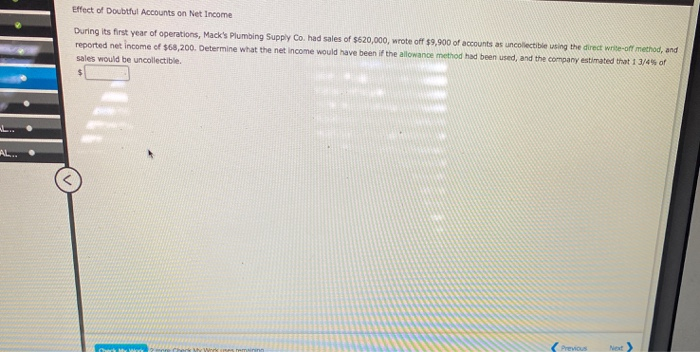

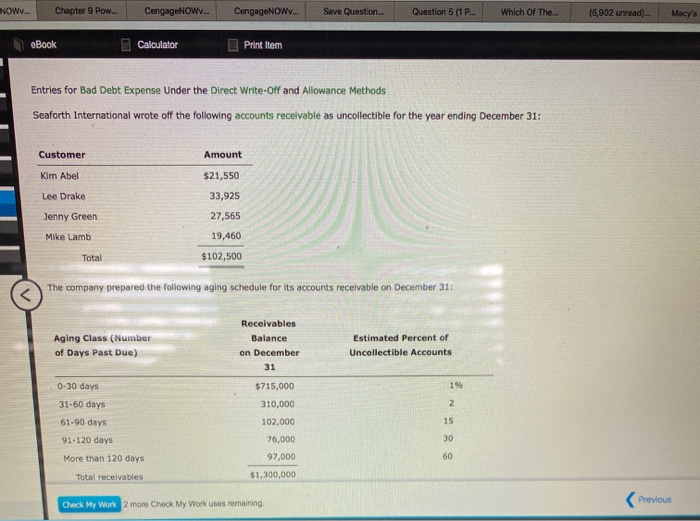

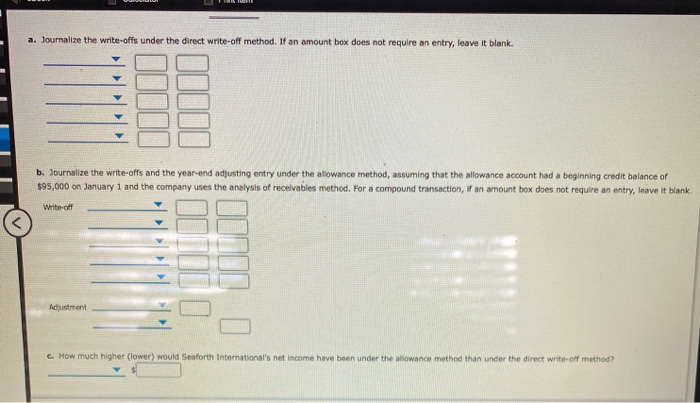

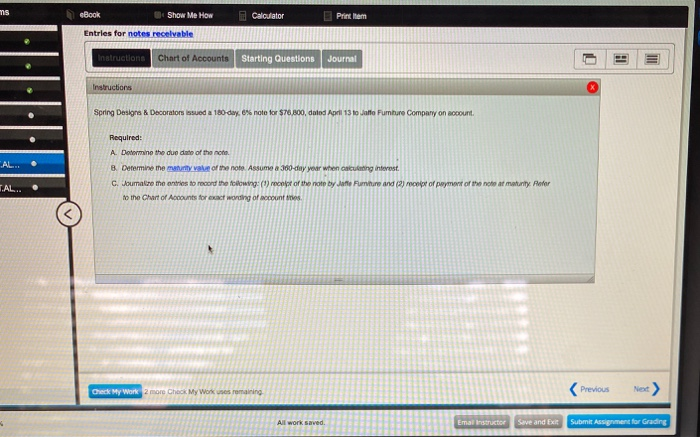

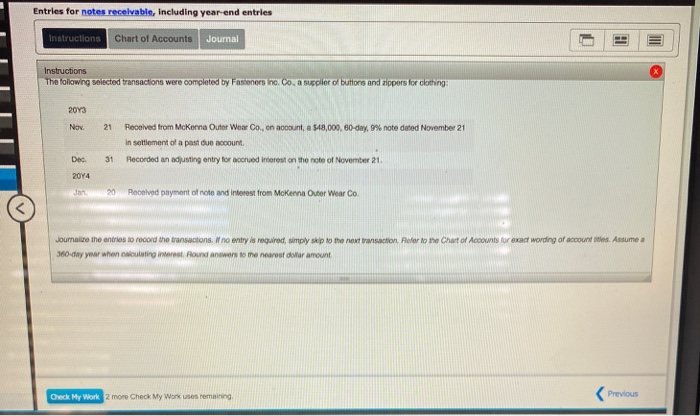

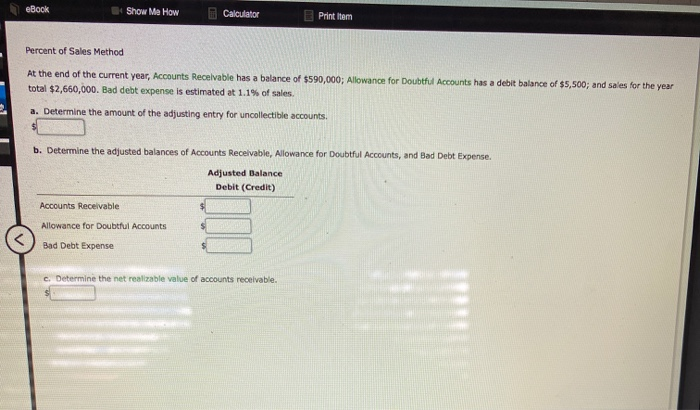

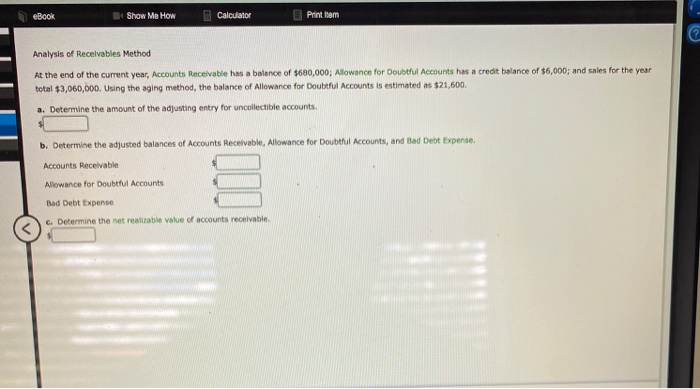

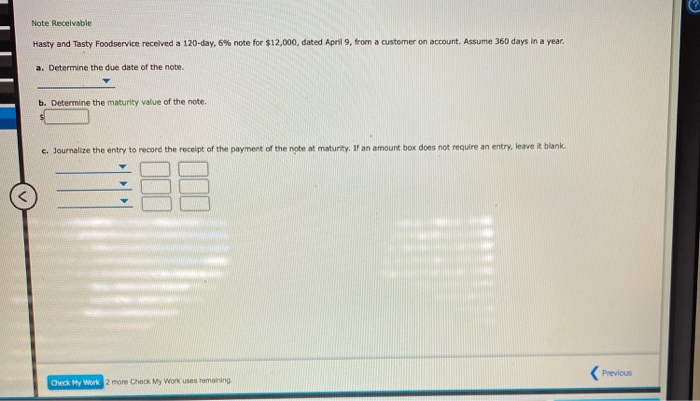

Effect of Doubtful Accounts on Net Income During its first year of operations, Mack's Plumbing Supply Co. had sales of $520,000, wrote off $9,900 of accounts as uncollectible using the direct write-off method, and reported net income of $68,200. Determine what the net income would have been if the allowance method had been used, and the company estimated that 13/4% of sales would be uncollectible. AL.. Previous NOW... Chapter 9 Pow... CengageNOW.. CengageNOW... Save Question.. Question 5 (1 P... Which of The... (6,902 unread)... Macy's eBook Calculator Print Item Entries for Bad Debt Expense Under the Direct Write-Off and Allowance Methods Seaforth International wrote off the following accounts receivable as uncollectible for the year ending December 31: Customer Amount Kim Abel Lee Drake $21,550 33,925 27,565 Jenny Green Mike Lamb 19,460 Total $102,500 The company prepared the following aging schedule for its accounts receivable on December 31: Aging Class (Number of Days Past Due) Receivables Balance on December 31 Estimated Percent of Uncollectible Accounts 0-30 days 1% 2 31-60 days 61-90 days 91-120 days 15 $715,000 310,000 102,000 76,000 97,000 $1,300,000 30 More than 120 days 60 Total receivables Check My Work 2 more Check My Work usos remaining Previous a. Journalize the write-offs under the direct write-off method. If an amount box does not require an entry, leave it blank. b. Journalize the write-offs and the year-end adjusting entry under the allowance method, assuming that the allowance account had a beginning credit balance of $95,000 on January 1 and the company uses the analysis of receivables method. For a compound transaction, if an amount box does not require an entry, leave it blank Write-off Adjustment c. How much higher (lower) would Seaforth International's net income have been under the allowance method than under the direct write-off method? ms eBook Show Me How Calculator Printem Entries for notes receivable Instructions Chart of Accounts Starting Questions Journal Instructions Spring Designs & Decorators issued a 180 day, 6% noto for $76,800, dated April 13 to Jaffo Fumhure Company on account. CAL. Required: A. Determine the dun dute of the note 8. Determine the maturity value of the note. Assume a 360-day your when cicleting interest C. Noumalize the enteres to record the following: (1) monfit of the noto by Jane Fumhure and (2) moody of payment or the noto at maturity. Peter to the Chart of Accounts for exact wording of countries C.AL.. Check My Work 2 more Check My Wok romaining Previous Not > All work saved Emal Instructor Save and Exit Submit Assignment for Grading Entries for notes receivable, including year end entries Instructions Chart of Accounts Journal Instructions The following selected transactions were completed by Fasteners Inc. Co, a supplier of buttons and zippers for clothing 2013 Now 21 Received from McKenna Outor Wow Co, on count, a $18,000, 60-day, 9% note dated November 21 in settlement of a past due account. Recorded an adjusting entry for more interest on the note of November 21 Dec 31 2014 Jan 20 Received payment of noto and interest from McKenna Otter Wear Co. Journalize the entries to record the transactions. W no entry is required, simply skip to the next transaction. Refer to me Chart of Accounts for exact wording of accounties. Assume a 360-day year when coulting interest Hound answers to the nearest doar amount Check My Work 2 more Check My Work uses remaining Previous eBook Show Me How Calculator Print Item Percent of Sales Method At the end of the current year, Accounts Receivable has a balance of $590,000; Allowance for Doubtful Accounts has a debit balance of $5,500; and sales for the year total $2,660,000. Bad debt expense is estimated at 1.1% of sales. a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Adjusted Balance Debit (Credit) Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense c. Determine the net realizable value of accounts receivable, eBook Show Me How Calculator Print Item Analysis of Recelvables Method At the end of the current year, Accounts Receivable has a balance of $680,000; Allowance for Doubtful Accounts has a credit balance of $6,000; and sales for the year total $3,060,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $21,600. a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Deot Expense, Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense c. Determine the net realizable value of accounts receivable Note Receivable Hasty and Tasty Foodservice received a 120-day, 6% note for $12,000, dated April 9, from a customer on account. Assume 360 days in a year. a. Determine the due date of the note b. Determine the maturity value of the note. c. Journalize the entry to record the receipt of the payment of the note at maturity. If an amount box does not require an entry, leave it blank. Previous Check My Work 2 more Check My Work uses remaining