EEven I marked on the questions, I am not sure the answer. Please answer all related questions. Thank you!

EEven I marked on the questions, I am not sure the answer. Please answer all related questions. Thank you!

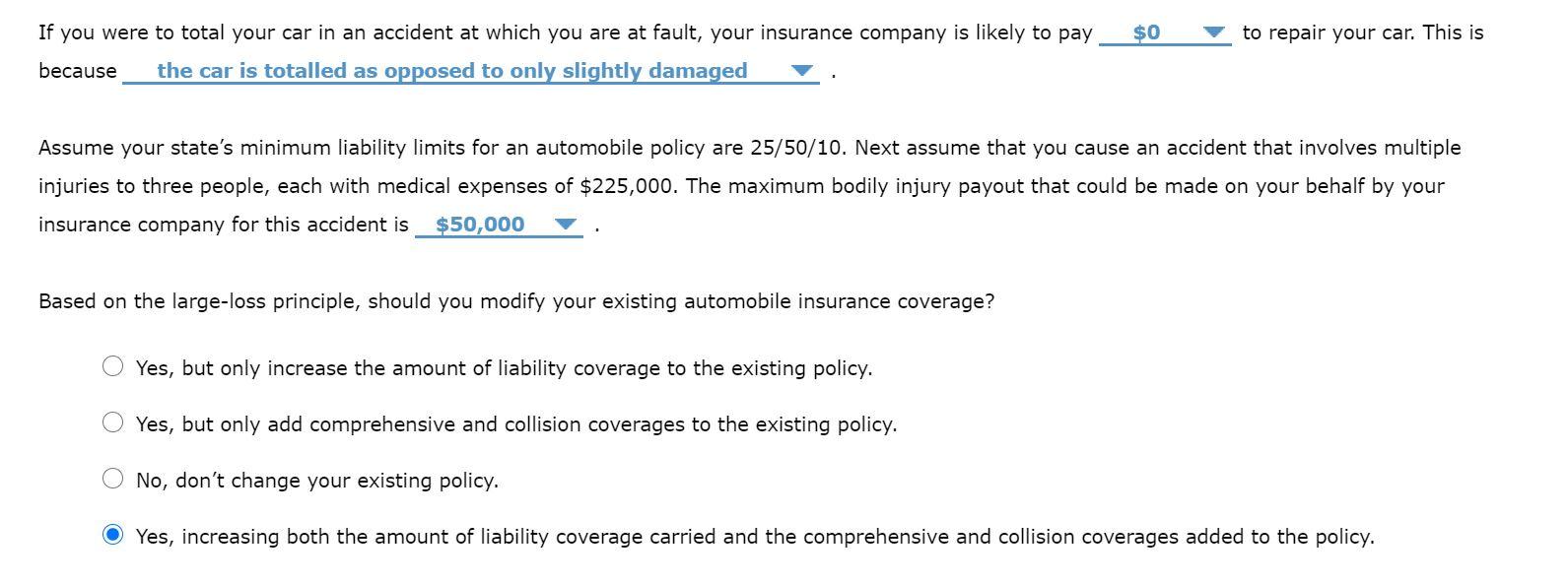

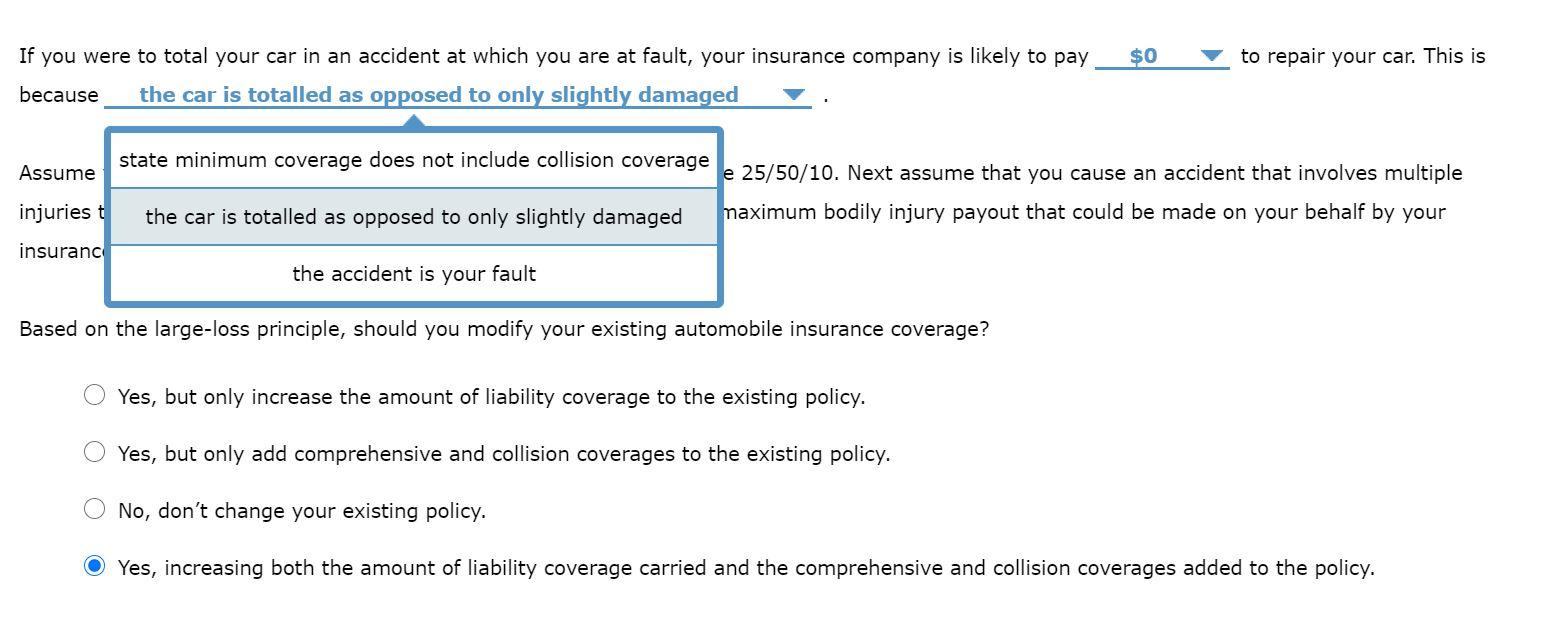

$0 to repair your car. This is If you were to total your car in an accident at which you are at fault, your insurance company is likely to pay because the car is totalled as opposed to only slightly damaged Assume your state's minimum liability limits for an automobile policy are 25/50/10. Next assume that you cause an accident that involves multiple injuries to three people, each with medical expenses of $225,000. The maximum bodily injury payout that could be made on your behalf by your insurance company for this accident is $50,000 Based on the large-loss principle, should you modify your existing automobile insurance coverage? Yes, but only increase the amount of liability coverage to the existing policy. Yes, but only add comprehensive and collision coverages to the existing policy. No, don't change your existing policy. Yes, increasing both the amount of liability coverage carried and the comprehensive and collision coverages added to the policy. $0 to repair your car. This is If you were to total your car in an accident at which you are at fault, your insurance company is likely to pay because the car is totalled as opposed to only slightly damaged state minimum coverage does not include collision coverage Assume e 25/50/10. Next assume that you cause an accident that involves multiple injuries t the car is totalled as opposed to only slightly damaged maximum bodily injury payout that could be made on your behalf by your insuranc the accident is your fault Based on the large-loss principle, should you modify your existing automobile insurance coverage? Yes, but only increase the amount of liability coverage to the existing policy. Yes, but only add comprehensive and collision coverages to the existing policy. No, don't change your existing policy. Yes, increasing both the amount of liability coverage carried and the comprehensive and collision coverages added to the policy. $0 to repair your car. This is If you were to total your car in an accident at which you are at fault, your insurance company is likely to pay because the car is totalled as opposed to only slightly damaged Assume your state's minimum liability limits for an automobile policy are 25/50/10. Next assume that you cause an accident that involves multiple injuries to three people, each with medical expenses of $225,000. The maximum bodily injury payout that could be made on your behalf by your insurance company for this accident is $50,000 Based on the large-loss principle, should you modify your existing automobile insurance coverage? Yes, but only increase the amount of liability coverage to the existing policy. Yes, but only add comprehensive and collision coverages to the existing policy. No, don't change your existing policy. Yes, increasing both the amount of liability coverage carried and the comprehensive and collision coverages added to the policy. $0 to repair your car. This is If you were to total your car in an accident at which you are at fault, your insurance company is likely to pay because the car is totalled as opposed to only slightly damaged state minimum coverage does not include collision coverage Assume e 25/50/10. Next assume that you cause an accident that involves multiple injuries t the car is totalled as opposed to only slightly damaged maximum bodily injury payout that could be made on your behalf by your insuranc the accident is your fault Based on the large-loss principle, should you modify your existing automobile insurance coverage? Yes, but only increase the amount of liability coverage to the existing policy. Yes, but only add comprehensive and collision coverages to the existing policy. No, don't change your existing policy. Yes, increasing both the amount of liability coverage carried and the comprehensive and collision coverages added to the policy

EEven I marked on the questions, I am not sure the answer. Please answer all related questions. Thank you!

EEven I marked on the questions, I am not sure the answer. Please answer all related questions. Thank you!