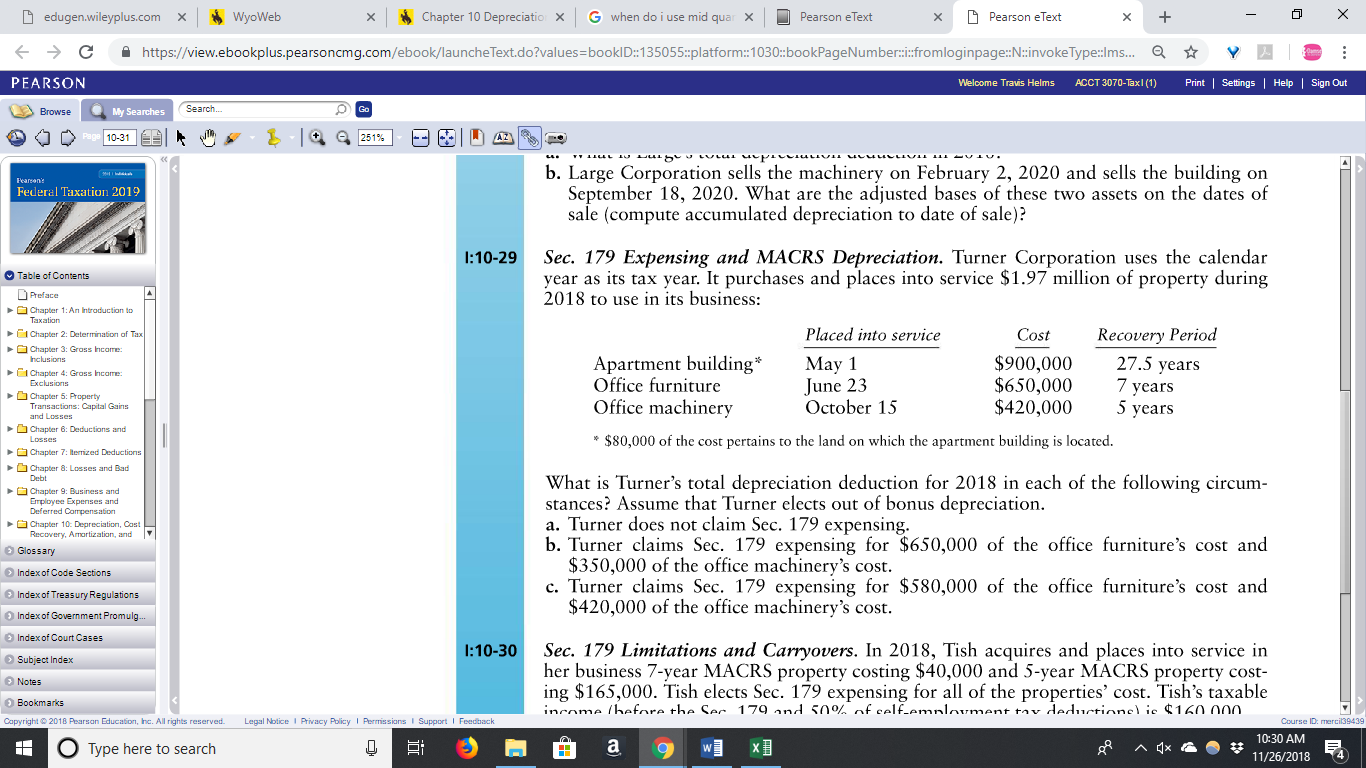

edugen.wileyplus.com WyoWeb Chapter 10 Depreciation X when do i use mid quar x Pearson eText Pearson eText C https://view.ebookplus.pearsoncmg.com/ebook/launcheText.do?values=bookID::135055::platform::1030::bookPageNumber::i::fromloginpage::N::invokeType::Ims... Q PEARSON Welcome Travis Helms ACCT 3070-Tax1 (1) Print | Settings | Help | Sign Out Browse My Searches Search.... 251% . 4 42) Fearing b. Large Corporation sells the machinery on February 2, 2020 and sells the building on Federal Taxation 2019 September 18, 2020. What are the adjusted bases of these two assets on the dates of sale (compute accumulated depreciation to date of sale)? 1:10-29 Sec. 179 Expensing and MACRS Depreciation. Turner Corporation uses the calendar @Table of Contents Preface year as its tax year. It purchases and places into service $1.97 million of property during Chapter 1: An Introduction to 2018 to use in its business: Taxation I Chapter 2: Determination of Tax Placed into service Cost Chapter 3: Gross Income: Recovery Period Inclusions I Chapter 4: Gross Income Apartment building* May 1 $900,000 27.5 years Exclusions Chapter 5: Property Office furniture June 23 $650,000 7 years Transactions: Capital Gains and Losses Office machinery October 15 $420,000 5 years Chapter 6: Deductions and Losses Chapter 7: Itemized Deductions * $80,000 of the cost pertains to the land on which the apartment building is located. Chapter 8: Losses and Bad Chapter 9: Business and What is Turner's total depreciation deduction for 2018 in each of the following circum- Employee Expenses and Deferred Compensation stances? Assume that Turner elects out of bonus depreciation. Chapter 10: Depreciation, Cost Recovery, Amortization, and a. Turner does not claim Sec. 179 expensing. Glossary b. Turner claims Sec. 179 expensing for $650,000 of the office furniture's cost and Index of Code Sections $350,000 of the office machinery's cost. Index of Treasury Regulations C. Turner claims Sec. 179 expensing for $580,000 of the office furniture's cost and Index of Government Promulg $420,000 of the office machinery's cost. Index of Court Cases >Subject Index 1:10-30 Sec. 179 Limitations and Carryovers. In 2018, Tish acquires and places into service in Notes her business 7-year MACRS property costing $40,000 and 5-year MACRS property cost- Bookmarks ing $165,000. Tish elects Sec. 179 expensing for all of the properties' cost. Tish's taxable Copyright @ 2018 Pearsan Education, Inc. All rights reserved. Legal Notice | Privacy Policy | Permissions | S Support | Feedback nme /hefare the Cer - 179 and 50% of calf_emnlou nloument tav av deduction anel ie $160 nnn Course ID: mercil39439 O Type here to search 2i a ^ 1x 6 10:30 AM 11/26/2018