Answered step by step

Verified Expert Solution

Question

1 Approved Answer

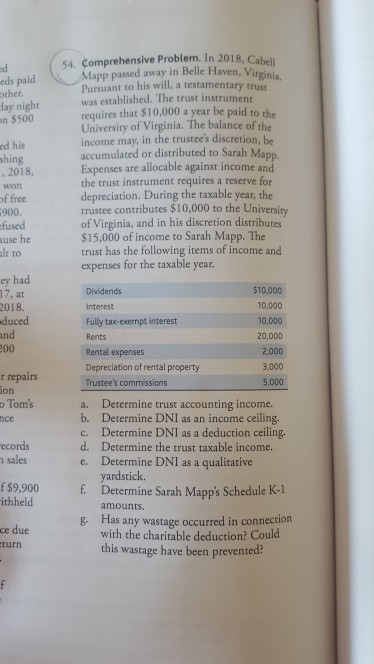

eds paid sthet. day night on $500 ed his shing 54. Comprehensive Problem. In 2018, Cabell Mapp passed away in Belle Haven, Virginia Pursuant to

eds paid sthet. day night on $500 ed his shing 54. Comprehensive Problem. In 2018, Cabell Mapp passed away in Belle Haven, Virginia Pursuant to his will, a testamentary trust was established. The trust instrument requires that $10,000 a year be paid to the University of Virginia. The balance of the income may, in the trustee's discretion, be accumulated or distributed to Sarah Mapp Expenses are allocable against income and the trust instrument requires a reserve for depreciation. During the taxable year, the trustee contributes $10,000 to the University of Virginia, and in his discretion distributes $15,000 of income to Sarah Mapp. The trust has the following items of income and expenses for the taxable year. 2018, won of free 900. fused ause he alt to ey had 17. at 2018. educed Dividends Interest Fully tax-exempt interest Rents $10,000 10,000 10,000 20,000 2,000 3,000 5,000 200 Rental expenses Depreciation of rental property Trustee's commissions r repairs son Tom's nce records sales a. Determine trust accounting income. b. Determine DNI as an income ceiling. c. Determine DNI as a deduction ceiling. d. Determine the trust taxable income. e. Determine DNI as a qualitative yardstick. f. Determine Sarah Mapp's Schedule K-1 amounts. 6. Has any wastage occurred in connection with the charitable deduction? Could this wastage have been prevented? f$9.900 ithheld ce due eturn eds paid sthet. day night on $500 ed his shing 54. Comprehensive Problem. In 2018, Cabell Mapp passed away in Belle Haven, Virginia Pursuant to his will, a testamentary trust was established. The trust instrument requires that $10,000 a year be paid to the University of Virginia. The balance of the income may, in the trustee's discretion, be accumulated or distributed to Sarah Mapp Expenses are allocable against income and the trust instrument requires a reserve for depreciation. During the taxable year, the trustee contributes $10,000 to the University of Virginia, and in his discretion distributes $15,000 of income to Sarah Mapp. The trust has the following items of income and expenses for the taxable year. 2018, won of free 900. fused ause he alt to ey had 17. at 2018. educed Dividends Interest Fully tax-exempt interest Rents $10,000 10,000 10,000 20,000 2,000 3,000 5,000 200 Rental expenses Depreciation of rental property Trustee's commissions r repairs son Tom's nce records sales a. Determine trust accounting income. b. Determine DNI as an income ceiling. c. Determine DNI as a deduction ceiling. d. Determine the trust taxable income. e. Determine DNI as a qualitative yardstick. f. Determine Sarah Mapp's Schedule K-1 amounts. 6. Has any wastage occurred in connection with the charitable deduction? Could this wastage have been prevented? f$9.900 ithheld ce due eturn

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started