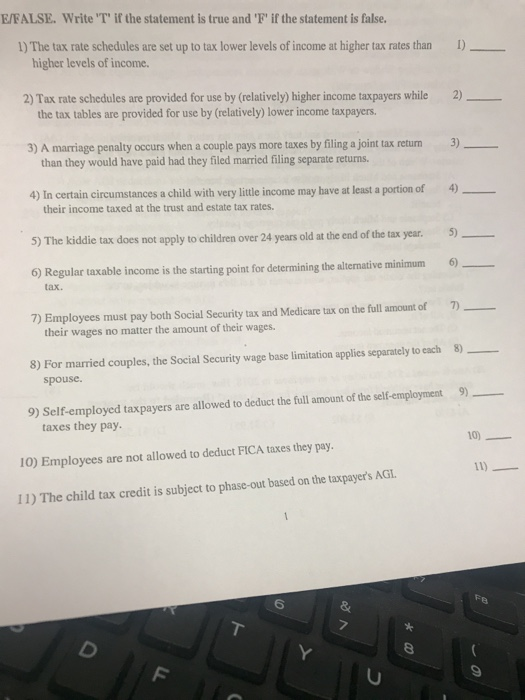

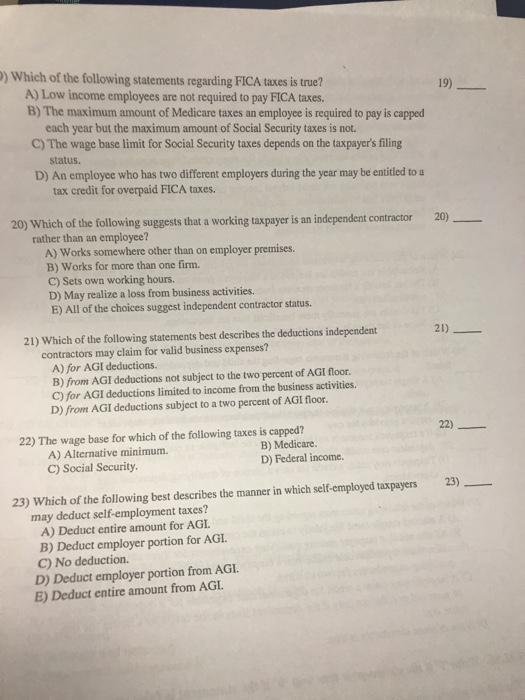

E/FALSE. Write 'T' if the statement is true and 'F' if the statement is false. 1) The tax rate schedules are set up to tax lower levels of income at higher tax rates than I) higher levels of income. 2) Tax rate schedules are provided for use by (relatively) higher income taxpayers while 2) the tax tables are provided for use by (relatively) lower income taxpayers. 3) A marriage penalty occurs when a couple pays more taxes by filing a joint tax return 3) 4) In certain circumstances a child with very litle income may have at least a portion of 4) ie tax does not apply to children over 24 years old at the end of the tax year.5) Regular taxable income is the starting point for determining the alternative minimum 6) 7) Employees must pay both Social Security tax and Medicare tax on the full amount of 7 8) For married couples, the Social Security wage base limitation applies separately to each 8) than they would have paid had they filed married filing separate returns their income taxed at the trust and estate tax rates. tax. their wages no matter the amount of their wages. spouse. 9) Self-employed taxpayers are allowed to deduct the full amount of the self-employment9) taxes they pay 10) Employees are not allowed to deduct FICA taxes they pay. 11) The child tax credit is subject to phase-out based on the tapa 10 Fe 6 8 ) Which of the following statements regarding FICA taxes is true? 19) A) Low income employees are not required to pay FICA taxes. B) The maximum amount of Medicare taxes an employee is required to pay is capped each year but the maximum amount of Social Security taxes is not. C) The wage base limit for Social Security taxes depends on the taxpayer's filing status. D) An employee who has two different employers during the year may be entitled to a tax credit for overpaid FICA taxes. 20) Which of the following suggests that a working taxpayer is an independent contractor 20)- - rather than an employee? A) Works somewhere other than on employer premises B) Works for more than one firm. C) Sets own working hours. D) May realize a loss from business activities. E) All of the choices suggest independent contractor status. 21) Which of the following statements best describes the deductions independent 2) contractors may claim for valid business expenses? A) for AGI deductions. B) from AGI deductions not subject to the two percent of AGI floor. C) for AGI deductions limited to income from the business activities D) from AGI deductions subject to a two percent of AGI floor. 22) 22) The wage base for which of the following taxes is capped? A) Alternative minimum. C) Social Security B) Medicare. D) Federal income. 23) Which of the following best describes the manner in which self-employed taxpayers 23) may deduct self-employment taxes? A) Deduct entire amount for AGL B) Deduct employer portion for AGI C) No deduction. D) Deduct employer portion from AGI E) Deduct entire amount from AGI