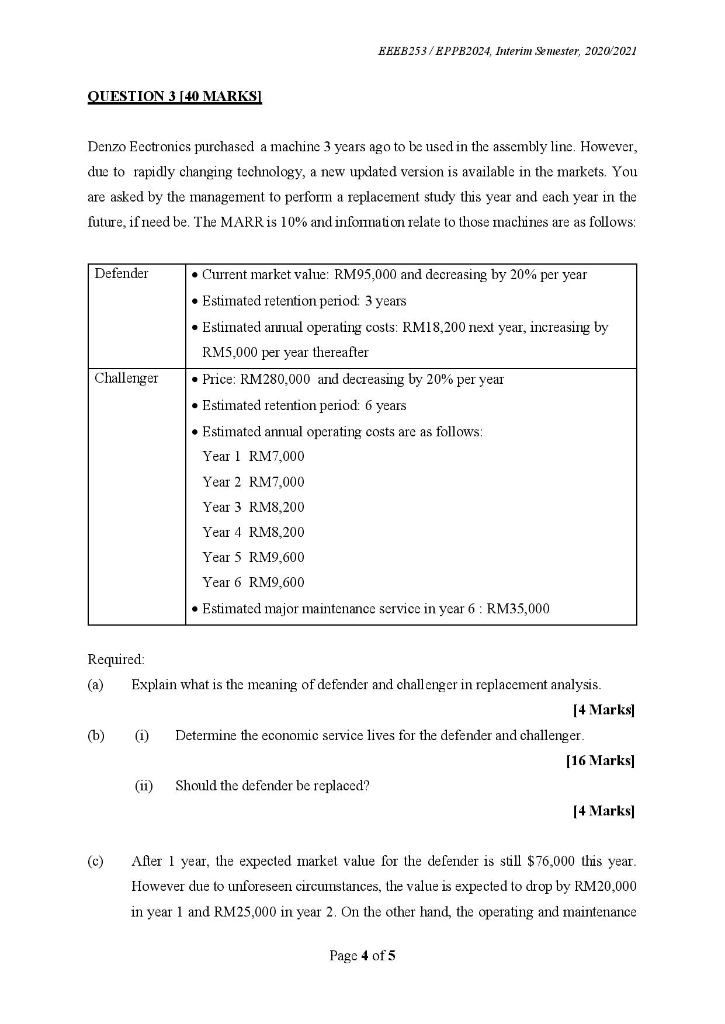

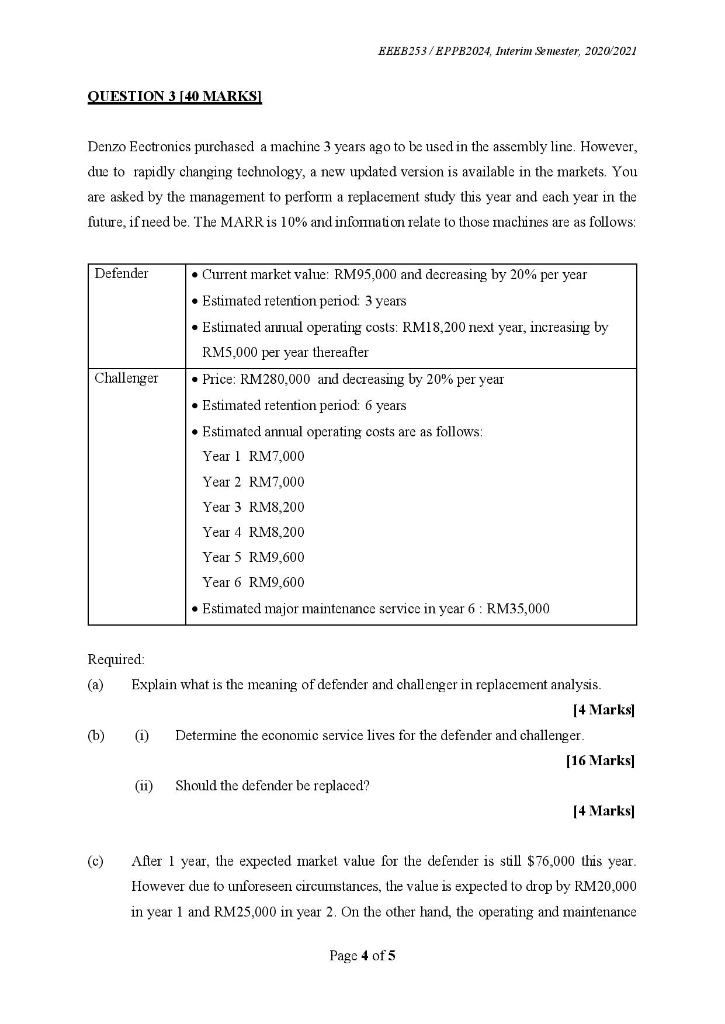

EEEB253/EPPB2024, Interim Semester, 2020/2021 QUESTION 3 [40 MARKSI Denzo Eectronics purchased a machine 3 years ago to be used in the assembly line. However, due to rapidly changing technology, a new updated version is available in the markets. You are asked by the management to perform a replacement study this year and each year in the future, if need be. The MARR is 10% and information relate to those machines are as follows: Defender Challenger . Current market value: RM95,000 and decreasing by 20% per year Estimated retention period: 3 years Estimated annual operating costs: RM18,200 next year, increasing by RM5,000 per year thereafter Price: RM280,000 and decreasing by 20% per year Estimated retention period: 6 years Estimated annual operating costs are as follows: Year 1 RM7,000 Year 2 RM7,000 Year 3 RM8.200 Year 4 RM8,200 Year 5 RM9,600 Year 6 RM9,600 Estimated major maintenance service in year 6 : RM35,000 Required: (a) Explain what is the meaning of defender and challenger in replacement analysis. [4 Marks) (b) (1) Determine the economic service lives for the defender and challenger. [16 Marks] (ii) Should the defender be replaced? [4 Marks (c) After 1 year, the expected market value for the defender is still $76,000 this year. However due to unforeseen circumstances, the value is expected to drop by RM20,000 in year 1 and RM25,000 in year 2. On the other hand, the operating and maintenance Page 4 of 5 REEB253/EPPB2024, Interim Semester, 2020/2021 cost of the machine is expected to double from the estimated figures made earlier for each of the remaining service life. Perform the follow-up analysis and give your suggestion to the management [16 Marks -END OF QUESTION PAPER- Page 5 of 5 EEEB253/EPPB2024, Interim Semester, 2020/2021 QUESTION 3 [40 MARKSI Denzo Eectronics purchased a machine 3 years ago to be used in the assembly line. However, due to rapidly changing technology, a new updated version is available in the markets. You are asked by the management to perform a replacement study this year and each year in the future, if need be. The MARR is 10% and information relate to those machines are as follows: Defender Challenger . Current market value: RM95,000 and decreasing by 20% per year Estimated retention period: 3 years Estimated annual operating costs: RM18,200 next year, increasing by RM5,000 per year thereafter Price: RM280,000 and decreasing by 20% per year Estimated retention period: 6 years Estimated annual operating costs are as follows: Year 1 RM7,000 Year 2 RM7,000 Year 3 RM8.200 Year 4 RM8,200 Year 5 RM9,600 Year 6 RM9,600 Estimated major maintenance service in year 6 : RM35,000 Required: (a) Explain what is the meaning of defender and challenger in replacement analysis. [4 Marks) (b) (1) Determine the economic service lives for the defender and challenger. [16 Marks] (ii) Should the defender be replaced? [4 Marks (c) After 1 year, the expected market value for the defender is still $76,000 this year. However due to unforeseen circumstances, the value is expected to drop by RM20,000 in year 1 and RM25,000 in year 2. On the other hand, the operating and maintenance Page 4 of 5 REEB253/EPPB2024, Interim Semester, 2020/2021 cost of the machine is expected to double from the estimated figures made earlier for each of the remaining service life. Perform the follow-up analysis and give your suggestion to the management [16 Marks -END OF QUESTION PAPER- Page 5 of 5