Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Edward Darwin, a bachelor and a resident of the republic, retired from his employment as an office manager of retail firm in Durban at

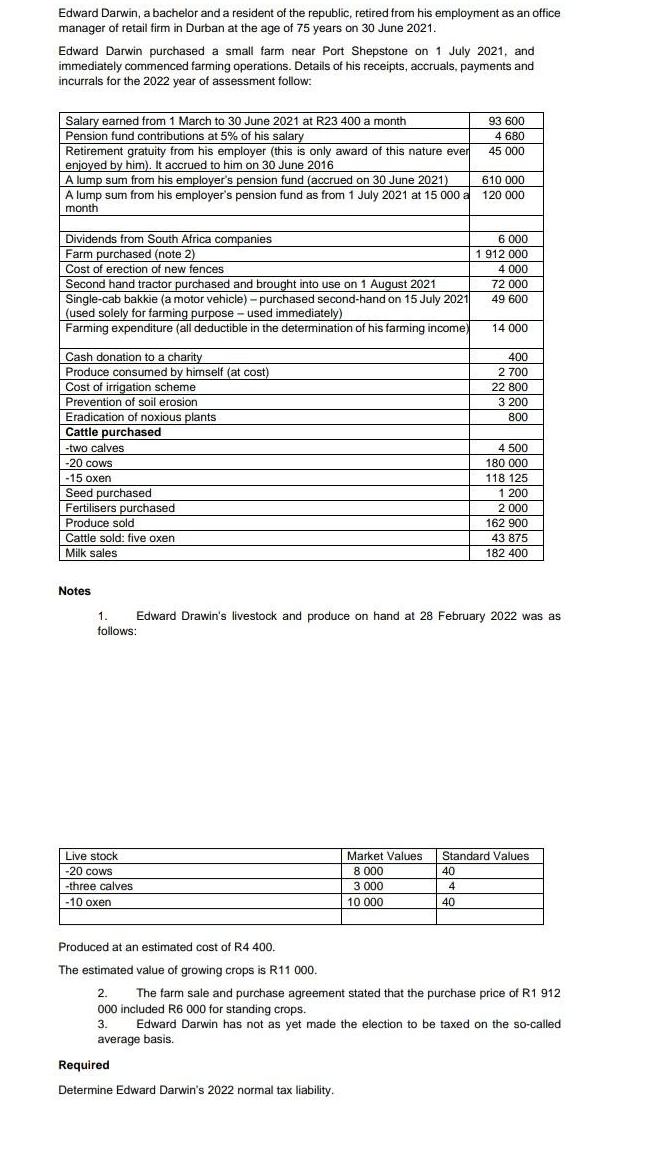

Edward Darwin, a bachelor and a resident of the republic, retired from his employment as an office manager of retail firm in Durban at the age of 75 years on 30 June 2021. Edward Darwin purchased a small farm near Port Shepstone on 1 July 2021, and immediately commenced farming operations. Details of his receipts, accruals, payments and incurrals for the 2022 year of assessment follow: Salary earned from 1 March to 30 June 2021 at R23 400 a month Pension fund contributions at 5% of his salary Retirement gratuity from his employer (this is only award of this nature ever enjoyed by him). It accrued to him on 30 June 2016 A lump sum from his employer's pension fund (accrued on 30 June 2021) A lump sum from his employer's pension fund as from 1 July 2021 at 15 000 a month Dividends from South Africa companies Farm purchased (note 2) Cost of erection of new fences Second hand tractor purchased and brought into use on 1 August 2021 Single-cab bakkie (a motor vehicle) - purchased second-hand on 15 July 2021 (used solely for farming purpose - used immediately) Farming expenditure (all deductible in the determination of his farming income) Cash donation to a charity. Produce consumed by himself (at cost) Cost of irrigation scheme Prevention of soil erosion Eradication of noxious plants Cattle purchased -two calves -20 cows -15 oxen Seed purchased Fertilisers purchased Produce sold Cattle sold: five oxen Milk sales Notes Live stock -20 cows -three calves -10 oxen 93 600 4 680 45 000 Required Determine Edward Darwin's 2022 normal tax liability. 610 000 120 000 40 4 40 6 000 1 912 000 4.000 72 000 49 600 14 000 400 2 700 22 800 3 200 800 1. Edward Drawin's livestock and produce on hand at 28 February 2022 was as follows: 4 500 180 000 118 125 1 200 2 000 162 900 43 875 182 400 Market Values Standard Values 8 000 3.000 10 000 Produced at an estimated cost of R4 400. The estimated value of growing crops is R11 000. 2. The farm sale and purchase agreement stated that the purchase price of R1 912 000 included R6 000 for standing crops. 3. Edward Darwin has not as yet made the election to be taxed on the so-called average basis.

Step by Step Solution

★★★★★

3.37 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started