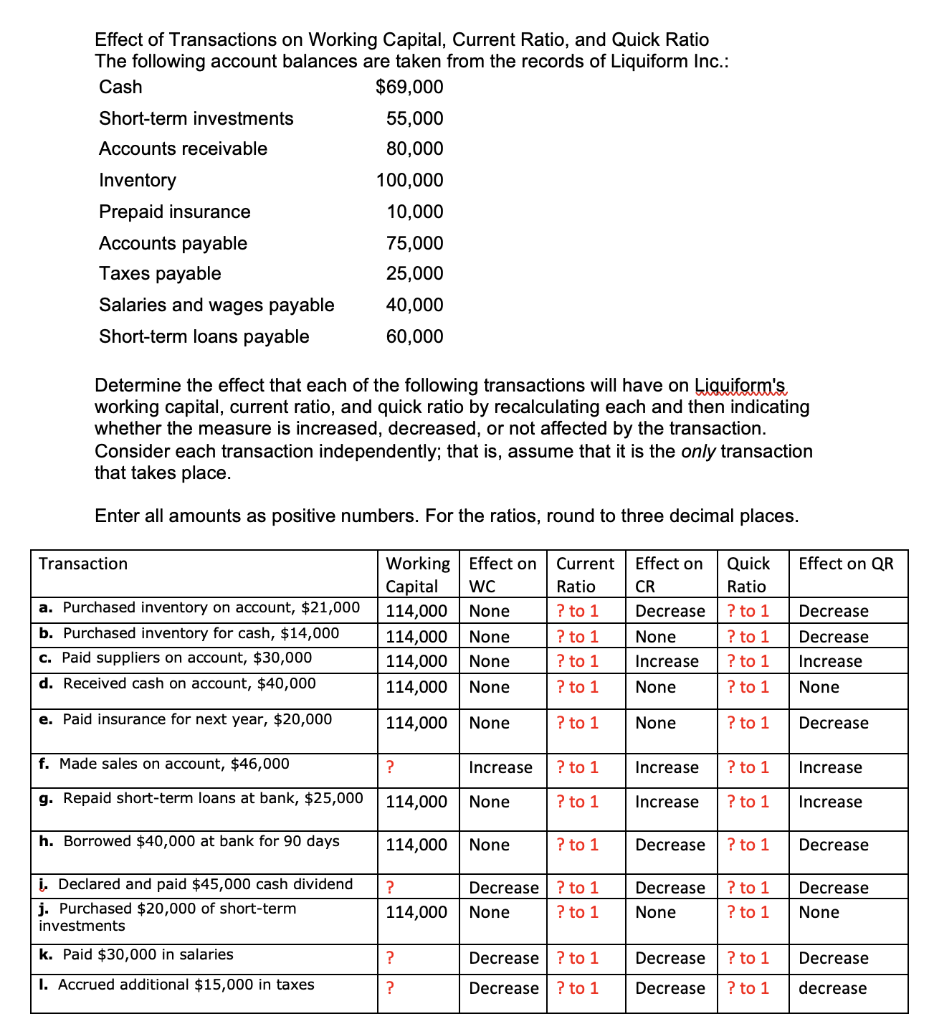

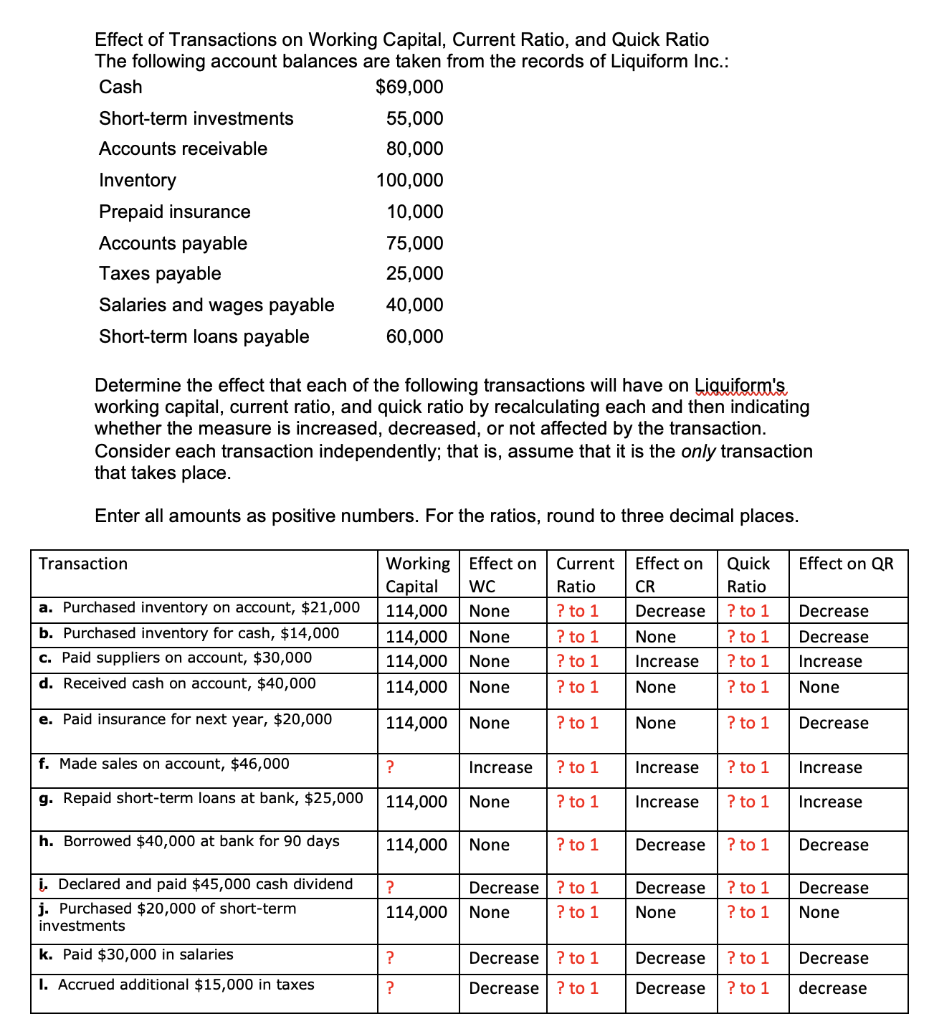

Effect of Transactions on Working Capital, Current Ratio, and Quick Ratio The following account balances are taken from the records of Liquiform Inc.: Cash $69,000 Short-term investments 55,000 Accounts receivable 80,000 Inventory 100,000 Prepaid insurance 10,000 Accounts payable 75,000 Taxes payable 25,000 Salaries and wages payable 40,000 Short-term loans payable 60,000 Determine the effect that each of the following transactions will have on Liquiform's working capital, current ratio, and quick ratio by recalculating each and then indicating whether the measure is increased, decreased, or not affected by the transaction. Consider each transaction independently; that is, assume that it is the only transaction that takes place. Enter all amounts as positive numbers. For the ratios, round to three decimal places. Transaction Effect on QR a. Purchased inventory on account, $21,000 b. Purchased inventory for cash, $14,000 c. Paid suppliers on account, $30,000 d. Received cash on account, $40,000 Working Effect on Capital WC 114,000 None 114,000 None 114,000 None 114,000 None Current Effect on Ratio CR ? to 1 Decrease ? to 1 None ? to 1 Increase ? to 1 None Quick Ratio ? to 1 ? to 1 ? to 1 ? to 1 Decrease Decrease Increase None e. Paid insurance for next year, $20,000 114,000 None ? to 1 None ? to 1 Decrease f. Made sales on account, $46,000 ? Increase ? to 1 Increase ? to 1 Increase g. Repaid short-term loans at bank, $25,000 114,000 None ? to 1 Increase ? to 1 Increase h. Borrowed $40,000 at bank for 90 days 114,000 None ? to 1 Decrease ? to 1 Decrease ? i. Declared and paid $45,000 cash dividend j. Purchased $20,000 of short-term investments Decrease ? to 1 None ? to 1 Decrease None ? to 1 ? to 1 Decrease None 114,000 k. Paid $30,000 in salaries ? Decrease ? to 1 Decrease ? to 1 Decrease 1. Accrued additional $15,000 in taxes ? Decrease ? to 1 Decrease ? to 1 decrease Effect of Transactions on Working Capital, Current Ratio, and Quick Ratio The following account balances are taken from the records of Liquiform Inc.: Cash $69,000 Short-term investments 55,000 Accounts receivable 80,000 Inventory 100,000 Prepaid insurance 10,000 Accounts payable 75,000 Taxes payable 25,000 Salaries and wages payable 40,000 Short-term loans payable 60,000 Determine the effect that each of the following transactions will have on Liquiform's working capital, current ratio, and quick ratio by recalculating each and then indicating whether the measure is increased, decreased, or not affected by the transaction. Consider each transaction independently; that is, assume that it is the only transaction that takes place. Enter all amounts as positive numbers. For the ratios, round to three decimal places. Transaction Effect on QR a. Purchased inventory on account, $21,000 b. Purchased inventory for cash, $14,000 c. Paid suppliers on account, $30,000 d. Received cash on account, $40,000 Working Effect on Capital WC 114,000 None 114,000 None 114,000 None 114,000 None Current Effect on Ratio CR ? to 1 Decrease ? to 1 None ? to 1 Increase ? to 1 None Quick Ratio ? to 1 ? to 1 ? to 1 ? to 1 Decrease Decrease Increase None e. Paid insurance for next year, $20,000 114,000 None ? to 1 None ? to 1 Decrease f. Made sales on account, $46,000 ? Increase ? to 1 Increase ? to 1 Increase g. Repaid short-term loans at bank, $25,000 114,000 None ? to 1 Increase ? to 1 Increase h. Borrowed $40,000 at bank for 90 days 114,000 None ? to 1 Decrease ? to 1 Decrease ? i. Declared and paid $45,000 cash dividend j. Purchased $20,000 of short-term investments Decrease ? to 1 None ? to 1 Decrease None ? to 1 ? to 1 Decrease None 114,000 k. Paid $30,000 in salaries ? Decrease ? to 1 Decrease ? to 1 Decrease 1. Accrued additional $15,000 in taxes ? Decrease ? to 1 Decrease ? to 1 decrease