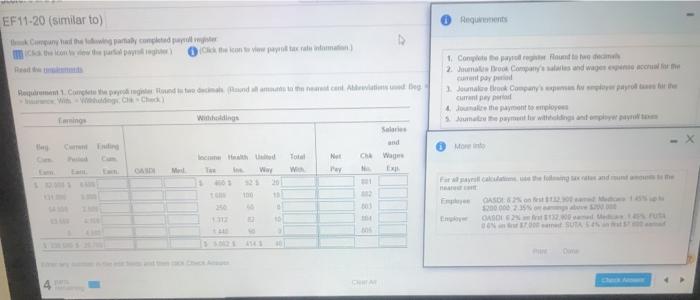

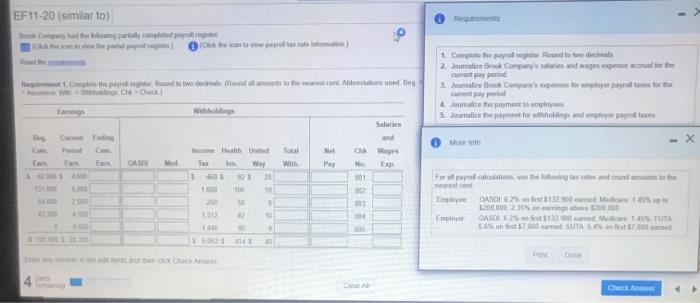

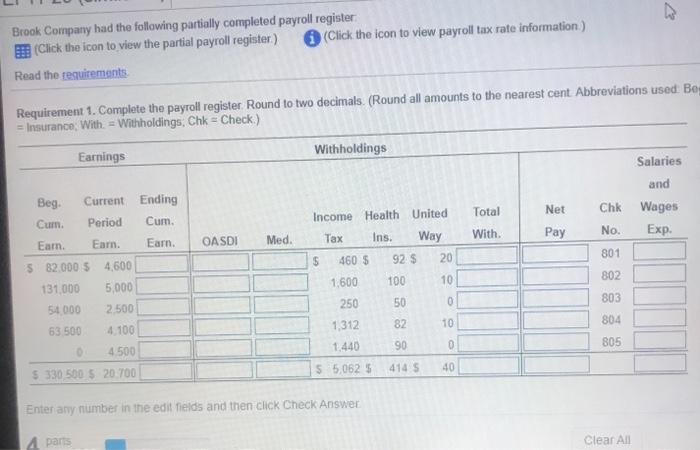

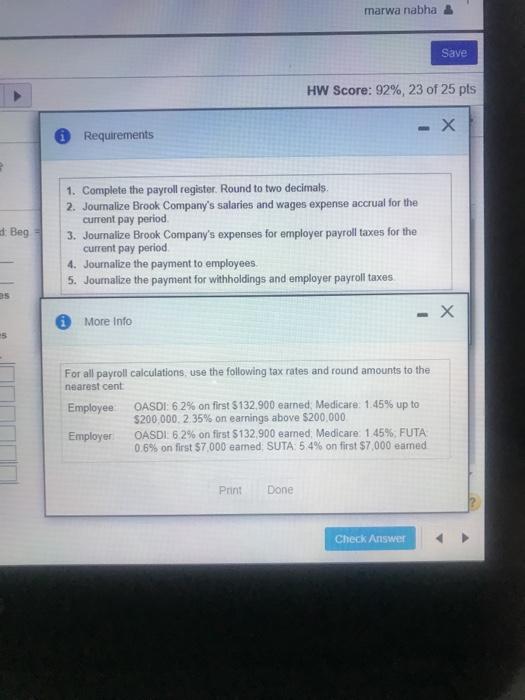

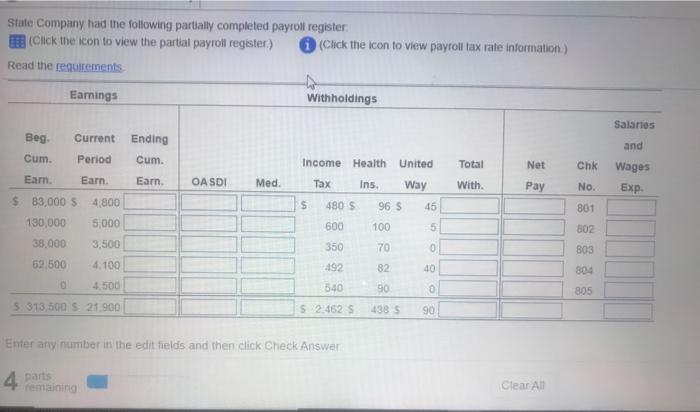

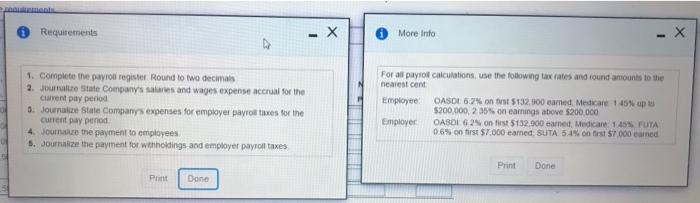

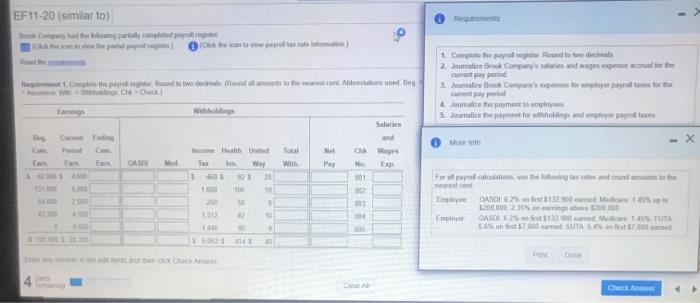

EF 11-20 (similar to) Requirements para compare Conlee Hound to come 2. Jums Come and water pay Jaume Company probe current per Joulure the payment to employees que compong Bandundamente Withings Kalan Che To W Net Pay CA Meil EXIB Way 20 GASON 52000002 CUADOR SUTA En 111 EF 11-20 (similar to) penyeding party conged pergi lett) 1. Cogether and to two decimal 2 Jutate Brock Company's and we coperte corte Gran pay period Jamie Book Company's story. Dayroon Happy Hoodies to mancant Aloe Beg 4 Sumatre the payment to employees S. Joace theme withholdings and myrom Cr Salaries and W More - X Net caso Med Income Health Coted Wwy 21 WI CAK No 01 Sot 13 Follow the following and most the mes con ) GASOL625512000 cm Mat 200.000 23% rings abowo Em OD MAFUTA G700 SUTAS 31 13 100 ta Brook Company had the following partially completed payroll register (Click the icon to view the partial payroll register) (Click the icon to view payroll tax rate information) Read the requirements Requirement 1. Complete the payroll register. Round to two decimals. (Round all amounts to the nearest cent Abbreviations used Be = Insurance With = Withholdings: Chk = Check.) Earnings Withholdings Salaries and Total Net Chk Wages Exp. With Pay No. OASDI Med. Beg. Current Ending Cum. Period Cum. Earn Earn. Earn. 5 82.000 $ 4.600 131,000 5000 54 000 2.500 63 500 4.100 Income Health United Tax Ins. Way $ 460 $ 92 $ 20 1.600 100 10 801 802 50 250 0 803 82 10 804 1,312 1.440 90 0 805 4.500 $ 330 500 5 20 700 5 5,0625 414 40 Enter any number in the edit fields and then click Check Answer 4 parts Clear All marwa nabha Save HW Score: 92%, 23 of 25 pts - X Requirements d. Beg 1. Complete the payroll register. Round to two decimals, 2. Journalize Brook Company's salaries and wages expense accrual for the current pay period 3. Journalize Brook Company's expenses for employer payroll taxes for the current pay period 4. Journalize the payment to employees 5. Journalize the payment for withholdings and employer payroll taxes - More Info 5 For all payroll calculations, use the following tax rates and round amounts to the nearest cent Employee OASDI: 62% on first 5132,900 earned Medicare: 1.45% up to $200,000. 2.35% on earnings above $200.000 Employer OASDI: 62% on first $132,900 earned: Medicare 1.45%, FUTA 0.6% on first $7.000 earned SUTA 5 4% on first $7,000 eamed Print Done Check Answer State Company had the following partially completed payroll register (Click the icon to view the partial payroll register) (Click the icon to view payroll tax rate information) Read the requirements Earnings Withholdings Salaries Beg Current Ending Cum. and Cum. Period Income Health United Total Net Chk Wages Earn. Earn Earn OASDI Med. Tax Ins. Way With Pay No. Exp $ 83,000 5 4.800 $ 480 S 96 S 45 801 130,000 5,000 600 100 802 38.000 3.500 350 70 0 803 52 500 4.100 492 82 40 804 805 4.500 540 90 5.313,500 21.900 52.462 S 4385 90 Enter any number in the edit fields and then click Check Answer 4 parts remaining Clear All Requirements - More Info 1. Complete the payroll register Round to two decimals 2. Jou State Company's salaries and wages expense accrual for the Current pay period 9. Journakze State Company's expenses for employer payroll taxes for the current pay pened 4. Journalize the payment to employees 5. Journize the payment for withholdings and employer payroll taxes For all payrol calculations, use the following tax rates and round amounts to the nearest cont Employee OASDL 6.2% on fost $132.900 camed Medicare 1 15% up $200,000, 25% on earnings above $200,000 Employer OASIG 2 on first 5132.900 earnest Medicare: 145% FUTA 06% on first $7.000 earned. SUTA 5 on first $7.000 and Print Done Dane