Effective Interest Versus Straight-Line Premium Amortization

\

\

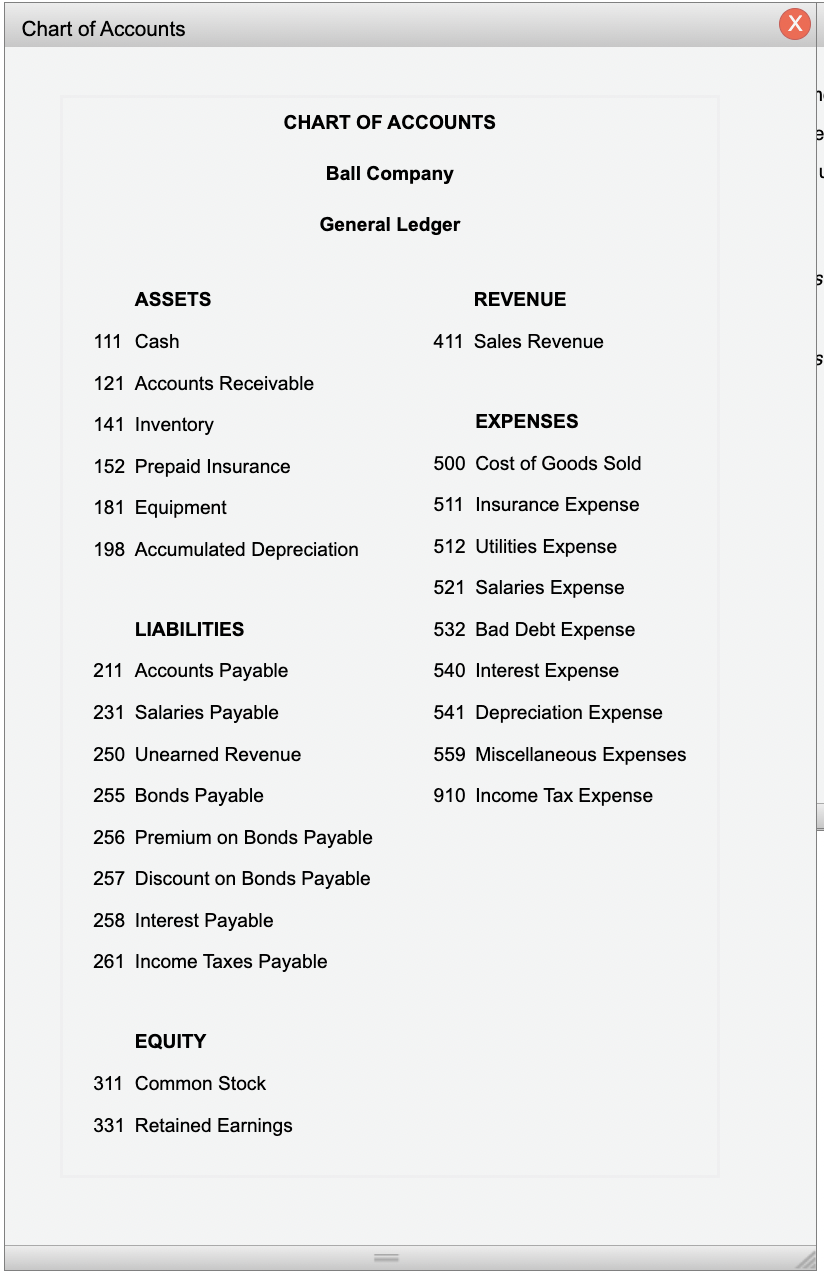

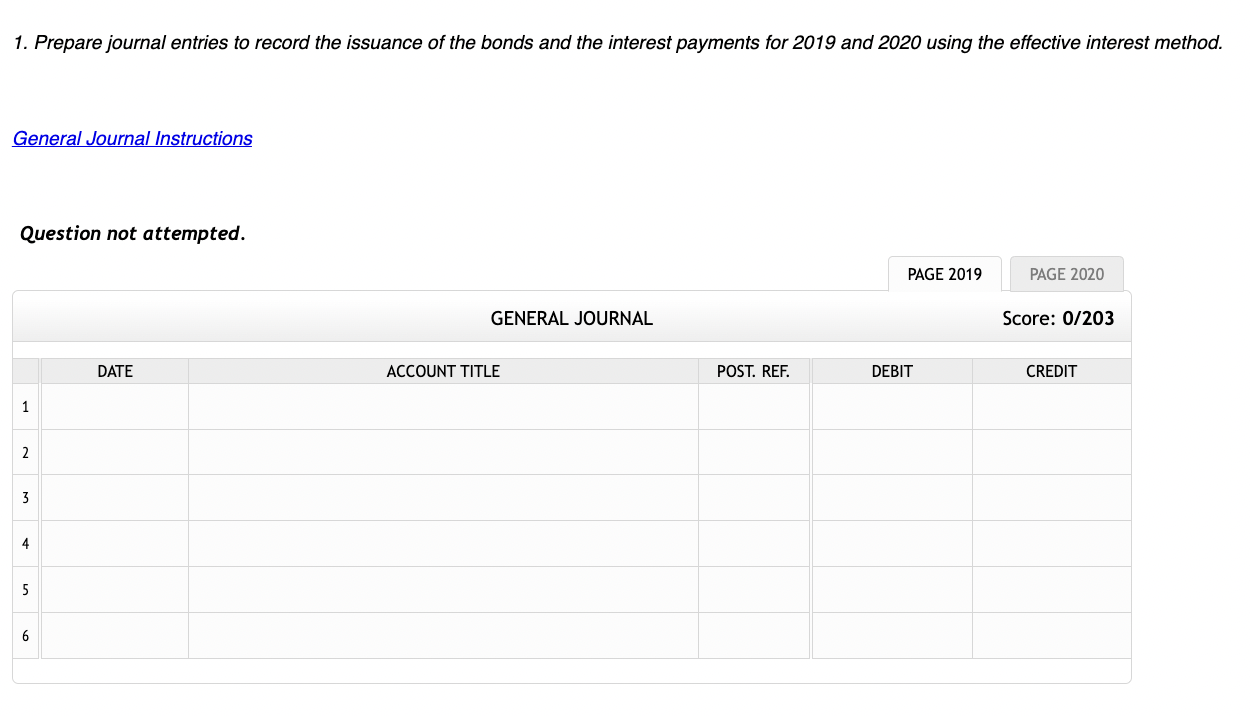

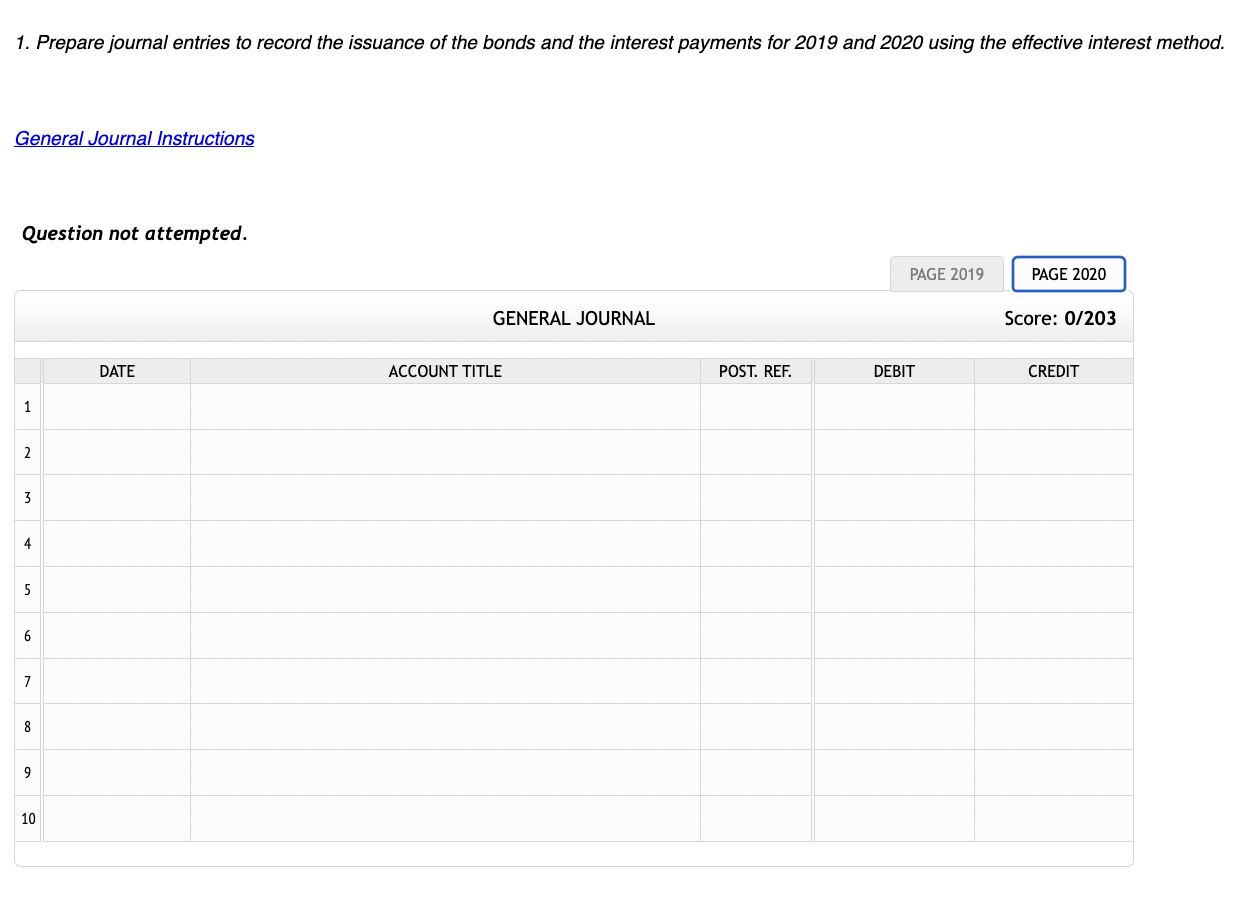

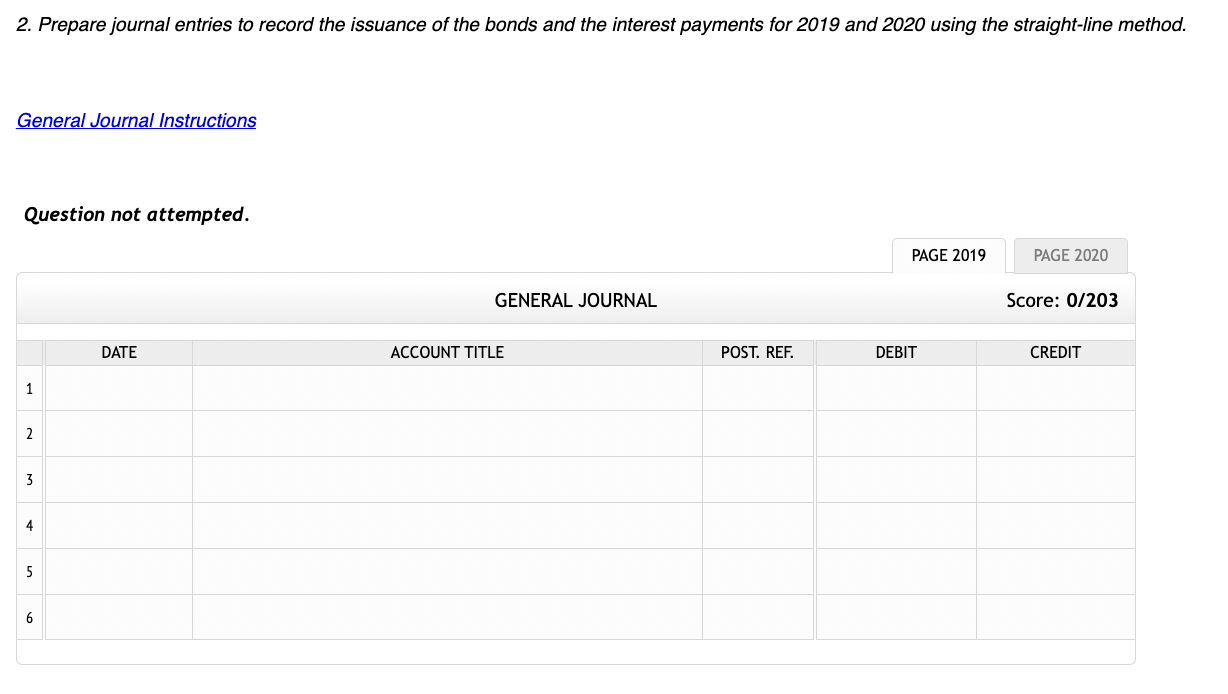

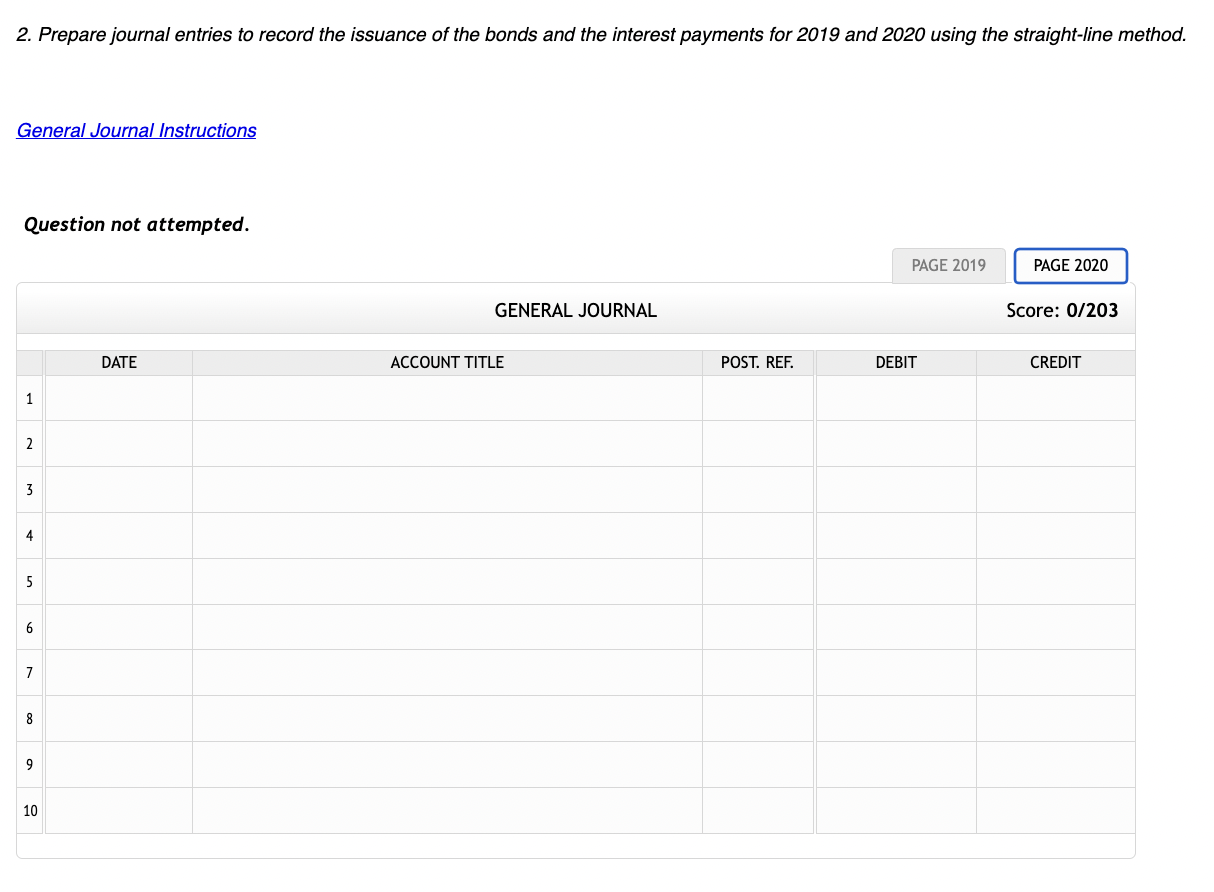

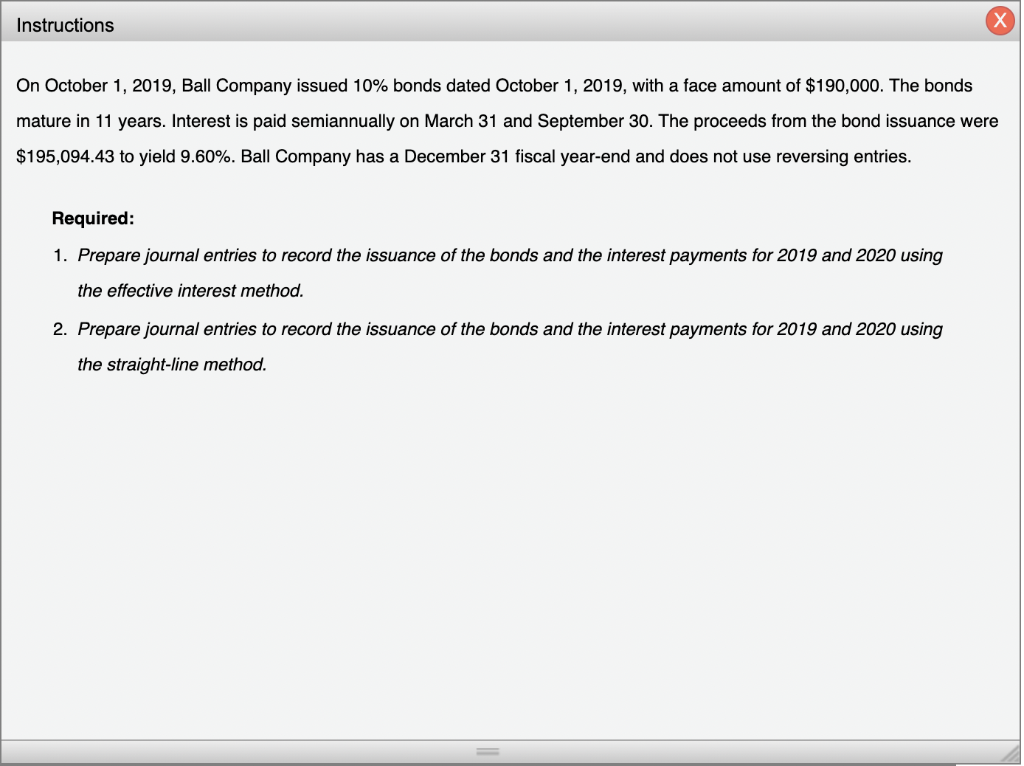

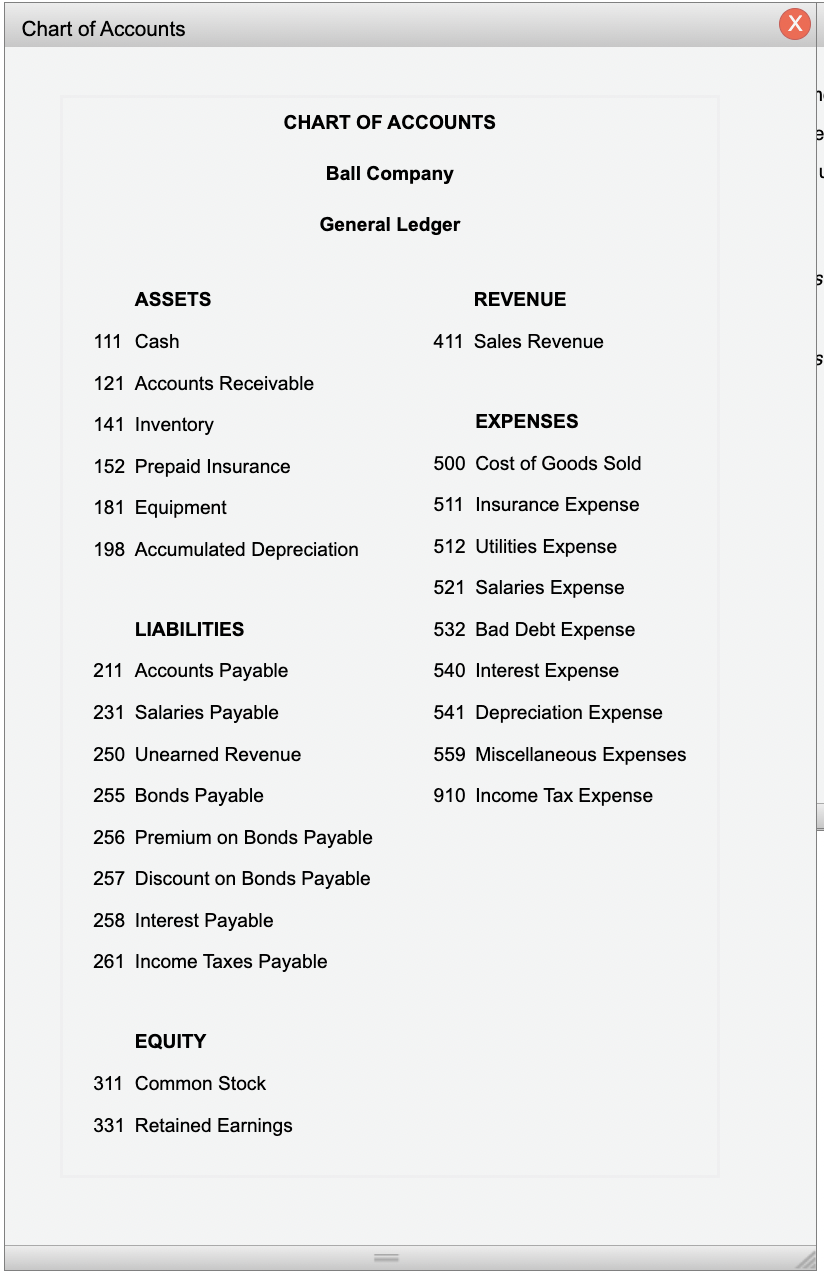

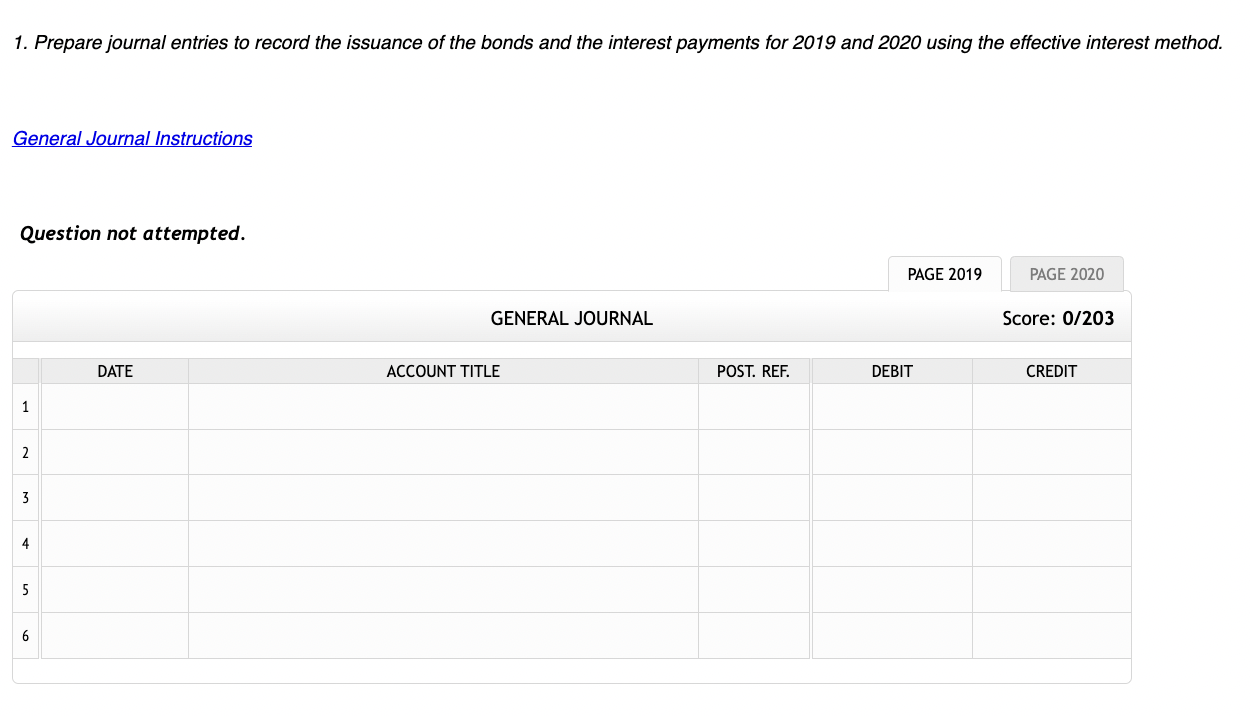

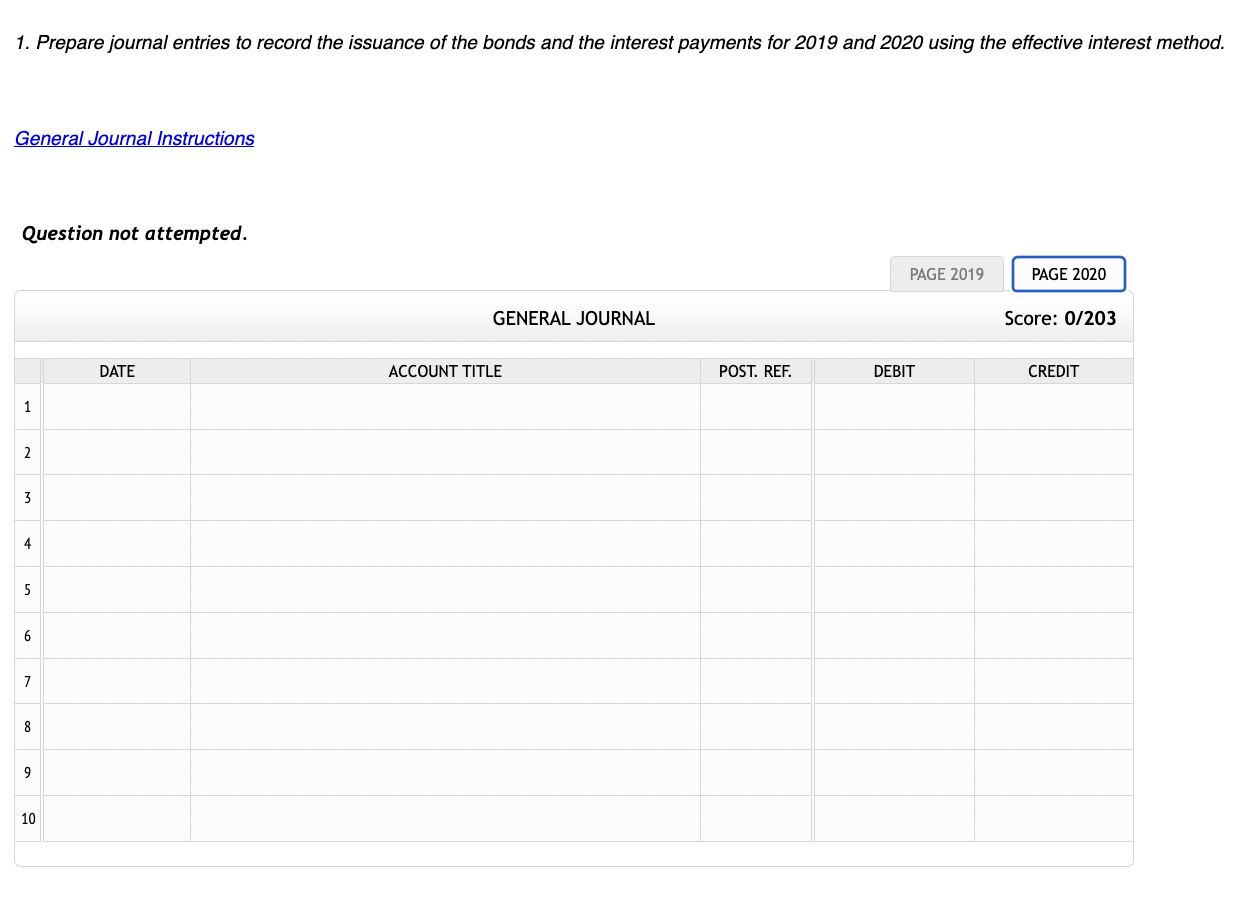

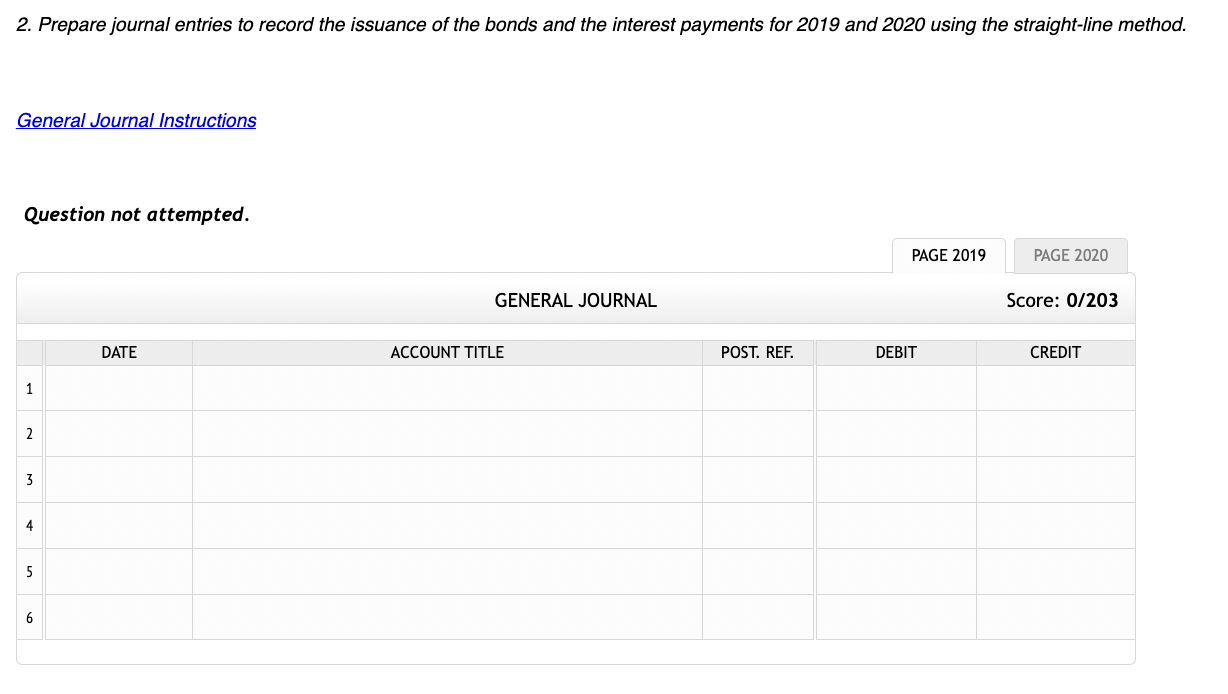

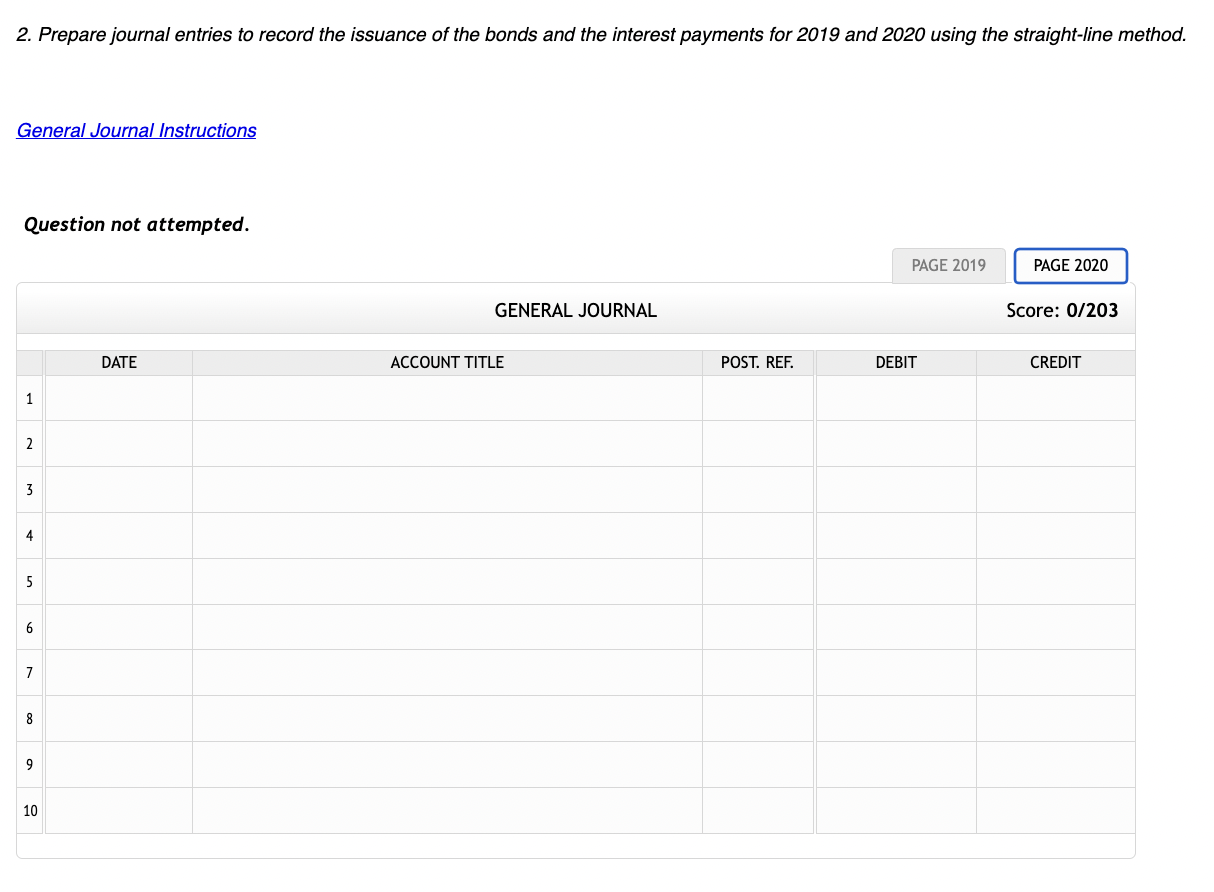

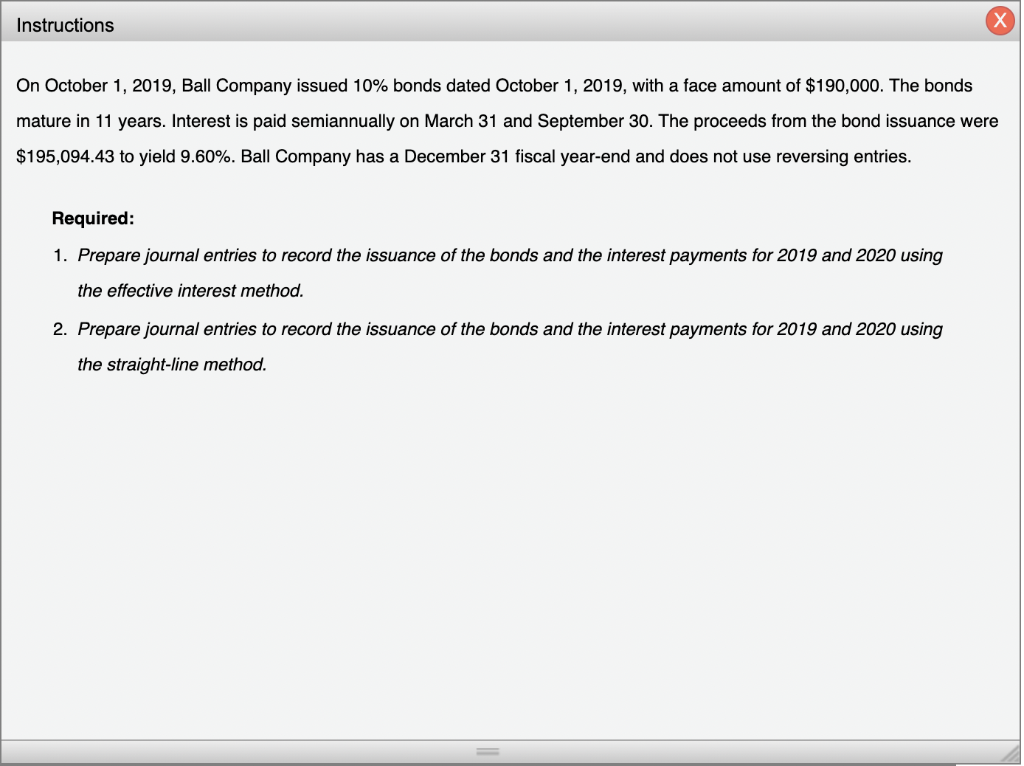

On October 1, 2019, Ball Company issued 10% bonds dated October 1,2019 , with a face amount of $190,000. The bonds nature in 11 years. Interest is paid semiannually on March 31 and September 30 . The proceeds from the bond issuance were \$195,094.43 to yield 9.60%. Ball Company has a December 31 fiscal year-end and does not use reversing entries. Required: 1. Prepare journal entries to record the issuance of the bonds and the interest payments for 2019 and 2020 using the effective interest method. 2. Prepare journal entries to record the issuance of the bonds and the interest payments for 2019 and 2020 using the straight-line method. Chart of Accounts CHART OF ACCOUNTS Ball Company General Ledger ASSETS REVENUE 111 Cash 411 Sales Revenue 121 Accounts Receivable 141 Inventory EXPENSES 152 Prepaid Insurance 500 Cost of Goods Sold 181 Equipment 511 Insurance Expense 198 Accumulated Depreciation 512 Utilities Expense 521 Salaries Expense LIABILITIES 532 Bad Debt Expense 211 Accounts Payable 540 Interest Expense 231 Salaries Payable 541 Depreciation Expense 250 Unearned Revenue 559 Miscellaneous Expenses 255 Bonds Payable 910 Income Tax Expense 256 Premium on Bonds Payable 257 Discount on Bonds Payable 258 Interest Payable 261 Income Taxes Payable EQUITY 311 Common Stock 331 Retained Earnings 1. Prepare journal entries to record the issuance of the bonds and the interest payments for 2019 and 2020 using the effective interest method. Question not attempted. 1. Prepare journal entries to record the issuance of the bonds and the interest payments for 2019 and 2020 using the effective interest methoo Question not attempted. 2. Prepare journal entries to record the issuance of the bonds and the interest payments for 2019 and 2020 using the straight-line method General Journal Instructions Question not attempted. 2. Prepare journal entries to record the issuance of the bonds and the interest payments for 2019 and 2020 using the straight-line method. General Journal Instructions Question not attempted. On October 1, 2019, Ball Company issued 10% bonds dated October 1,2019 , with a face amount of $190,000. The bonds nature in 11 years. Interest is paid semiannually on March 31 and September 30 . The proceeds from the bond issuance were \$195,094.43 to yield 9.60%. Ball Company has a December 31 fiscal year-end and does not use reversing entries. Required: 1. Prepare journal entries to record the issuance of the bonds and the interest payments for 2019 and 2020 using the effective interest method. 2. Prepare journal entries to record the issuance of the bonds and the interest payments for 2019 and 2020 using the straight-line method. Chart of Accounts CHART OF ACCOUNTS Ball Company General Ledger ASSETS REVENUE 111 Cash 411 Sales Revenue 121 Accounts Receivable 141 Inventory EXPENSES 152 Prepaid Insurance 500 Cost of Goods Sold 181 Equipment 511 Insurance Expense 198 Accumulated Depreciation 512 Utilities Expense 521 Salaries Expense LIABILITIES 532 Bad Debt Expense 211 Accounts Payable 540 Interest Expense 231 Salaries Payable 541 Depreciation Expense 250 Unearned Revenue 559 Miscellaneous Expenses 255 Bonds Payable 910 Income Tax Expense 256 Premium on Bonds Payable 257 Discount on Bonds Payable 258 Interest Payable 261 Income Taxes Payable EQUITY 311 Common Stock 331 Retained Earnings 1. Prepare journal entries to record the issuance of the bonds and the interest payments for 2019 and 2020 using the effective interest method. Question not attempted. 1. Prepare journal entries to record the issuance of the bonds and the interest payments for 2019 and 2020 using the effective interest methoo Question not attempted. 2. Prepare journal entries to record the issuance of the bonds and the interest payments for 2019 and 2020 using the straight-line method General Journal Instructions Question not attempted. 2. Prepare journal entries to record the issuance of the bonds and the interest payments for 2019 and 2020 using the straight-line method. General Journal Instructions Question not attempted

\

\