Answered step by step

Verified Expert Solution

Question

1 Approved Answer

edmon low manufacturing uses a job order cost system and applies overhead to production on the basis of machine hours. on january 1, 2020, job

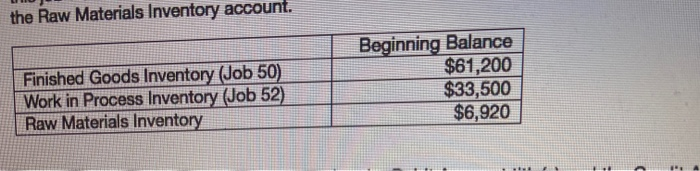

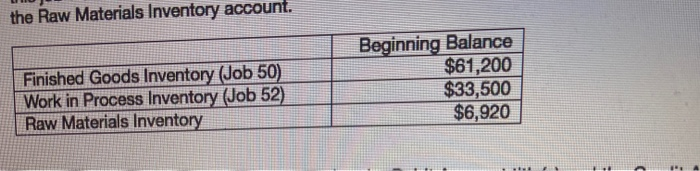

edmon low manufacturing uses a job order cost system and applies overhead to production on the basis of machine hours. on january 1, 2020, job No. 52 was the only job in process. the costs incurred prior to January 1 on the job were direct materials $13,400 ; direct labor 8040, and manufacturing overhead 12,060. job No. 50 had been completed at the cost of $61,200 and was part of finished goods inventory. there was $6,920 balance in the raw materials inventory account.

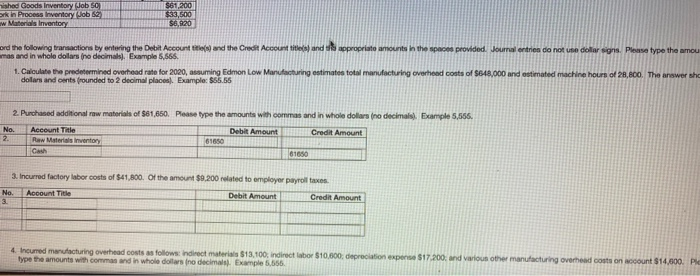

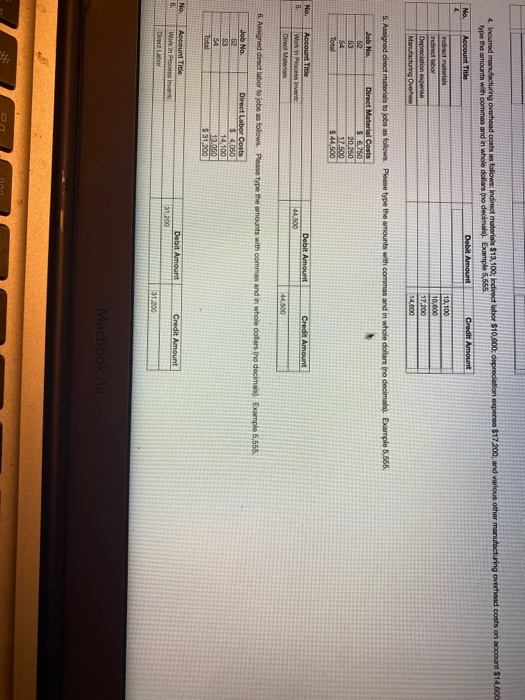

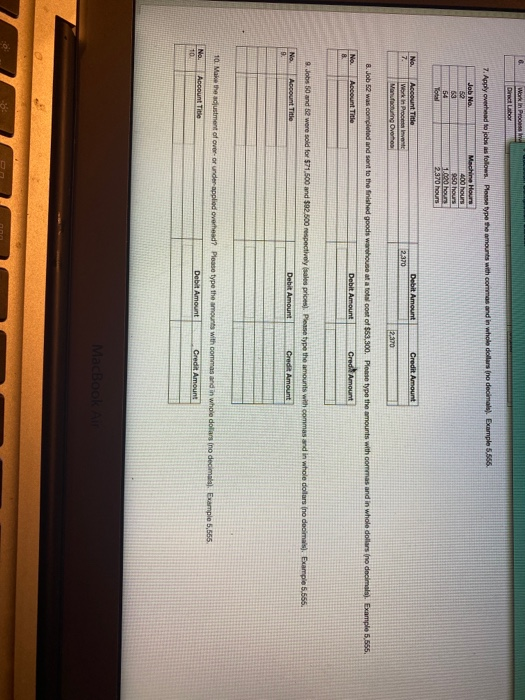

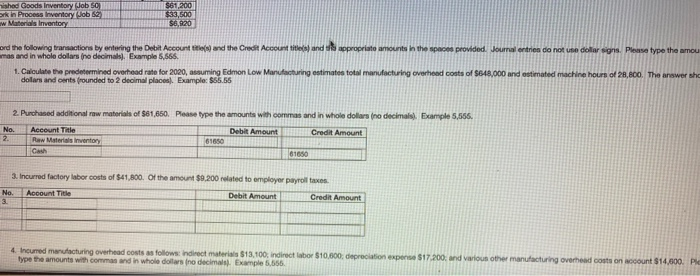

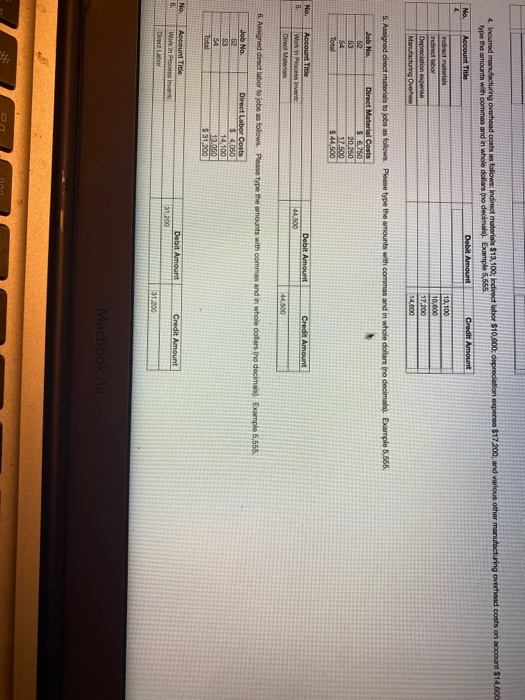

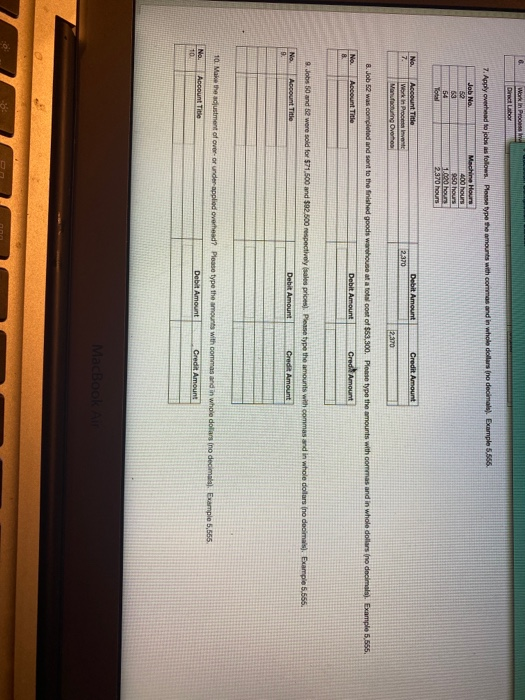

the Raw Materials Inventory account. Finished Goods Inventory (Job 50) Work in Process Inventory (Job 52) Raw Materials Inventory Beginning Balance $61,200 $33,500 $6,920 . ished Goods Inventory Job 50 ork in Process Inventory Jobs w Me Inventos $61,200 $33,600 $6,920 ord the following transactions by entering the Debit Account title(s) and the Credit Account title and appropriate amounts in the spaces provided. Journal entrien do not use dollar sons. Please type the amou mas and in whole dollars (no decimals). Example 5,566. 1. Calculate the predetermined overhead rate for 2020, assuming Edmon Low Manufacturing ontimates total manufacturing overhead costs of $648,000 and estimated machine hours of 28,800. The answer she dolars and conts founded to 2 decimal places. Example: $55.55 2. Purchased additional raw materials of $81,660, Please type the amounts with commes and in whole dollars (no decimals). Example 5,866. Credit Amount No. 2. Debit Amount Account Title Raw Materials inventory Cash 61650 61650 3. Incurred factory labor costs of $41,800. Of the amount $9,200 related to employer payroll taxes. No. 3. Account Title Debit Amount Credit Amount 4. Incurred manufacturing overhead costs as follows: Indirect materials $13,100 indirect labor $10,000 depreciation expense $17.200, and various other manufacturing overhead costs on account $14,000. Ple type the amounts with common and in whole dollars no decimal. Example 5,666 4. Incurred maracturing overhead costs as follows: Indirect materials $13,100; indirect bor $10,800, depreciation expense $17,200; and various other manufacturing overhead costs on account $14,600 type the amounts with commes and in whole dollars (no decimals). Example 5,555 Account Title Debit Amount Credit Amount No. 4. Indirect materials Indirect labor Depreciation expense Manufacturing Over 13,100 10,000 17,200 14.000 5. Aasigned direct materials to jobs as follows. Please type the amounts with commas and in whole dollars (no decimals). Example 5,566. Job No. 62 63 54 Tots Direct Material Costs $ 6.50 20260 17,500 $ 44,500 No. 5. Debit Amount Credit Amount Account Title Work in Pro Invente Direct Material 44,500 44,500 6. Assigned direct labor to jobs as follows. Please type the amounts with commas and in whole dollars ino decimal). Example 5,555. Job No. Direct Labor Costs 52 $ 4,050 53 14,100 54 13.060 Total $ 31,200 No 6. Account Title Work in Processive Director Debit Amount 31,200 Credit Amount 31,200 MacBook Work in Process Director 7. Apply overhead jobs as follows. Please type the amounts with commas and in whole dollars ino decimals. Example 5.556 Job Ne 52 1 54 Total Machine Hours 000 hours 950 hours 11.00 h 2370 hours No 7 Debit Amount Credit Amount Account Title Work in Process Manufacturing Overes 2.370 2,870 8. Job 52 was completed and sent to the finished goods warehouse at a cost of $53,300. Please type the amounts with commas and in whole dollars no decimale). Example 5,555 No Account Title Debit Amount Cred Amount 8 9. Jobs 50 and 2 were sold for $71,500 and $2.500 respectively sale prices. Please type the amounts with command in whole dollars (no decimals). Example 5,566. No Account Title Debit Amount Credit Amount 9. 10. Make the adjustment of over or under applied overhead? Please type the amounts with command in whole dollis no decimal. Example 5,566 Account Title Debit Amount Credit Amount 10 No Mac BooK

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started