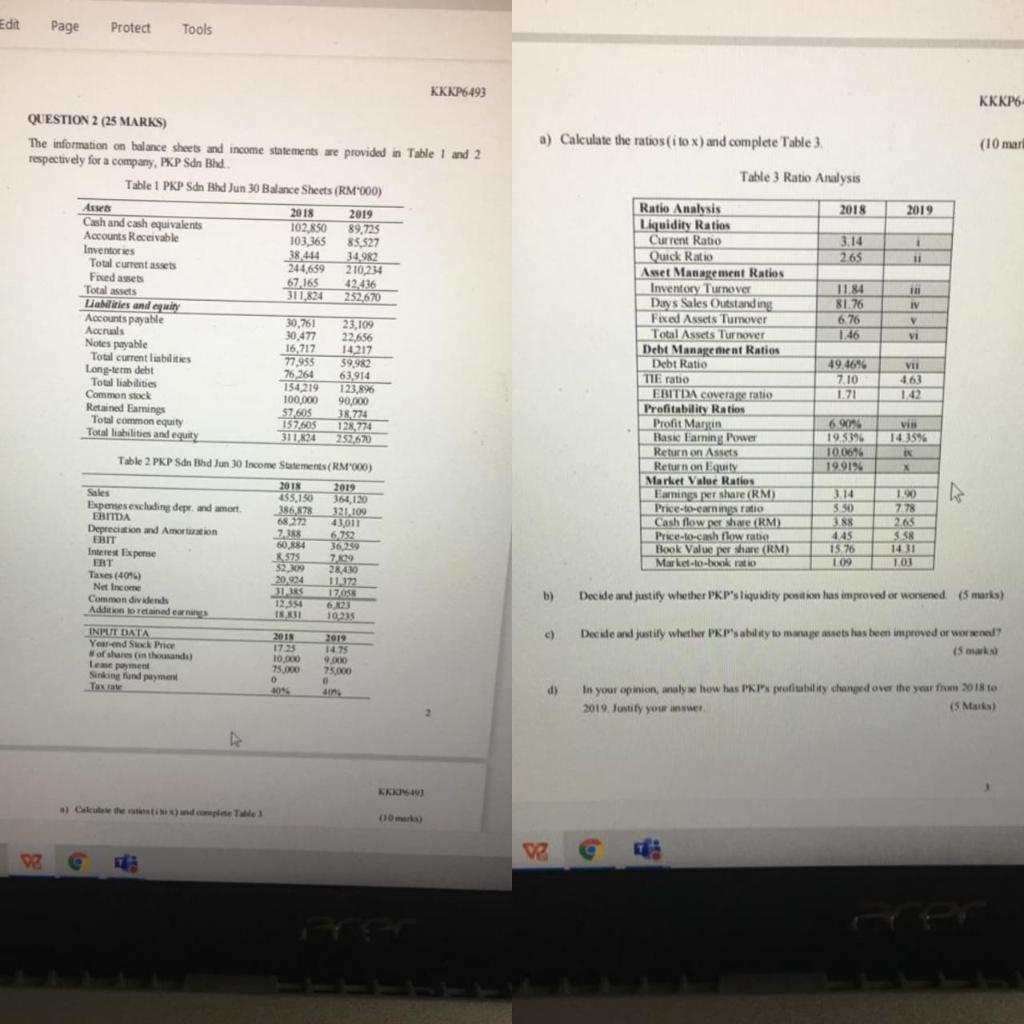

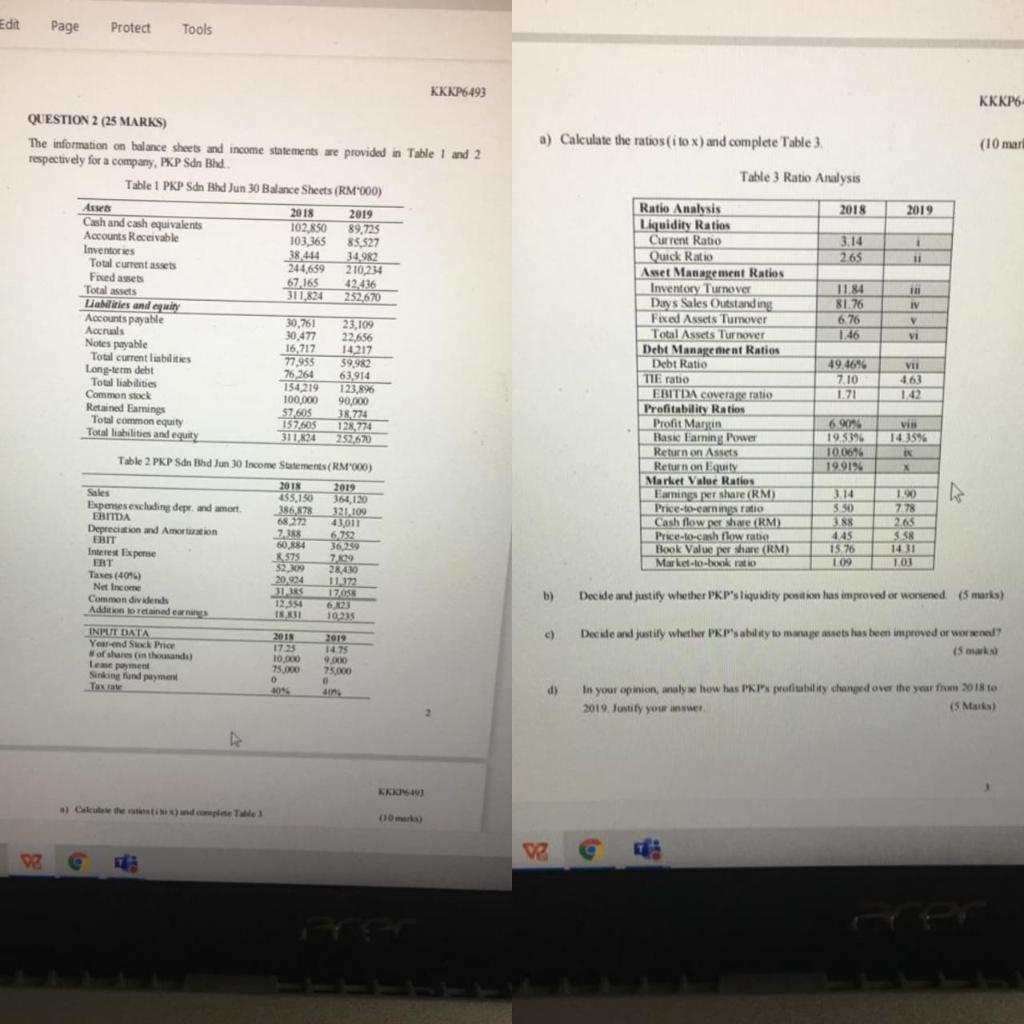

Edit Page Protect Tools KKKP6493 KKKP a) Calculate the ratios(i tox) and complete Table 3 (10 marl Table 3 Ratio Analysis 2018 2019 3.14 265 1 11 11.84 81.76 6.76 1.46 in IV V VI Ratio Analysis Liquidity Ratios Current Ratio Quick Ratio Asset Management Ratios Inventory Turnover Days Sales Outstanding Fixed Assets Turnover Total Assets Turnover Debt Management Ratios Debt Ratio TIE ratio EBITDA coverage ratio Profitability Ratios Profit Martin Basie Faming Power Return on Assets Return on Equity Market Value Ratios Earnings per share (RM) Price-toernings ratio Cash flow per share (RM) Price-to-cash flow rate Book Value per here (RM) Market-to-book ratio 49.46% 7.10 QUESTION 2 (25 MARKS) The information on balance sheets and income statements are provided in Table 1 and 2 respectively for a company, PKP Sdn Bhd Table 1 PKP Sdn Bhd Jun 30 Balance Sheets (RM"000) Asses 2018 2019 Cash and cash equivalents 102.850 89,723 Accounts Receivable 103.365 85,527 Inventories 38.444 34.982 Total current assets 244,659 210,234 Fixed asets 67,165 42,436 Total assets 311.834 252670 L'abilities and cry Accounts payable 30,761 23.109 Accruals 30.477 22.656 Notes payable 16,717 14217 Total current liabilities 77935 59962 Long-term debt 76,264 63.914 Total liabilities 154,219 123.896 Common stock 100,000 90,000 Retained Earnings 57605 38,774 Total common equity 157605 128,774 Total liabilities and equity 31 124 252.670 Table 2 PKP Sdn Bhd Jun 30 Income Statements (RM 000) " 2018 2019 Sales 455,150 364,120 Expenses excluding dep and amort 186578 321.109 EBITDA 43011 Depreciation and Amortization 7.RS 6782 ERIT 60.884 36,259 Interest Experte 575 709 ERT $2,09 28430 Taxes (409) 20,934 1077 Net Income 33R5 17053 Common dividends 12.354 6.23 Addition to retained earnings ISI 10215 INPUT DATA 2018 2019 Yourend Suck Prior 173 1475 of shares in thousands) 10.000 9.000 Lee 75.000 75,000 Sinking find payment O TAX VII 4.63 1.42 6.90% 193394 100646 19.9194 VW 14 15% IN 3.14 550 3 445 15.76 109 1.90 7.78 2.65 S.58 14 101 b) Decide and justify whether PKP's liquidity position has improved or worsened. (marks) c) Decide and justify whether PKP's ability to manage assets has been improved or word (5 mark d) In your opinion, analyse how has PKP profitability changed over the year from 2018 to 2019. Justify your ne 5 Marks) 2 KER - Cape 10 mars ve V VG