Question

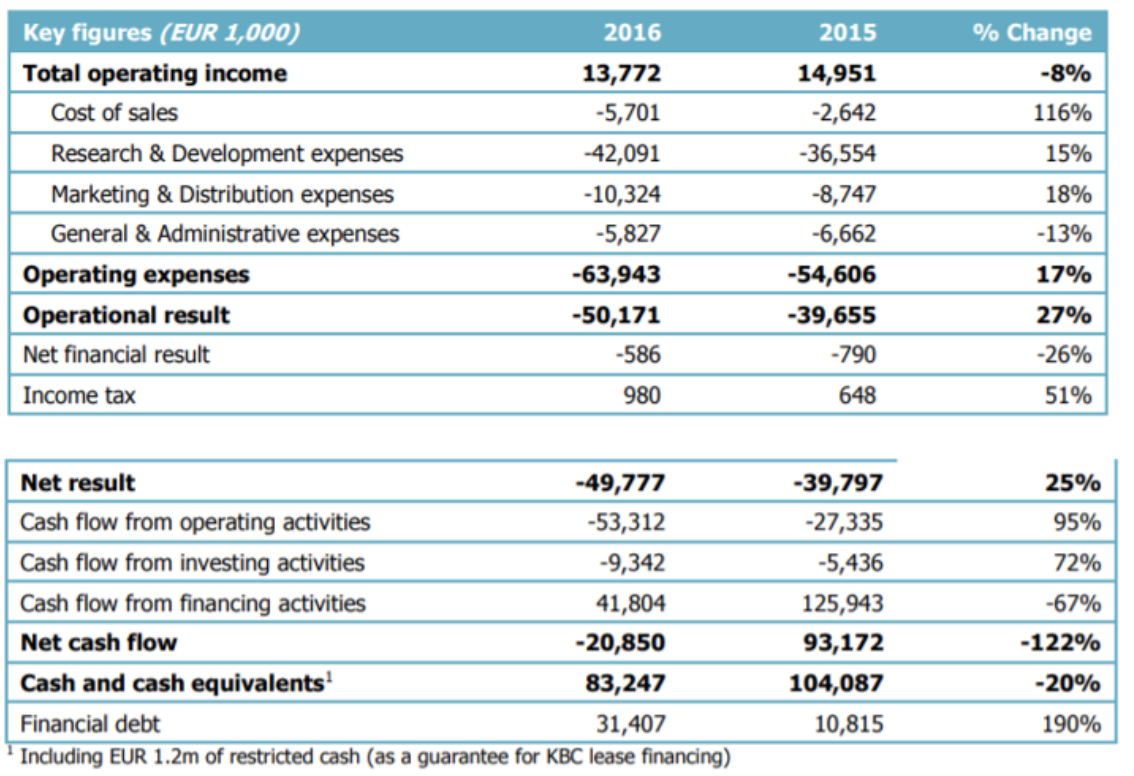

Edit question Below you can find the profit and loss (P&L) and cash flow statements of a healthtech company called Biocartis. Biocartis launched a highly

Edit question Below you can find the profit and loss (P&L) and cash flow statements of a healthtech company called Biocartis. Biocartis launched a highly innovative molecular diagnostic testing system called Idylla. Idylla is a fully automated, walkaway, real-time system to test DNA with a hands-on time of less than two minutes. Its access on-demand design and assay turnaround time of between 90 and 150 minutes allow pathologists and doctors to analyse human samples at any time, without the need for batching or for trained operators, in virtually any laboratory. It can speed up the detection of cancer and other diseases in a matter of hours. The fully integrated system enables clinical laboratories to perform a broad range of applications in oncology, infectious diseases and beyond. The revenue model consists of system sales complemented with cartridge sales to perform the test as shown in the picture. Different types of cartridges exist to test different types of diseases.

a) What has been the monthly burn rate including operational and investment activities in 2016? With the amount of cash left in the bank at the end of 2016 and assuming the previously calculated burn stays stable in 2017, what is the runway expressed in months at the end of 2016?

b) The company has sold 224 Idylla units (recorded above as Idella system sales) in 2016. The average selling price equalled 12,300. What is the average customer acquisition cost (CAC) if the marketing and distribution expenses of 10,324k represent the major customer acquisition cost related to the Idella system in 2016 and the average customer buys one unit? How does the CAC compare to the average selling price? How can they improve the balance between CAC and customer lifetime value?

c) The so-called valley of death (i.e., the negative and prolonged cash flow curve) has been significant for Biocartis. What can the founding team do to limit the amount of dilution they will face when growing this venture?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started