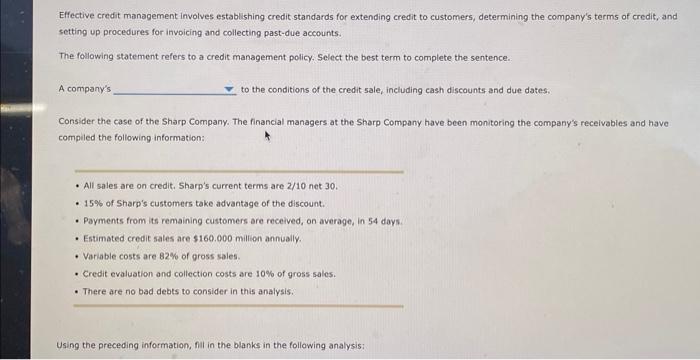

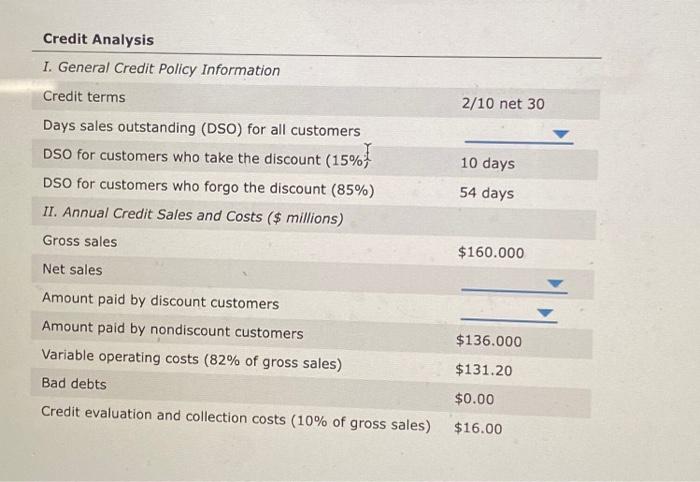

Effective credit management involves establishing credit standards for extending credit to customers, determining the company's terms of credit, and setting up procedures for invoicing and collecting past-due accounts. The following statement refers to a credit management policy. Select the best term to complete the sentence. A company's to the conditions of the credit sale, including cash discounts and due dates. Consider the case of the Sharp Company. The financial managers at the Sharp Company have been monitoring the company's receivables and have compiled the following information: - All sales are on credit, Sharp's current terms are 2/10 net 30. - 15% of Sharp's customers take advantage of the discount. - Payments from its remaining customers are received, on average, in 54 doys. - Estimated credit sales are $160.000 million annially. - Variable costs are 82% of gross sales. - Credit evaluation and collection costs are 10% of gross sales. - There are no bad debts to consider in this analysis. Using the preceding information, fil in the blanks in the following analysis: Credit Analysis I. General Credit Policy Information Credit terms 2/10 net 30 Days sales outstanding (DSO) for all customers DSOforcustomerswhotakethediscount(15%)DSOforcustomerswhoforgothediscount(85%)10days54days II. Annual Credit Sales and Costs (\$ millions) Gross sales $160.000 Net sales Amount paid by discount customers AmountpaidbynondiscountcustomersVariableoperatingcosts(82%ofgrosssales)BaddebtsCreditevaluationandcollectioncosts(10%ofgrosssales)$136.000$131.20$16.00 Effective credit management involves establishing credit standards for extending credit to customers, determining the company's terms of credit, and setting up procedures for invoicing and collecting past-due accounts. The following statement refers to a credit management policy. Select the best term to complete the sentence. A company's to the conditions of the credit sale, including cash discounts and due dates. Consider the case of the Sharp Company. The financial managers at the Sharp Company have been monitoring the company's receivables and have compiled the following information: - All sales are on credit, Sharp's current terms are 2/10 net 30. - 15% of Sharp's customers take advantage of the discount. - Payments from its remaining customers are received, on average, in 54 doys. - Estimated credit sales are $160.000 million annially. - Variable costs are 82% of gross sales. - Credit evaluation and collection costs are 10% of gross sales. - There are no bad debts to consider in this analysis. Using the preceding information, fil in the blanks in the following analysis: Credit Analysis I. General Credit Policy Information Credit terms 2/10 net 30 Days sales outstanding (DSO) for all customers DSOforcustomerswhotakethediscount(15%)DSOforcustomerswhoforgothediscount(85%)10days54days II. Annual Credit Sales and Costs (\$ millions) Gross sales $160.000 Net sales Amount paid by discount customers AmountpaidbynondiscountcustomersVariableoperatingcosts(82%ofgrosssales)BaddebtsCreditevaluationandcollectioncosts(10%ofgrosssales)$136.000$131.20$16.00