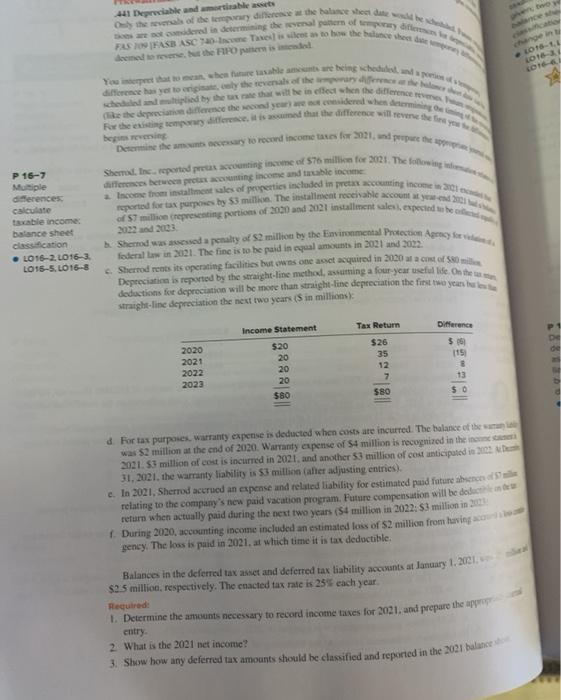

eemed to the FIFO persis 016-1 0163 begin differences between pretes coming income and taxable income FUNFAB Ce Talcotto the balance sheet Tottenere in chedule de hoyong by the reveals the chead by the that will be in then the delence the decadence the decided when For the serce is that the difference with Detentie them to record income 21 put the Shem the reported practing me of 576 million for 2021. The big lace front of properties included in proting od for a purposes by 33 m The stallent receivable account of $7 million representing portions of 2020 and 2021 installment les expected to be bu Shared seda pealty of 52 million by the Environmental Protection for Balances in the deferral tax act and deferred tax liability accounts at lanuary 1 2001 1. Determine the amounts necessary to record income taxes for 2021. and prepare the 3. Show how any deferred tax amounts should be classified and reported in the balance 441 Depreciable and the P 16-7 Miple diferences calculate taxable income balance sheet classification .LO 16-2L016-3 federal law in 2021. The fine is to be paid in equal amounts in 2021 and 2023 LO15-5.LO15-8 Sherrod rents its operating facilities but was one and acquired in 2020 at a cost of 50ml Depreciation is teported by the straight-line method aming a four yeat useful life. On the deductions for depreciation will be more than straight-line depreciation the first two years to be straight-line depreciation the next two years (S in millions Income Statement Tax Return Difference $26 $20 $ 2020 2021 20 35 115 2022 20 12 8 20 2023 7 13 580 $80 $0 d. For tax purposes, warranty expense is deducted when costs are incurred. The balance of the was $2 million at the end of 2020. Warranty expense of S4 million is recognized in the income 2021. 53 million of cost is incurred in 2021, and another 53 million of cost anticipated in 3D 31, 2021.the warranty liability is $3 million aller adljusting entries). c. In 2021, Sherrod accrued an expense and related liability for estimated puid future heren relating to the company's new paid vacation program. Future compensation will be done return when actually paid during the next two years ($1 million in 2022, 53 million in 2008 1. During 2020, accusanting income included an estimated loss of 52 million from having com gency. The loss is paid in 2021. at which time it is tax deductible $2.5 million, respectively. The enacted tax rate is 255 each year. Required entry 2. What is the 2021 net income? eemed to the FIFO persis 016-1 0163 begin differences between pretes coming income and taxable income FUNFAB Ce Talcotto the balance sheet Tottenere in chedule de hoyong by the reveals the chead by the that will be in then the delence the decadence the decided when For the serce is that the difference with Detentie them to record income 21 put the Shem the reported practing me of 576 million for 2021. The big lace front of properties included in proting od for a purposes by 33 m The stallent receivable account of $7 million representing portions of 2020 and 2021 installment les expected to be bu Shared seda pealty of 52 million by the Environmental Protection for Balances in the deferral tax act and deferred tax liability accounts at lanuary 1 2001 1. Determine the amounts necessary to record income taxes for 2021. and prepare the 3. Show how any deferred tax amounts should be classified and reported in the balance 441 Depreciable and the P 16-7 Miple diferences calculate taxable income balance sheet classification .LO 16-2L016-3 federal law in 2021. The fine is to be paid in equal amounts in 2021 and 2023 LO15-5.LO15-8 Sherrod rents its operating facilities but was one and acquired in 2020 at a cost of 50ml Depreciation is teported by the straight-line method aming a four yeat useful life. On the deductions for depreciation will be more than straight-line depreciation the first two years to be straight-line depreciation the next two years (S in millions Income Statement Tax Return Difference $26 $20 $ 2020 2021 20 35 115 2022 20 12 8 20 2023 7 13 580 $80 $0 d. For tax purposes, warranty expense is deducted when costs are incurred. The balance of the was $2 million at the end of 2020. Warranty expense of S4 million is recognized in the income 2021. 53 million of cost is incurred in 2021, and another 53 million of cost anticipated in 3D 31, 2021.the warranty liability is $3 million aller adljusting entries). c. In 2021, Sherrod accrued an expense and related liability for estimated puid future heren relating to the company's new paid vacation program. Future compensation will be done return when actually paid during the next two years ($1 million in 2022, 53 million in 2008 1. During 2020, accusanting income included an estimated loss of 52 million from having com gency. The loss is paid in 2021. at which time it is tax deductible $2.5 million, respectively. The enacted tax rate is 255 each year. Required entry 2. What is the 2021 net income