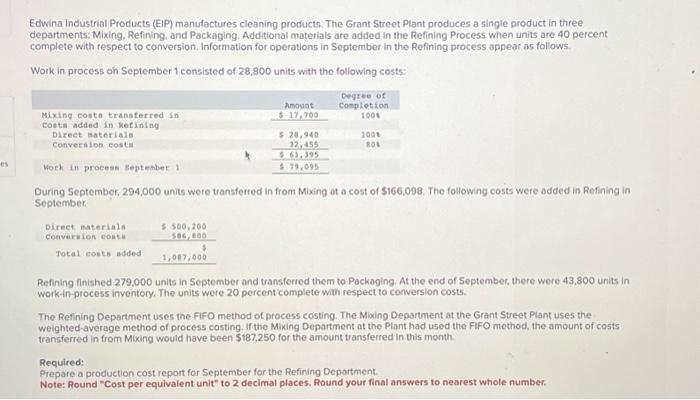

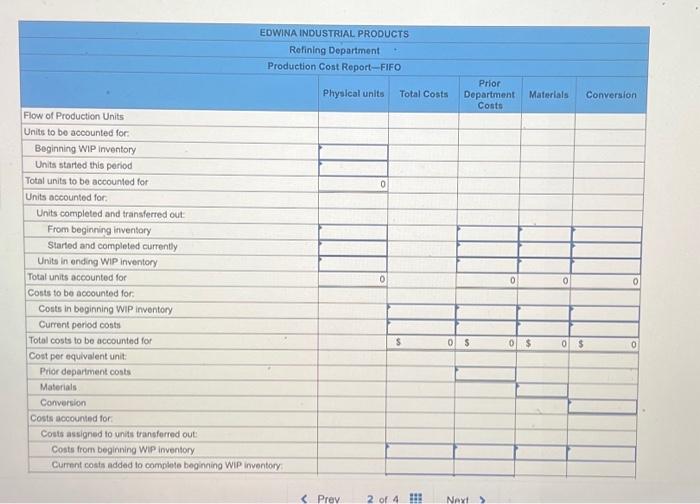

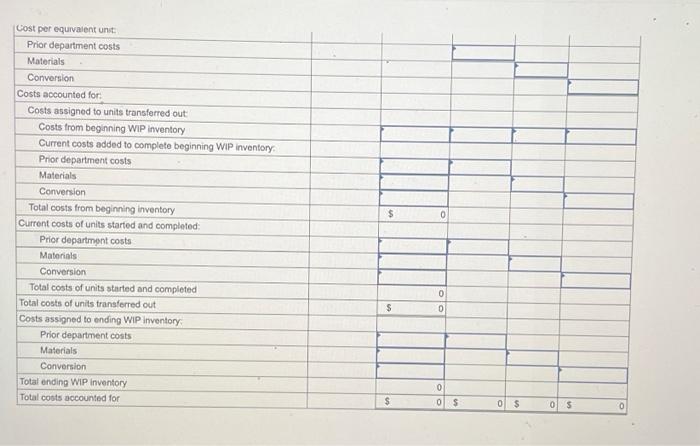

Edwina industrial Products (EIP) manufactures cleaning products. The Grant Street Plant produces a single product in three departments: Mixing, Refining, and Packaging. Additional materials are added in the Refining Process when units are 40 percent complete with respect to conversion, Information for operations in September in the Refining process appear as follows. Work in process on September 1 consisted of 28,800 units with the following costs: During September, 294,000 units were transferred in from Mixing ot a cost of $166,098. The following costs were odded in Refining in September. Refining finished 279,000 units in September and transferred them to Packaging. At the end of September, there were 43,800 units in work-in-process inventory. The units were 20 percent complete with respect to conversion costs. The Refining Department uses the FIFO method of process costing. The Mixing Department at the Grant Street Plant uses the weighted-average method of process costing. If the Mixing Department at the Plant had used the FFFO method, the amount of costs transferred in from Mixing would have been $187,250 for the amount transferred in this month. Required: Prepare a production cost report for September for the Refining Deportment. Note: Round "Cost per equivalent unit" to 2 decimal places. Round your final answers to nearest whole number. \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ EDWINA INDUSTRAAL PRODUCTS } \\ \hline \multicolumn{6}{|c|}{ Refining Department *: } \\ \hline \multicolumn{6}{|c|}{ Production Cost Report-FIFO } \\ \hline & Physical units & Total Costs & PriorDepartmentCosts & Materials & Conversion \\ \hline \multicolumn{6}{|l|}{ Flow of Production Units } \\ \hline \multicolumn{6}{|l|}{ Units to bo accounted for: } \\ \hline Beginning WIP inventory & & & & & \\ \hline \multicolumn{6}{|l|}{ Units started this period } \\ \hline Total units to be accounted for & 0 & & & & \\ \hline \multicolumn{6}{|l|}{ Units accounted for: } \\ \hline \multicolumn{6}{|l|}{ Units completed and transferred out: } \\ \hline \multicolumn{6}{|l|}{ From beginning inventory } \\ \hline \multicolumn{6}{|l|}{ Started and completed currently } \\ \hline \multicolumn{6}{|l|}{ Units in ending WiP inventory } \\ \hline Total units accounted for & & & 0 & 0 & 0 \\ \hline \multicolumn{6}{|l|}{ Costs to be accounted for: } \\ \hline \multicolumn{6}{|l|}{ Costs in beginning WIP inventory } \\ \hline \multicolumn{6}{|l|}{ Current period costs } \\ \hline Total costs to be accounted for & & $ & 0 & $ & $ \\ \hline \multicolumn{6}{|l|}{ Cost por equivalent unit: } \\ \hline Prior department costs & & & & & \\ \hline \multicolumn{6}{|l|}{ Materials . } \\ \hline Conversion & & & & & \\ \hline \multicolumn{6}{|l|}{ Costs accounted for: } \\ \hline \multicolumn{6}{|l|}{ Costs assigned to units transforred out: } \\ \hline \multicolumn{6}{|l|}{ Costs from beginning WiP inventory } \\ \hline Current costs added to complote beginning WiP inventory: & & & & & \\ \hline \end{tabular} Cost per equivalent unt: \begin{tabular}{|c|c|c|c|c|c|} \hline Prior department costs & & & & & \\ \hline Materials - & & & & & \\ \hline Conversion & & & & & \\ \hline Costs accounted for: & & & & & \\ \hline Costs assigned to units tronsferred out: & & & & & \\ \hline Costs from beginning WIP inventory & & & & & \\ \hline Current costs added to complete beginn & & & & & \\ \hline Pror department costs & & & & & \\ \hline Materials & & & - & & \\ \hline Conversion & & & & & \\ \hline Total costs from beginning inventory & $ & 0 & & & \\ \hline Current costs of units started and completed: & & & & & \\ \hline Prior department costs & & & & & \\ \hline Materinls & & & & & \\ \hline Conversion & & & & & \\ \hline Total costs of units started and completed & & 0 & & & \\ \hline Total costs of units transferred out & $ & 0 & & & \\ \hline Costs assigned to ending WIP inventory & & & & & \\ \hline Prior department costs & & & & & \\ \hline Materials & & & & & \\ \hline Conversion & & & & & \\ \hline Total ending WIP inventory & & 0 & & & \\ \hline Total costs accounted for & $ & 0 & 0 & 0 & $ \\ \hline \end{tabular}