Effects of the Federal Reserve

The Federal Reserve tries to create a positive economic environment capable of sustaining low inflation, high levels of employment, a balance in international payments, and long-term economic growth using a variety of monetary tools. In the following activity, use the hints to categorize both the effects on money supply and economic activity by the monetary tools used to create each effect.

The guardian of the American financial system is the Federal Reserve Board, or "the Fed" as it is commonly called, an independent agency of the federal government established in 1913 to regulate the nation's banking and financial industry. The Federal Reserve Board is the chief economic policy arm of the United States. Working with Congress and the president, the Fed tries to create a positive economic environment capable of sustaining low inflation, high levels of employment, a balance in international payments, and long-term economic growth.

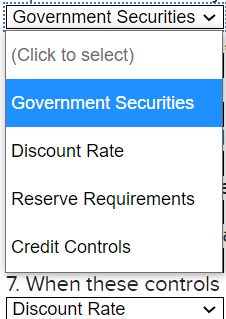

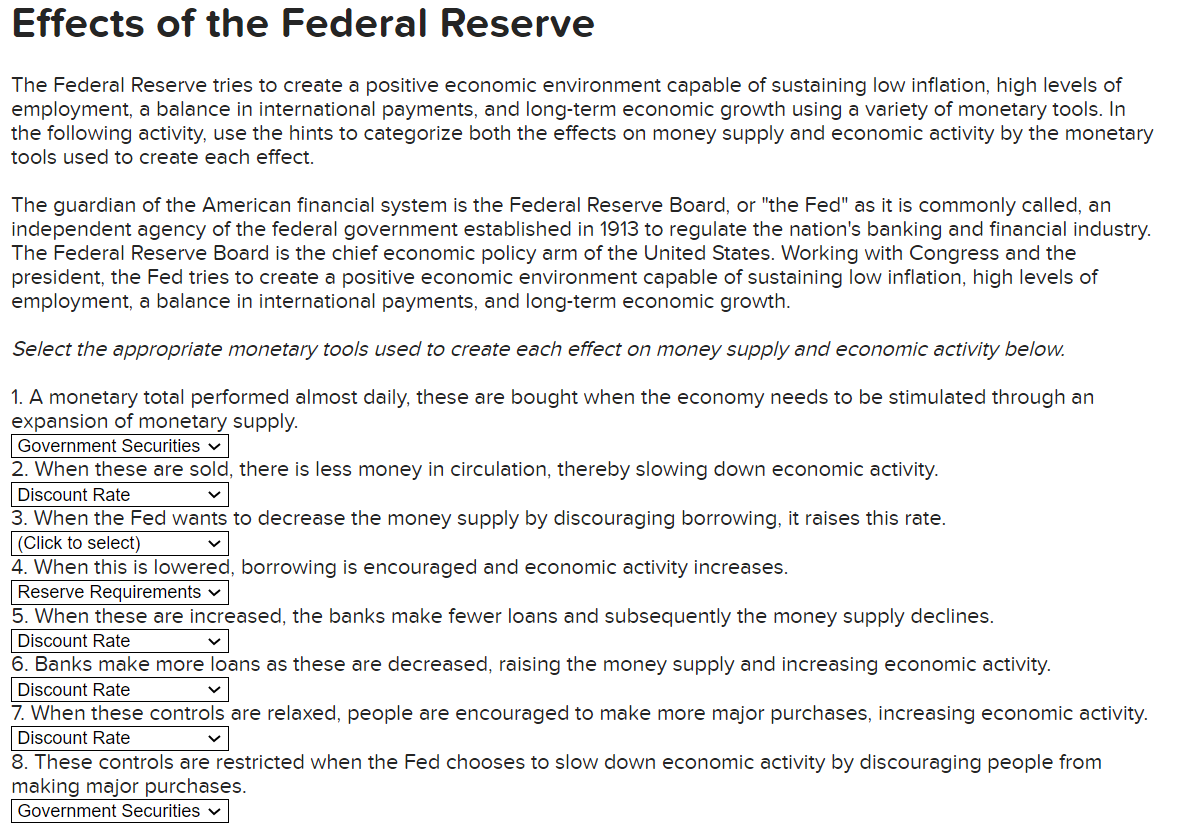

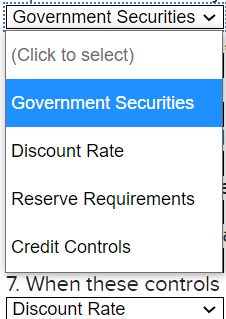

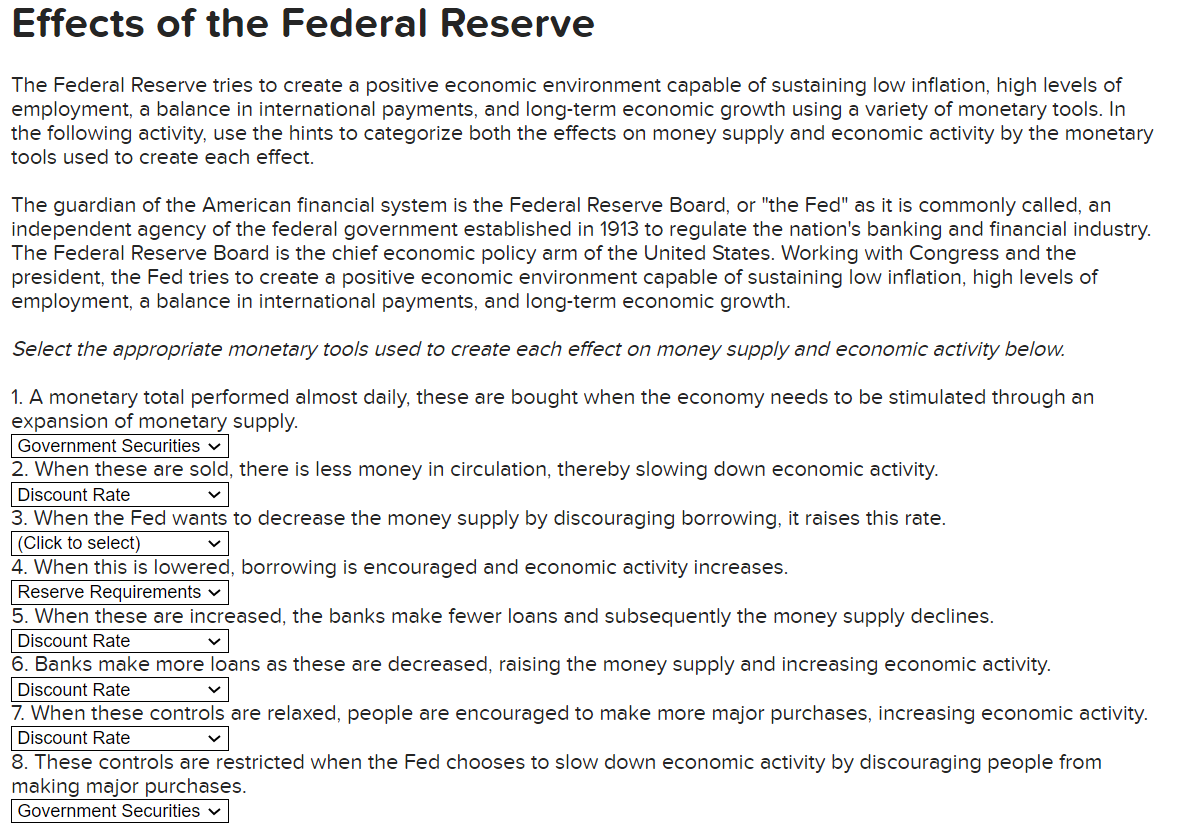

elect the appropriate monetary tools used to create each effect on money supply and economic activity below.

Government Securities (Click to select) Government Securities Discount Rate Reserve Requirements Credit Controls 7. When these controls Discount Rate Effects of the Federal Reserve The Federal Reserve tries to create a positive economic environment capable of sustaining low inflation, high levels of employment, a balance in international payments, and long-term economic growth using a variety of monetary tools. In the following activity, use the hints to categorize both the effects on money supply and economic activity by the monetary tools used to create each effect. The guardian of the American financial system is the Federal Reserve Board, or "the Fed" as it is commonly called, an independent agency of the federal government established in 1913 to regulate the nation's banking and financial industry. The Federal Reserve Board is the chief economic policy arm of the United States. Working with Congress and the president, the Fed tries to create a positive economic environment capable of sustaining low inflation, high levels of employment, a balance in international payments, and long-term economic growth. Select the appropriate monetary tools used to create each effect on money supply and economic activity below. 1. A monetary total performed almost daily, these are bought when the economy needs to be stimulated through an expansion of monetary supply. Government Securities 2. When these are sold, there is less money in circulation, thereby slowing down economic activity. Discount Rate 3. When the Fed wants to decrease the money supply by discouraging borrowing, it raises this rate. (Click to select) 4. When this is lowered, borrowing is encouraged and economic activity increases. Reserve Requirements 5. When these are increased, the banks make fewer loans and subsequently the money supply declines. Discount Rate 6. Banks make more loans as these are decreased, raising the money supply and increasing economic activity. Discount Rate 7. When these controls are relaxed, people are encouraged to make more major purchases, increasing economic activity. Discount Rate 8. These controls are restricted when the Fed chooses to slow down economic activity by discouraging people from making major purchases. Government Securities Government Securities (Click to select) Government Securities Discount Rate Reserve Requirements Credit Controls 7. When these controls Discount Rate Effects of the Federal Reserve The Federal Reserve tries to create a positive economic environment capable of sustaining low inflation, high levels of employment, a balance in international payments, and long-term economic growth using a variety of monetary tools. In the following activity, use the hints to categorize both the effects on money supply and economic activity by the monetary tools used to create each effect. The guardian of the American financial system is the Federal Reserve Board, or "the Fed" as it is commonly called, an independent agency of the federal government established in 1913 to regulate the nation's banking and financial industry. The Federal Reserve Board is the chief economic policy arm of the United States. Working with Congress and the president, the Fed tries to create a positive economic environment capable of sustaining low inflation, high levels of employment, a balance in international payments, and long-term economic growth. Select the appropriate monetary tools used to create each effect on money supply and economic activity below. 1. A monetary total performed almost daily, these are bought when the economy needs to be stimulated through an expansion of monetary supply. Government Securities 2. When these are sold, there is less money in circulation, thereby slowing down economic activity. Discount Rate 3. When the Fed wants to decrease the money supply by discouraging borrowing, it raises this rate. (Click to select) 4. When this is lowered, borrowing is encouraged and economic activity increases. Reserve Requirements 5. When these are increased, the banks make fewer loans and subsequently the money supply declines. Discount Rate 6. Banks make more loans as these are decreased, raising the money supply and increasing economic activity. Discount Rate 7. When these controls are relaxed, people are encouraged to make more major purchases, increasing economic activity. Discount Rate 8. These controls are restricted when the Fed chooses to slow down economic activity by discouraging people from making major purchases. Government Securities