Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Edwards Ltd purchases a new machine on 1 July 2020 for $70,000 cash. Residual value and useful life were estimated to be $10,000 and

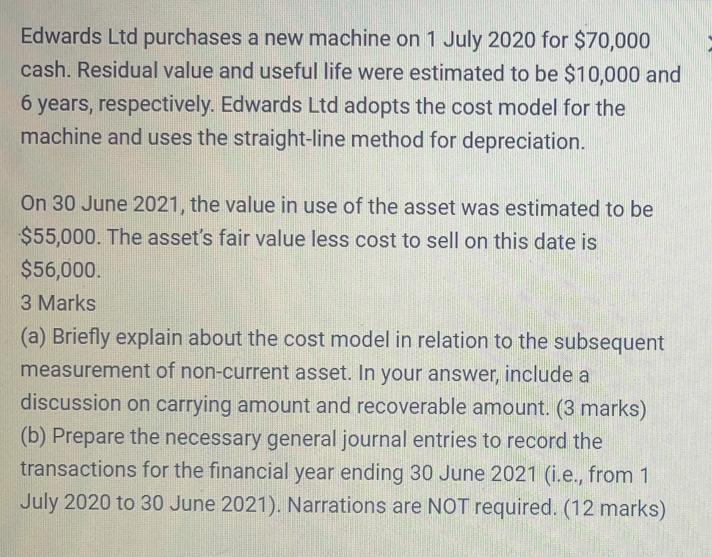

Edwards Ltd purchases a new machine on 1 July 2020 for $70,000 cash. Residual value and useful life were estimated to be $10,000 and 6 years, respectively. Edwards Ltd adopts the cost model for the machine and uses the straight-line method for depreciation. On 30 June 2021, the value in use of the asset was estimated to be $55,000. The asset's fair value less cost to sell on this date is $56,000. 3 Marks (a) Briefly explain about the cost model in relation to the subsequent measurement of non-current asset. In your answer, include a discussion on carrying amount and recoverable amount. (3 marks) (b) Prepare the necessary general journal entries to record the transactions for the financial year ending 30 June 2021 (i.e., from 1 July 2020 to 30 June 2021). Narrations are NOT required. (12 marks)

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a The cost model is an accounting policy used for the subsequent measurement of noncurrent ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started