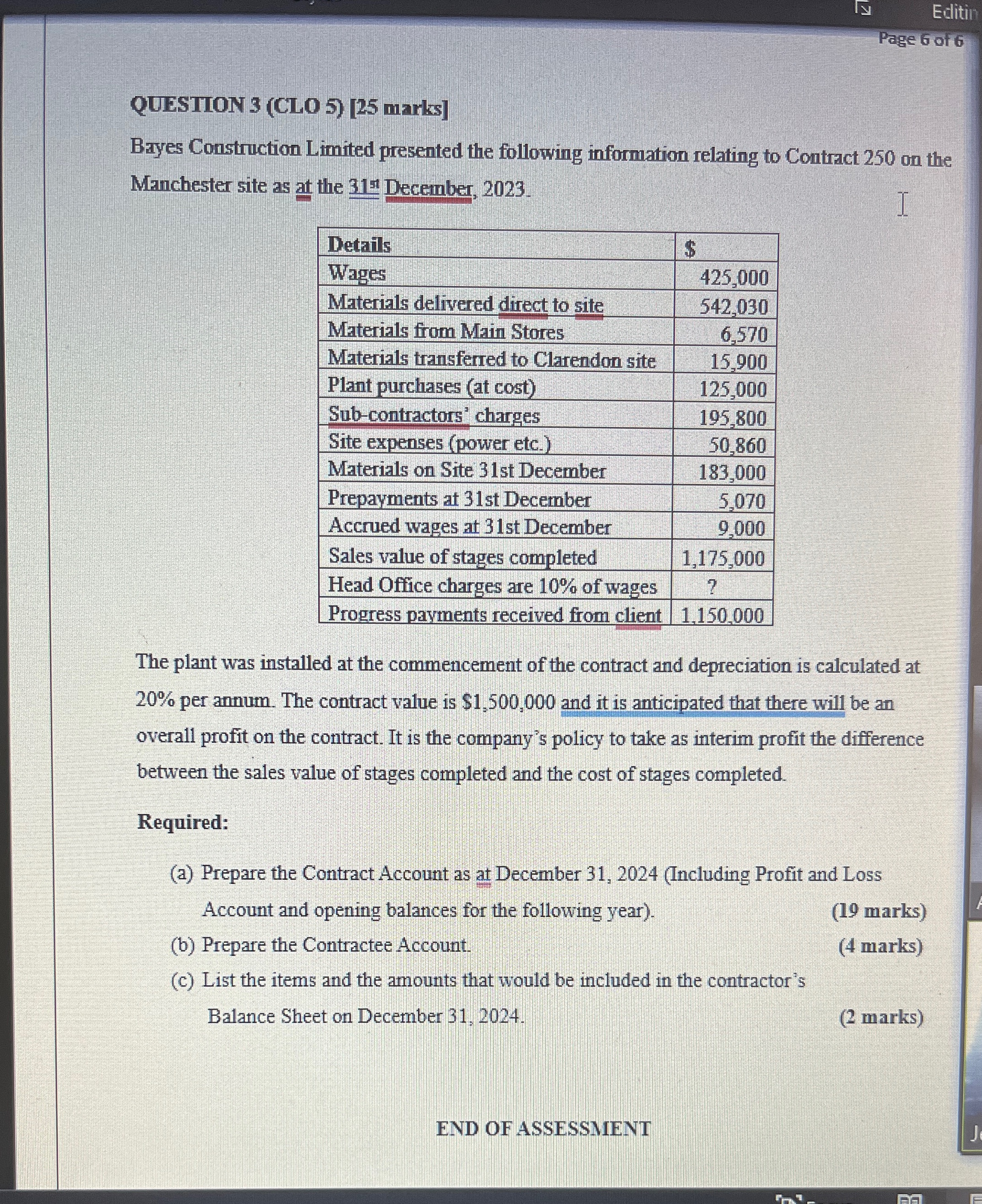

Editin Page 6 of 6 QUESTION 3 (CLO 5) [25 marks] Bayes Construction Limited presented the following information relating to Contract 250 on the

Editin Page 6 of 6 QUESTION 3 (CLO 5) [25 marks] Bayes Construction Limited presented the following information relating to Contract 250 on the I Manchester site as at the 31st December, 2023. Details $ Wages 425,000 Materials delivered direct to site 542,030 Materials from Main Stores 6,570 Materials transferred to Clarendon site 15,900 Plant purchases (at cost) 125,000 Sub-contractors' charges 195,800 Site expenses (power etc.) 50,860 Materials on Site 31st December 183,000 Prepayments at 31st December 5,070 Accrued wages at 31st December 9,000 Sales value of stages completed 1,175,000 Head Office charges are 10% of wages 7 Progress payments received from client 1,150,000 The plant was installed at the commencement of the contract and depreciation is calculated at 20% per annum. The contract value is $1,500,000 and it is anticipated that there will be an overall profit on the contract. It is the company's policy to take as interim profit the difference between the sales value of stages completed and the cost of stages completed. Required: (a) Prepare the Contract Account as at December 31, 2024 (Including Profit and Loss Account and opening balances for the following year). (19 marks) (b) Prepare the Contractee Account. (4 marks) (c) List the items and the amounts that would be included in the contractor's Balance Sheet on December 31, 2024. (2 marks) END OF ASSESSMENT J

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started